NYC 114 7 2024-2026

What is the NYC 114 7

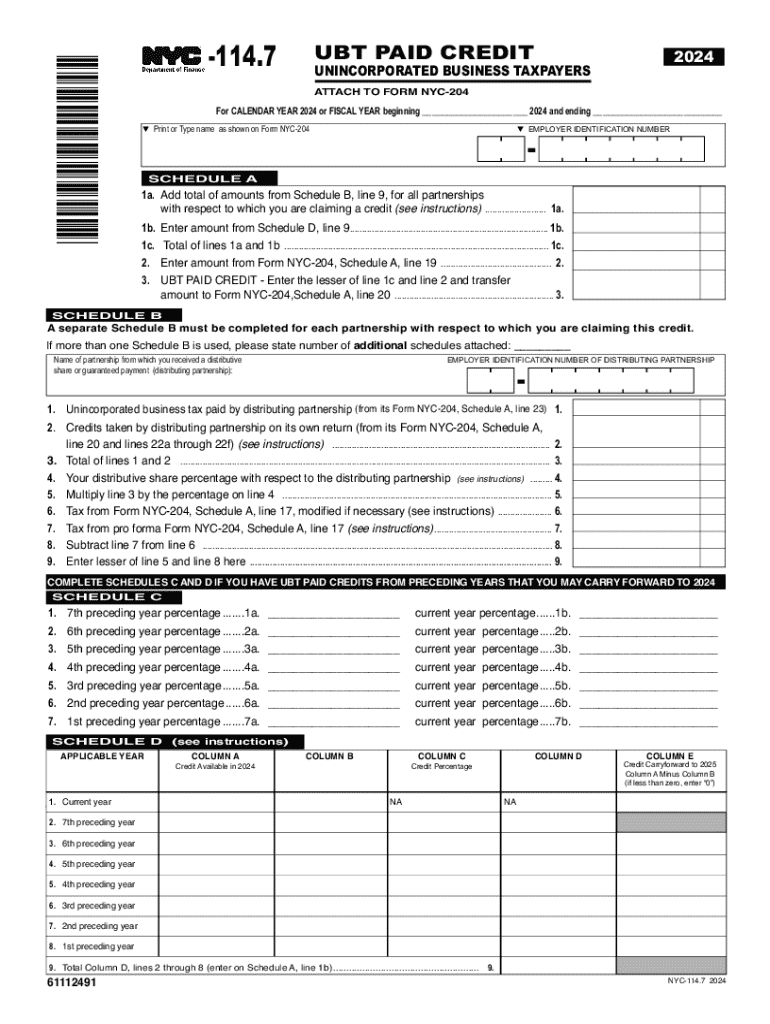

The NYC 114 7 form is a tax document specifically designed for unincorporated businesses operating within New York City. It is used to report the Unincorporated Business Tax (UBT) owed by businesses that do not have a formal corporate structure. This form is essential for ensuring compliance with local tax regulations and is typically required for businesses that generate income from services or sales.

How to use the NYC 114 7

To use the NYC 114 7 form, businesses must accurately report their gross income, allowable deductions, and calculate the tax owed. The form requires detailed information about the business's financial activities over the tax year. It is crucial to ensure that all figures are correct to avoid penalties. After completing the form, it should be submitted to the appropriate tax authority by the designated deadline.

Steps to complete the NYC 114 7

Completing the NYC 114 7 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form with accurate figures for gross income and deductions.

- Calculate the UBT based on the provided income and deductions.

- Review the form for accuracy and completeness.

- Submit the completed form to the New York City Department of Finance by the filing deadline.

Legal use of the NYC 114 7

The NYC 114 7 form must be used in accordance with New York City tax laws. It is legally required for unincorporated businesses to file this form if they meet the income threshold set by the city. Failure to file can result in penalties and interest on unpaid taxes. It is important for business owners to understand their obligations to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 114 7 are typically aligned with the annual tax calendar. Businesses must submit their forms by the due date to avoid penalties. Important dates include:

- Annual filing deadline: Generally, this falls on the 15th day of the fourth month following the end of the tax year.

- Extension requests: If additional time is needed, businesses can file for an extension, but they must still pay any estimated taxes owed by the original deadline.

Required Documents

To complete the NYC 114 7 form, several documents are required:

- Financial statements detailing income and expenses.

- Records of any deductions claimed.

- Previous year's tax returns, if applicable, for reference.

- Any additional documentation that supports the figures reported on the form.

Create this form in 5 minutes or less

Find and fill out the correct nyc 114 7

Create this form in 5 minutes!

How to create an eSignature for the nyc 114 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc 114 7?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. In the context of nyc 114 7, it provides a streamlined way for companies in New York City to manage their document workflows efficiently and securely.

-

How much does airSlate SignNow cost for users in the nyc 114 7 area?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses in the nyc 114 7 area. You can select from different tiers that cater to various needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for businesses in nyc 114 7?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are particularly beneficial for businesses in nyc 114 7 looking to enhance their document management processes.

-

How can airSlate SignNow benefit my business in nyc 114 7?

By using airSlate SignNow, businesses in nyc 114 7 can improve efficiency, reduce turnaround times, and enhance customer satisfaction. The platform simplifies the signing process, allowing you to focus on what matters most—growing your business.

-

Does airSlate SignNow integrate with other software commonly used in nyc 114 7?

Yes, airSlate SignNow integrates seamlessly with various software applications that businesses in nyc 114 7 frequently use, such as CRM systems and project management tools. This integration helps streamline workflows and enhances productivity.

-

Is airSlate SignNow secure for handling sensitive documents in nyc 114 7?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents, making it a reliable choice for businesses in nyc 114 7. With features like encryption and secure access, you can trust that your data is safe.

-

Can I use airSlate SignNow for mobile signing in nyc 114 7?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users in nyc 114 7 to sign documents on the go. This flexibility ensures that you can manage your document signing needs anytime, anywhere.

Get more for NYC 114 7

Find out other NYC 114 7

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement