Business Activities NAICS Codes Treasurer & Tax Collector 2022

Understanding the Business Activities NAICS Codes

The North American Industry Classification System (NAICS) codes are essential for identifying the type of business activities conducted by an organization. These codes are used by federal and state agencies, including the Kansas Department of Revenue, to classify businesses for tax purposes. Each business type has a specific code that helps in determining tax obligations and compliance requirements. For Kansas corporate income tax, accurately identifying your NAICS code is crucial for correctly filing your taxes and ensuring compliance with state regulations.

Steps to Complete the Business Activities NAICS Codes

To complete the NAICS codes section on the Kansas corporate income tax form, follow these steps:

- Identify your primary business activity. This is the main service or product your business provides.

- Consult the NAICS code directory, which is available online, to find the code that best describes your business activity.

- Record the six-digit NAICS code on your Kansas corporate income tax form. Ensure that it is accurate to avoid potential compliance issues.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for compliance with Kansas corporate income tax regulations. The due date for filing your corporate income tax return typically aligns with the federal tax return deadline. For most corporations, this is the fifteenth day of the fourth month following the end of the tax year. If you are filing for the 2021 tax year, the deadline would be April 15, 2022. Extensions may be available, but it's important to check the specific guidelines to avoid penalties.

Required Documents for Filing

When preparing to file your Kansas corporate income tax return, gather the following documents:

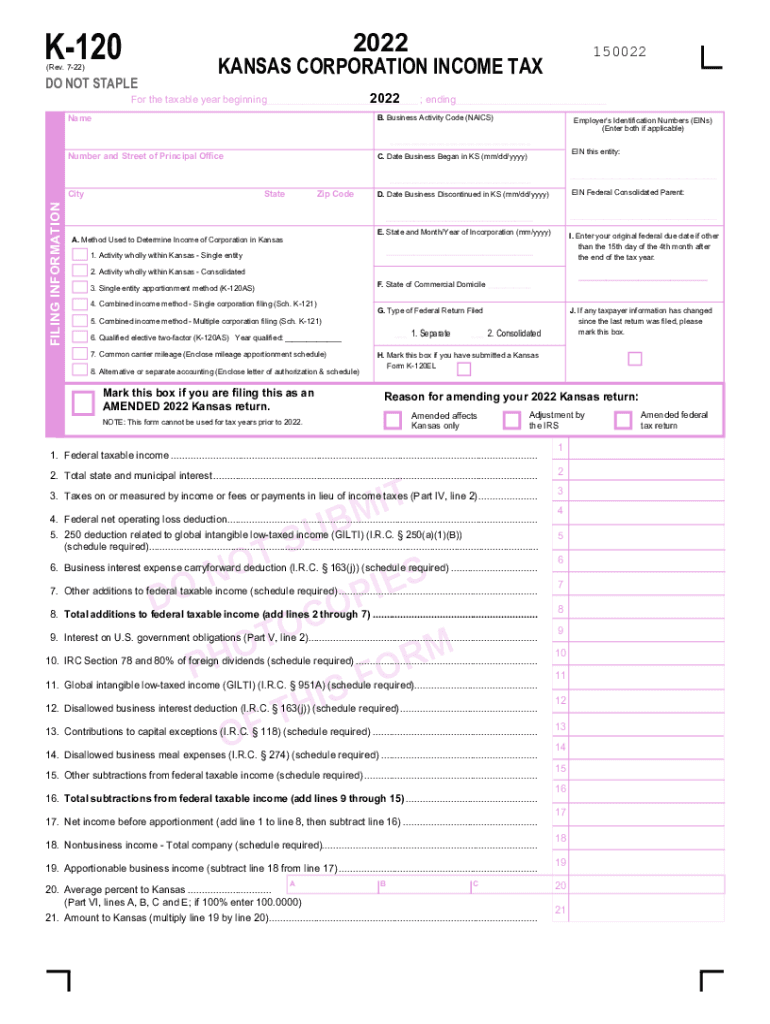

- Your completed Kansas corporate income tax form (K-120).

- Financial statements, including income statements and balance sheets.

- Documentation supporting any deductions or credits claimed.

- Your NAICS code, which should be included on the tax form.

Penalties for Non-Compliance

Failure to comply with Kansas corporate income tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to file your return accurately and on time to avoid these consequences. Understanding the specific penalties associated with late or incorrect filings can help you prioritize compliance and maintain good standing with tax authorities.

Digital vs. Paper Version of the Form

Filing your Kansas corporate income tax can be done either digitally or via paper forms. The digital version allows for easier submission and may provide benefits such as automatic calculations and reduced processing times. Conversely, paper submissions may take longer to process and could be more prone to errors. Consider your business's needs and capabilities when deciding which method to use for filing.

Quick guide on how to complete business activities naics codes treasurer ampamp tax collector

Easily prepare Business Activities NAICS Codes Treasurer & Tax Collector on any device

The popularity of online document management has surged among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any hurdles. Manage Business Activities NAICS Codes Treasurer & Tax Collector on any device using the airSlate SignNow apps for Android or iOS and simplify any document-centric process today.

Effortlessly edit and eSign Business Activities NAICS Codes Treasurer & Tax Collector

- Find Business Activities NAICS Codes Treasurer & Tax Collector and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to finalize your modifications.

- Choose your delivery method for the form, such as email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs within just a few clicks from any device you prefer. Modify and eSign Business Activities NAICS Codes Treasurer & Tax Collector to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business activities naics codes treasurer ampamp tax collector

Create this form in 5 minutes!

How to create an eSignature for the business activities naics codes treasurer ampamp tax collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Kansas Form K-120 for 2022?

The Kansas Form K-120 for 2022 is utilized for corporate income tax reporting in the state of Kansas. This form enables businesses to report their income and calculate their tax liability accurately. Understanding the Kansas Form K-120 instructions 2022 is crucial for compliance and to ensure proper filing.

-

Where can I find the Kansas Form K-120 instructions for 2022?

The Kansas Form K-120 instructions for 2022 can be found on the official Kansas Department of Revenue website. This resource provides detailed guidance on how to complete the form correctly. It's essential to refer to the Kansas Form K-120 instructions 2022 to avoid any filing errors.

-

What features does airSlate SignNow offer for managing forms like the Kansas Form K-120?

airSlate SignNow provides several features for managing documents, including eSigning, document templates, and automated workflows. These features facilitate a seamless experience for businesses needing to handle the Kansas Form K-120 instructions 2022. The user-friendly interface makes it easy to navigate and complete necessary forms.

-

Is airSlate SignNow suitable for large businesses needing to file the Kansas Form K-120?

Yes, airSlate SignNow is suitable for businesses of all sizes, including large corporations. It scales effectively to accommodate additional users and documents, making it an ideal choice for filing the Kansas Form K-120 instructions 2022. The platform's efficiency can streamline the process for larger teams.

-

How does airSlate SignNow ensure the security of my Kansas Form K-120 documents?

AirSlate SignNow employs advanced security measures including encryption, secure storage, and access controls to protect your documents. This level of security ensures that your Kansas Form K-120 documents remain private and safeguarded. Trusting airSlate SignNow means you're prioritizing the safety of sensitive information.

-

What are the pricing options for using airSlate SignNow for Kansas Form K-120?

AirSlate SignNow offers various pricing plans to cater to different business needs. These plans include features ideal for completing the Kansas Form K-120 instructions 2022 efficiently. Check their website for the most up-to-date pricing and features to find a plan that suits your organization.

-

Can I integrate airSlate SignNow with other software for filing the Kansas Form K-120?

Yes, airSlate SignNow integrates seamlessly with many popular software applications, enhancing your workflow. Whether it's accounting software or document management systems, you can leverage these integrations to facilitate the filing of the Kansas Form K-120 instructions 2022. This flexibility helps streamline your processes.

Get more for Business Activities NAICS Codes Treasurer & Tax Collector

- Texas information form

- Quitclaim deed by two individuals to husband and wife texas form

- Warranty deed from two individuals to husband and wife texas form

- Estate lady bird form

- Enhanced life estate deed 497327348 form

- Request for information from subcontractor individual texas

- Tx limited partnership form

- Texas gift form

Find out other Business Activities NAICS Codes Treasurer & Tax Collector

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy