Kansas Form K 120 2018

What is the Kansas Form K-120?

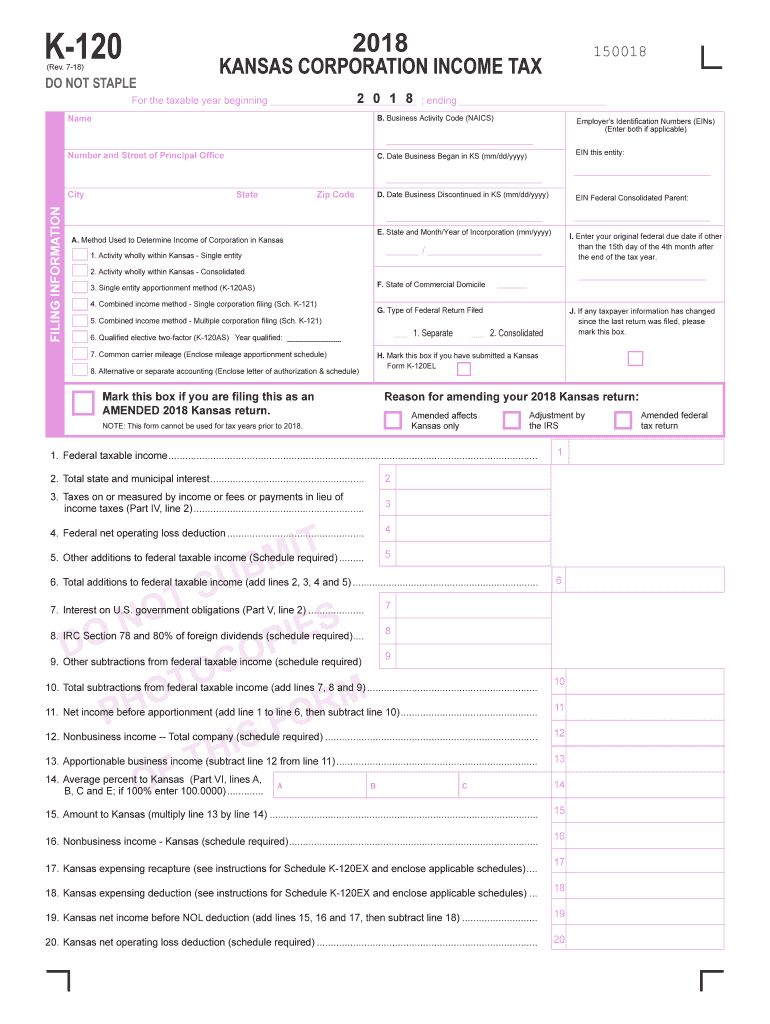

The Kansas Form K-120 is a tax form used by partnerships to report income, deductions, and credits to the state of Kansas. This form is essential for partnerships that operate within Kansas, as it ensures compliance with state tax regulations. The K-120 form allows partnerships to detail their financial activities and allocate income among partners, which is crucial for accurate tax reporting. Understanding the purpose and structure of the K-120 is vital for any partnership operating in the state.

Steps to Complete the Kansas Form K-120

Completing the Kansas Form K-120 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the partnership's income, deductions, and credits in the appropriate sections. It is important to accurately allocate income to each partner based on the partnership agreement. After completing the form, review all entries for accuracy, sign where required, and prepare for submission. Ensuring that the form is filled out correctly is crucial to avoid penalties and ensure timely processing.

Legal Use of the Kansas Form K-120

The Kansas Form K-120 must be used in accordance with state tax laws to maintain its legal validity. Partnerships are required to file this form to report their income and pay any applicable taxes. It is important for partnerships to adhere to the guidelines set forth by the Kansas Department of Revenue to ensure compliance. Failure to use the form correctly or to file it on time can result in penalties, interest, and other legal repercussions. Understanding the legal implications of the K-120 form is essential for any partnership operating in Kansas.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Form K-120 are critical for compliance with state tax regulations. Typically, partnerships must submit their K-120 form by the 15th day of the fourth month following the end of their tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. It is important to note that extensions may be available, but they must be requested in advance. Keeping track of these deadlines helps partnerships avoid late fees and ensures timely processing of their tax returns.

Required Documents

To complete the Kansas Form K-120, several documents are necessary. Partnerships should gather income statements, expense records, and any relevant tax documents that detail deductions and credits. Additionally, the partnership agreement is crucial for determining how income is allocated among partners. Having all required documents on hand simplifies the process of filling out the K-120 and helps ensure that the information reported is accurate and complete.

Form Submission Methods

The Kansas Form K-120 can be submitted through various methods, including online filing, mailing, or in-person submission. Online filing is often the most efficient option, allowing for quicker processing times. Partnerships can also choose to mail their completed forms to the Kansas Department of Revenue or submit them in person at designated locations. Each submission method has its own advantages, and partnerships should select the one that best fits their needs while ensuring compliance with state regulations.

Key Elements of the Kansas Form K-120

The Kansas Form K-120 includes several key elements that are essential for accurate reporting. These elements typically consist of sections for reporting income, deductions, credits, and partner information. Additionally, the form requires partnerships to provide details about their business activities and any applicable tax liabilities. Understanding these key elements is crucial for partnerships to ensure that they report their financial information accurately and comply with state tax laws.

Quick guide on how to complete k 120 corporation income tax return rev 7 18fillable corporation tax

Your assistance manual on how to prepare your Kansas Form K 120

If you’re interested in understanding how to generate and submit your Kansas Form K 120, here are some brief instructions on how to simplify tax declarations.

To begin, all you need is to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to alter, generate, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revert to amend information as needed. Streamline your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Kansas Form K 120 within minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Access form to open your Kansas Form K 120 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Signature Tool to affix your legally-binding electronic signature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may lead to increased return mistakes and delayed refunds. Before e-filing your taxes, please check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct k 120 corporation income tax return rev 7 18fillable corporation tax

FAQs

-

Does a DE Corporation, based in CA, have to file Form 100 (franchise/income tax return)?

Yes, if the corporation has a physical presence in CA, then it has to register as a foreign entity doing business in CA and file and pay CA income/franchise tax.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the k 120 corporation income tax return rev 7 18fillable corporation tax

How to create an eSignature for your K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax online

How to make an eSignature for the K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax in Google Chrome

How to generate an electronic signature for signing the K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax in Gmail

How to create an eSignature for the K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax right from your smart phone

How to create an electronic signature for the K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax on iOS devices

How to create an eSignature for the K 120 Corporation Income Tax Return Rev 7 18fillable Corporation Tax on Android OS

People also ask

-

What are the k 120s instructions 2018 for setting up airSlate SignNow?

The k 120s instructions 2018 include a step-by-step guide on how to set up your airSlate SignNow account, ensuring you can easily send and eSign documents. Follow the provided links to access the user-friendly interface and complete the setup efficiently.

-

Are there any costs associated with the k 120s instructions 2018?

The k 120s instructions 2018 are provided as part of the airSlate SignNow service, which offers cost-effective pricing plans. You can explore our different plans to find one that fits your business needs without hidden fees.

-

What features are highlighted in the k 120s instructions 2018?

The k 120s instructions 2018 emphasize key features such as document templates, secure eSignature functionality, and easy integration with various platforms. These features are designed to streamline document workflows and enhance productivity.

-

Can I integrate airSlate SignNow using the k 120s instructions 2018?

Yes, the k 120s instructions 2018 provide detailed guidance on how to integrate airSlate SignNow with popular applications like Google Drive and Salesforce. This seamless integration allows for better document management within your existing workflows.

-

What are the benefits of using airSlate SignNow according to the k 120s instructions 2018?

According to the k 120s instructions 2018, using airSlate SignNow streamlines your document signing process, enhances compliance, and saves time. The platform is designed to provide businesses with a reliable solution for quick and secure document handling.

-

How user-friendly is the airSlate SignNow interface as per the k 120s instructions 2018?

The k 120s instructions 2018 highlight that airSlate SignNow has a highly intuitive interface that requires minimal training. This design makes it easy for users of all technical skill levels to navigate and utilize the eSigning features effectively.

-

Are there mobile options available in the k 120s instructions 2018?

Absolutely! The k 120s instructions 2018 mention that airSlate SignNow is fully optimized for mobile use. This allows users to send and eSign documents on the go, ensuring flexibility and convenience.

Get more for Kansas Form K 120

- Electronic form offline online or any other

- Nys doh cli forms 2423

- Federated insurance beneficiary change form

- Declaration for the passes ampamp ptos for family members dependents for the year 200 form

- Affidavit distance education bureau ugc form

- Lic form no 470 rev pdf download fill online

- Indian association for cognitive behavior iacbt form

- Madhyamik certificate download fill online printable form

Find out other Kansas Form K 120

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement