K 120 2024-2026

What is the K-120?

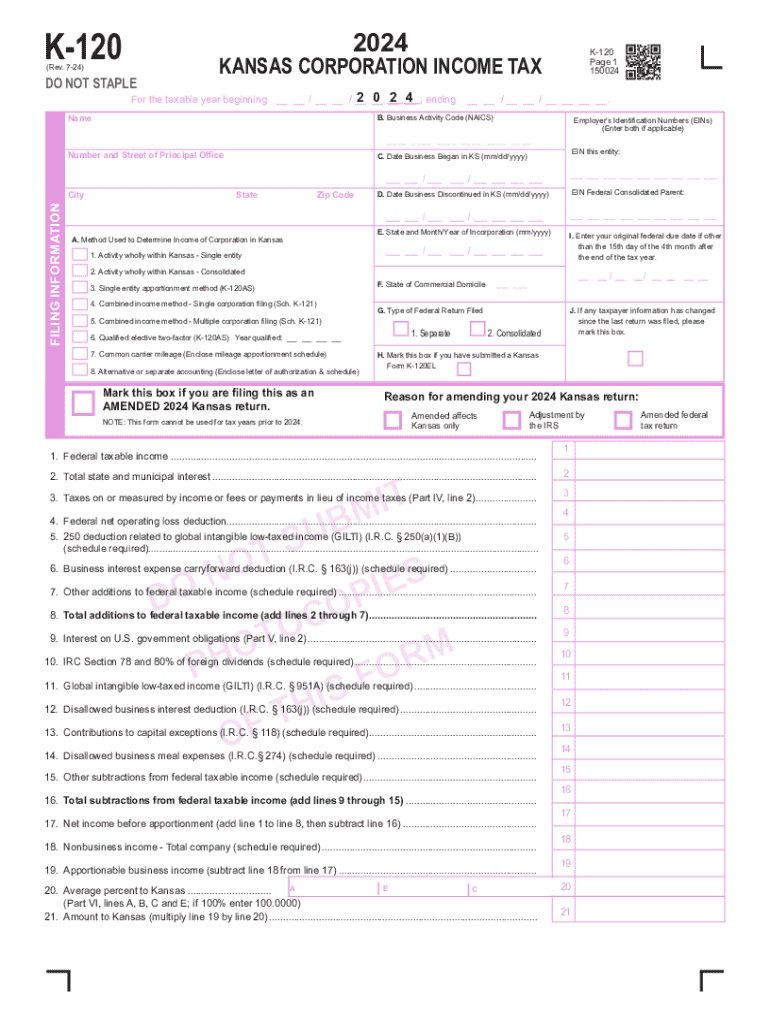

The K-120, also known as the Kansas Form K-120, is a tax form used by corporations operating in Kansas. This form is essential for reporting income, deductions, and credits for state tax purposes. It is specifically designed for C corporations, which are taxed separately from their owners. Understanding the K-120 is crucial for compliance with Kansas tax laws and ensuring accurate tax filings.

How to Obtain the K-120

To obtain the K-120, taxpayers can visit the Kansas Department of Revenue's official website, where the form is available for download. Additionally, physical copies of the form can be requested directly from the department. It is important to ensure that you are using the correct version of the form for the applicable tax year, as forms may be updated annually.

Steps to Complete the K-120

Completing the K-120 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the identification section, including the corporation's name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the appropriate sections.

- Calculate the tax liability based on the income reported.

- Review the form for accuracy before submission.

Legal Use of the K-120

The K-120 must be used in accordance with Kansas tax regulations. Corporations are legally required to file this form if they meet the state's criteria for corporate taxation. Failure to file the K-120 can result in penalties and interest on unpaid taxes. It is important for corporations to stay informed about any changes in tax laws that may affect their filing obligations.

Filing Deadlines / Important Dates

The K-120 must be filed on or before the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by April 15. It is advisable to mark this date on your calendar to avoid late filing penalties. Extensions may be available, but they must be requested in advance.

Required Documents

When completing the K-120, several documents are necessary to support the information reported on the form:

- Federal tax return (Form 1120 or 1120-S)

- Financial statements, including balance sheets and income statements

- Documentation for any deductions or credits claimed

- Records of estimated tax payments made during the year

Form Submission Methods

The K-120 can be submitted in various ways, including:

- Online through the Kansas Department of Revenue's e-filing system

- By mail, using the address specified on the form

- In-person at designated state tax offices

Choosing the appropriate submission method can help ensure timely processing of the form and compliance with filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct k 120

Create this form in 5 minutes!

How to create an eSignature for the k 120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ks form 120 and how can airSlate SignNow help?

The ks form 120 is a crucial document for various business processes in Kansas. airSlate SignNow simplifies the completion and signing of the ks form 120 by providing an intuitive platform that allows users to fill out, send, and eSign the document quickly and securely.

-

How much does it cost to use airSlate SignNow for the ks form 120?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose from various subscription options that provide access to features specifically designed for managing documents like the ks form 120, ensuring a cost-effective solution for all.

-

What features does airSlate SignNow offer for the ks form 120?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning, all tailored for documents like the ks form 120. These features enhance efficiency and ensure that your documents are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other applications for the ks form 120?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage the ks form 120 alongside your existing tools. This flexibility allows businesses to streamline their workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for the ks form 120?

Using airSlate SignNow for the ks form 120 provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform's user-friendly interface ensures that both senders and signers can navigate the process with ease.

-

Is airSlate SignNow secure for handling the ks form 120?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information associated with the ks form 120. With features like encryption and secure cloud storage, users can trust that their documents are safe.

-

How can I get started with airSlate SignNow for the ks form 120?

Getting started with airSlate SignNow for the ks form 120 is simple. You can sign up for a free trial on our website, explore the features, and begin creating and sending your documents right away.

Get more for K 120

- Tenants in common or other form of ownership

- Receive this property form

- The self proving affidavit is optional but recommended form

- Beneficiarys property be placed in trust form

- I of county arkansas form

- Varese si conferma grande battuta milano al forum form

- A home and school where his love abides dear parents form

- County arizona form

Find out other K 120

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple