Annual Report Kansas Department of Revenue 2021

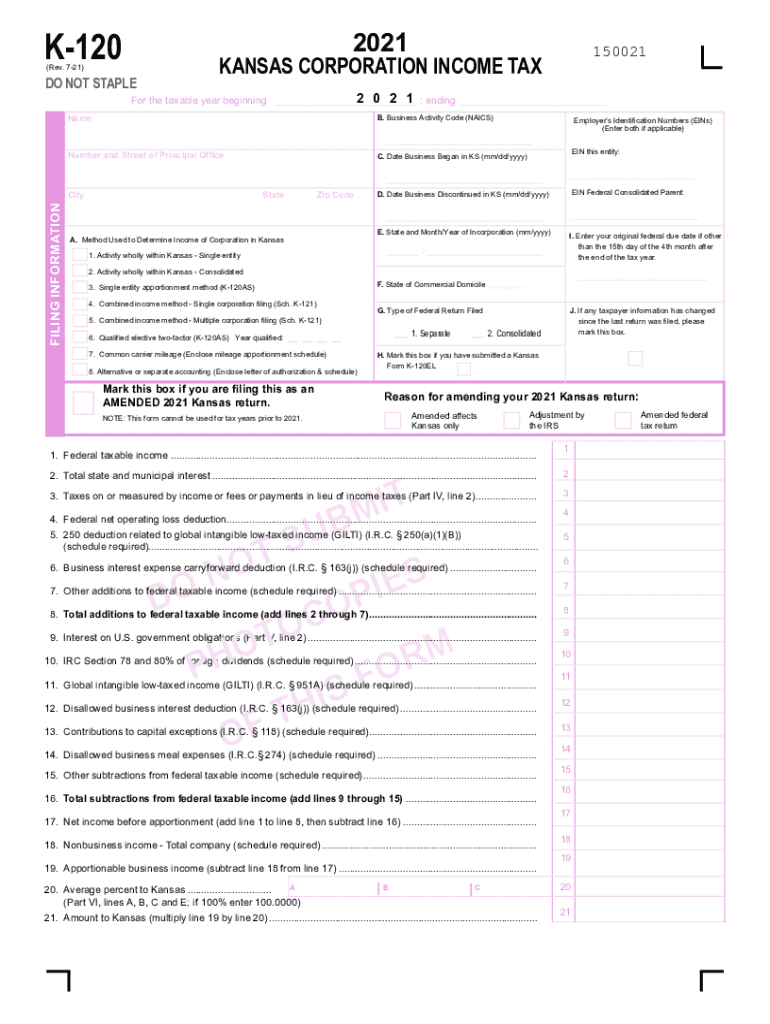

What is the Kansas Form K-120?

The Kansas Form K-120 is an annual tax return form specifically designed for corporations operating within the state of Kansas. This form is used to report the corporation's income, deductions, and tax liability for the fiscal year. Understanding the purpose of the K-120 is essential for ensuring compliance with state tax laws and accurately calculating the amount of tax owed to the Kansas Department of Revenue.

Steps to Complete the Kansas Form K-120

Completing the Kansas Form K-120 involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering your corporation's income, deductions, and any applicable credits. Ensure that you carefully follow the instructions provided with the form to avoid errors. Once completed, review the form for accuracy before submitting it to the Kansas Department of Revenue.

Required Documents for Kansas Form K-120

To successfully complete the Kansas Form K-120, certain documents are required. These include:

- Financial statements, such as profit and loss statements and balance sheets.

- Records of all income received during the fiscal year.

- Documentation of any deductions or credits claimed.

- Previous year's tax return, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Filing Deadlines for Kansas Form K-120

It is crucial to be aware of the filing deadlines associated with the Kansas Form K-120. Generally, the form must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the deadline is April 15. Missing the deadline can result in penalties and interest on any unpaid taxes, making timely submission essential.

Penalties for Non-Compliance with Kansas Form K-120

Failure to file the Kansas Form K-120 on time can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, which accrues from the original due date.

- Potential legal action for continued non-compliance.

Corporations should prioritize timely submission to avoid these penalties and maintain good standing with the Kansas Department of Revenue.

Digital vs. Paper Version of Kansas Form K-120

The Kansas Form K-120 can be filed either digitally or via paper submission. The digital version offers several advantages, including faster processing times and reduced risk of errors. Electronic filing can also streamline the payment process for any taxes owed. However, some corporations may prefer the traditional paper method. It is important to choose the method that best suits your corporation's needs while ensuring compliance with state regulations.

Quick guide on how to complete 2016 annual report kansas department of revenue

Easily Prepare Annual Report Kansas Department Of Revenue on Any Gadget

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Annual Report Kansas Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and streamline your document-driven tasks today.

How to Adjust and Electronically Sign Annual Report Kansas Department Of Revenue Effortlessly

- Obtain Annual Report Kansas Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Annual Report Kansas Department Of Revenue and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 annual report kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2016 annual report kansas department of revenue

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to kansas form k 120 instructions 2021?

airSlate SignNow offers a user-friendly interface that simplifies the process of eSigning and sending documents, including the kansas form k 120 instructions 2021. Users can create templates, share documents securely, and track the status of their forms in real-time, making it easier to manage tax documentation.

-

How can I get started with airSlate SignNow for kansas form k 120 instructions 2021?

Getting started with airSlate SignNow for the kansas form k 120 instructions 2021 is easy. Simply sign up for a free trial on our website, explore our features, and begin uploading your documents. We provide helpful resources and support to assist you in navigating the eSigning process.

-

Is there a cost associated with using airSlate SignNow for kansas form k 120 instructions 2021?

Yes, airSlate SignNow offers various pricing plans to suit different needs, starting with a free trial. For those specifically focusing on the kansas form k 120 instructions 2021, our affordable plans provide unlimited eSigning and document management capabilities, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other applications for kansas form k 120 instructions 2021?

Absolutely! airSlate SignNow easily integrates with numerous applications to enhance your workflow related to the kansas form k 120 instructions 2021. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect seamlessly to facilitate your needs.

-

What benefits can I expect from using airSlate SignNow for kansas form k 120 instructions 2021?

By using airSlate SignNow for the kansas form k 120 instructions 2021, you can expect increased efficiency, reduced turnaround times, and enhanced security for your documents. Our platform also minimizes paperwork and saves you time, allowing for quicker filing and processing of tax documents.

-

Does airSlate SignNow provide support for kansas form k 120 instructions 2021?

Yes, airSlate SignNow offers comprehensive support for users navigating the kansas form k 120 instructions 2021. Whether you have technical questions or need assistance with document preparation, our support team is available to guide you through the process.

-

Is airSlate SignNow compliant with legal requirements for kansas form k 120 instructions 2021?

Yes, airSlate SignNow complies with all legal requirements necessary for the kansas form k 120 instructions 2021. Our eSignatures are legally binding and meet industry standards, providing you with peace of mind while handling your tax documents.

Get more for Annual Report Kansas Department Of Revenue

- Notice of dishonored check civil keywords bad check bounced check colorado form

- Mutual wills containing last will and testaments for unmarried persons living together with no children colorado form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children colorado form

- Mutual wills or last will and testaments for unmarried persons living together with minor children colorado form

- Non marital cohabitation living together agreement colorado form

- Writ continuing garnishment form

- Paternity law and procedure handbook colorado form

- Bill of sale in connection with sale of business by individual or corporate seller colorado form

Find out other Annual Report Kansas Department Of Revenue

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now