Kentucky Kentucky Tax Registration Application and Instructions 2022

What is the Kentucky Tax Registration Application?

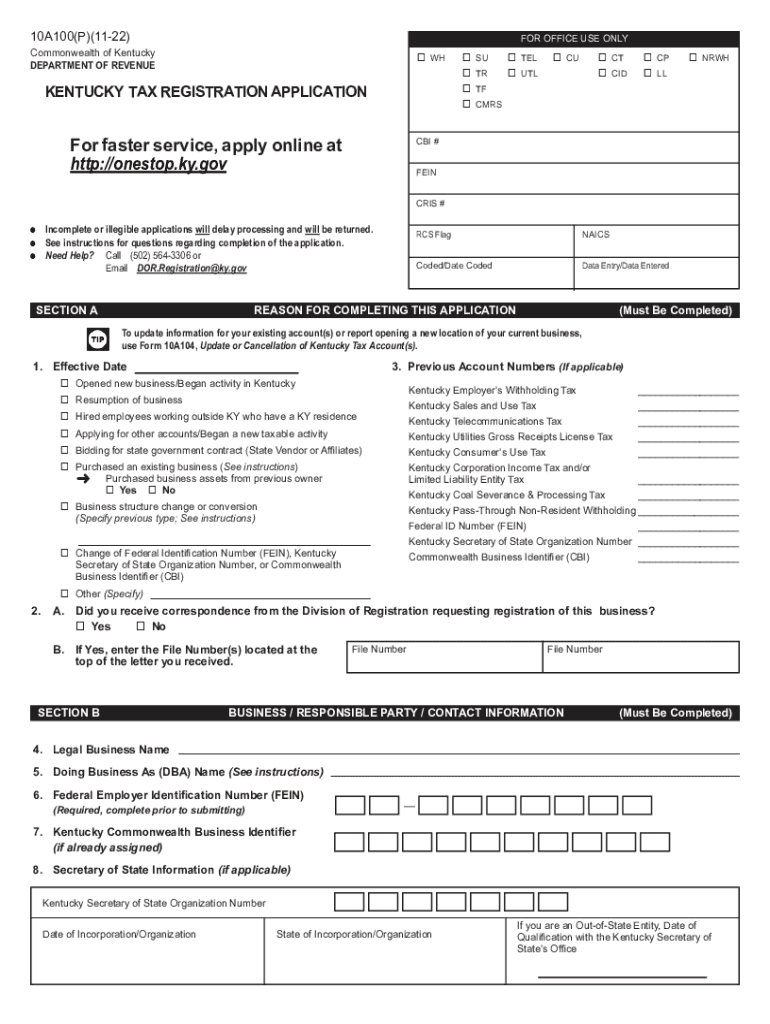

The Kentucky Tax Registration Application, known as the 10a100, is a crucial document for businesses operating in Kentucky. This application is required for entities to register for various tax accounts with the Kentucky Department of Revenue. It serves as a means for businesses to report their tax obligations, including sales tax, withholding tax, and other state taxes. Completing the 10a100 ensures compliance with Kentucky tax laws and helps streamline the tax registration process for new and existing businesses.

Steps to Complete the Kentucky Tax Registration Application

Completing the Kentucky Tax Registration Application involves several key steps to ensure accuracy and compliance:

- Gather necessary information about your business, including the legal name, address, and federal Employer Identification Number (EIN).

- Determine the types of taxes for which you need to register, such as sales tax or withholding tax.

- Fill out the 10a100 form with the required details, ensuring all sections are completed accurately.

- Review the application for any errors or omissions before submission.

- Submit the completed form electronically or by mail to the Kentucky Department of Revenue.

Required Documents for the Kentucky Tax Registration Application

When applying for tax registration in Kentucky using the 10a100 form, several documents may be required to support your application:

- Federal Employer Identification Number (EIN) confirmation.

- Proof of business formation, such as Articles of Incorporation or Organization.

- Identification for the business owner or authorized representative.

- Any additional documentation specific to the type of tax registration being applied for.

Legal Use of the Kentucky Tax Registration Application

The 10a100 form is legally binding when completed and submitted in accordance with Kentucky law. It provides the necessary legal framework for businesses to operate within the state and fulfill their tax obligations. Compliance with the Kentucky Department of Revenue regulations ensures that businesses can avoid penalties and maintain good standing.

Form Submission Methods for the Kentucky Tax Registration Application

The Kentucky Tax Registration Application can be submitted through various methods, providing flexibility for businesses:

- Online Submission: Businesses can complete and submit the 10a100 form electronically via the Kentucky Department of Revenue's website.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Kentucky Department of Revenue.

- In-Person: Businesses may also choose to submit the application in person at designated Kentucky Department of Revenue offices.

Eligibility Criteria for the Kentucky Tax Registration Application

To be eligible to complete the 10a100 form, businesses must meet certain criteria established by the Kentucky Department of Revenue. This includes:

- Operating as a legal business entity within Kentucky.

- Having a valid federal Employer Identification Number (EIN).

- Intending to engage in activities that require tax registration, such as selling goods or hiring employees.

Quick guide on how to complete kentucky kentucky tax registration application and instructions

Complete Kentucky Kentucky Tax Registration Application And Instructions seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the precise form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Kentucky Kentucky Tax Registration Application And Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Kentucky Kentucky Tax Registration Application And Instructions effortlessly

- Locate Kentucky Kentucky Tax Registration Application And Instructions and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Kentucky Kentucky Tax Registration Application And Instructions and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky kentucky tax registration application and instructions

Create this form in 5 minutes!

How to create an eSignature for the kentucky kentucky tax registration application and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 10a100 feature in airSlate SignNow?

The 10a100 feature in airSlate SignNow enhances the document signing process by providing users with streamlined workflows. This feature allows multiple signers to act on a document simultaneously, ensuring quicker turnaround times. With 10a100, you can easily manage signatures and approvals in one efficient platform.

-

How does pricing work for the 10a100 plan?

airSlate SignNow offers a competitive pricing structure for the 10a100 plan, ensuring that businesses of all sizes can afford effective document management. Subscription fees are based on the number of users and features required, making it flexible for every budget. You can start with a free trial to see how 10a100 fits your needs.

-

What features are included in the 10a100 package?

The 10a100 package includes essential features like customizable templates, team collaboration, and advanced security measures. Users also benefit from automated reminders and tracking options that enhance document flow. These features work together to optimize the signing process and save time for businesses.

-

Can I integrate airSlate SignNow's 10a100 with other software?

Yes, airSlate SignNow's 10a100 supports seamless integrations with various third-party applications such as CRM systems and cloud storage platforms. This capability enhances the overall functionality and efficiency of your workflows. Whether you use Salesforce, Google Drive, or others, you can easily connect these tools with the 10a100 feature.

-

What are the main benefits of using the 10a100 solution?

Using airSlate SignNow's 10a100 solution allows businesses to signNowly reduce the time spent on document management. The user-friendly interface simplifies eSigning, and the automation features minimize manual tasks. Additionally, the 10a100 solution helps maintain compliance and security, which is crucial for businesses handling sensitive information.

-

Is airSlate SignNow's 10a100 suitable for small businesses?

Absolutely! The 10a100 from airSlate SignNow is designed with small businesses in mind, providing an affordable and user-friendly eSigning solution. With its intuitive interface and essential features, small businesses can effectively manage documents without a large investment. It empowers teams to operate efficiently regardless of size.

-

How secure is the 10a100 eSigning process?

The 10a100 eSigning process in airSlate SignNow is highly secure, employing industry-standard encryption to protect your documents. Additionally, it ensures compliance with legal regulations, providing confidence in the authenticity of signatures. With 10a100, you can rest assured that your sensitive data is safeguarded throughout the signing process.

Get more for Kentucky Kentucky Tax Registration Application And Instructions

- Notice of dishonored check criminal keywords bad check bounced check texas form

- Mutual wills containing last will and testaments for man and woman living together not married with no children texas form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children texas form

- Mutual wills or last will and testaments for man and woman living together not married with minor children texas form

- Texas cohabitation form

- Tx paternity form

- Bill of sale in connection with sale of business by individual or corporate seller texas form

- Office lease agreement texas form

Find out other Kentucky Kentucky Tax Registration Application And Instructions

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF