Kentucky Tax Registration Form 2011

What is the Kentucky Tax Registration Form

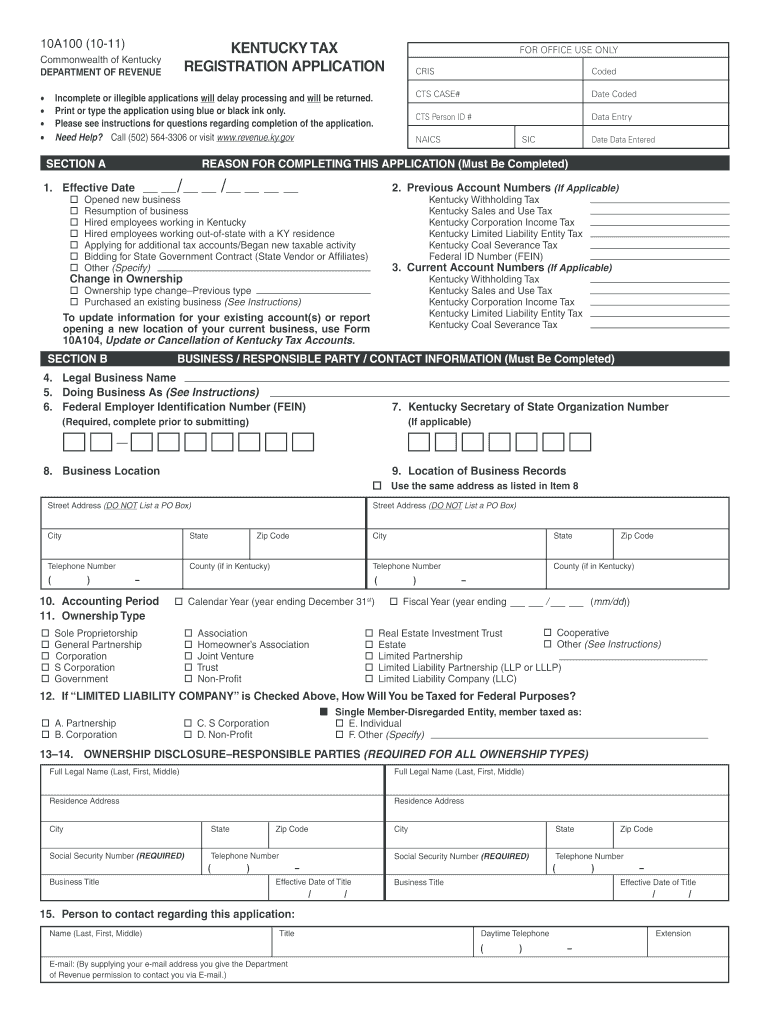

The Kentucky Tax Registration Form is an essential document for businesses operating within the state. This form is used to register for various state taxes, including sales tax, income tax, and employer withholding tax. By completing this form, businesses ensure compliance with Kentucky tax regulations and obtain the necessary identification numbers for tax reporting purposes. It is crucial for both new and existing businesses to understand the importance of this registration to avoid potential penalties and ensure smooth operations.

Steps to complete the Kentucky Tax Registration Form

Completing the Kentucky Tax Registration Form involves several key steps:

- Gather necessary information, including your business name, address, and federal Employer Identification Number (EIN).

- Determine the type of taxes you need to register for based on your business activities.

- Access the Kentucky Tax Registration Form online or obtain a paper version from the Kentucky Department of Revenue.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, following the instructions provided.

How to obtain the Kentucky Tax Registration Form

The Kentucky Tax Registration Form can be obtained through the Kentucky Department of Revenue's official website. It is available for download in a fillable format, allowing businesses to complete the form digitally. Alternatively, businesses can request a paper copy by contacting the Department of Revenue directly. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Key elements of the Kentucky Tax Registration Form

Several key elements are critical when filling out the Kentucky Tax Registration Form:

- Business Information: This includes the legal name, trade name, and physical address of the business.

- Tax Type Selection: Indicate which types of taxes the business will be liable for, such as sales tax or withholding tax.

- Owner Information: Provide details about the business owner(s), including names and contact information.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Form Submission Methods

Businesses can submit the Kentucky Tax Registration Form through various methods:

- Online Submission: The form can be completed and submitted electronically via the Kentucky Department of Revenue's online portal.

- Mail: A completed paper form can be mailed to the designated address provided by the Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at their local Department of Revenue office.

Legal use of the Kentucky Tax Registration Form

The Kentucky Tax Registration Form serves a legal purpose by establishing a business's compliance with state tax laws. Once submitted and processed, the form provides the business with a tax identification number, which is necessary for filing tax returns and making tax payments. Proper completion and submission of this form help prevent legal issues and penalties associated with tax non-compliance.

Quick guide on how to complete kentucky tax registration 2011 form

Your assistance manual on how to prepare your Kentucky Tax Registration Form

If you are curious about how to generate and submit your Kentucky Tax Registration Form, here are some brief instructions on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to change responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Kentucky Tax Registration Form in no time:

- Create your account and start working on PDFs within minutes.

- Utilize our library to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Kentucky Tax Registration Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Make use of the Signature Tool to add your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay refunds. As always, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct kentucky tax registration 2011 form

FAQs

-

How do I fill out the ICSI registration form?

Online Registration for CS Foundation | Executive | ProfessionalCheck this site

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the kentucky tax registration 2011 form

How to create an eSignature for your Kentucky Tax Registration 2011 Form in the online mode

How to create an electronic signature for the Kentucky Tax Registration 2011 Form in Google Chrome

How to generate an eSignature for signing the Kentucky Tax Registration 2011 Form in Gmail

How to make an electronic signature for the Kentucky Tax Registration 2011 Form from your smart phone

How to generate an eSignature for the Kentucky Tax Registration 2011 Form on iOS

How to create an electronic signature for the Kentucky Tax Registration 2011 Form on Android

People also ask

-

What is the Kentucky Tax Registration Form?

The Kentucky Tax Registration Form is a document required for businesses operating in Kentucky to register for various state taxes. This form helps ensure compliance with state tax laws and allows businesses to collect and remit taxes appropriately. Completing the Kentucky Tax Registration Form is essential for legal operation within the state.

-

How can airSlate SignNow help with the Kentucky Tax Registration Form?

airSlate SignNow provides an easy-to-use platform to electronically sign and send the Kentucky Tax Registration Form. Our solution streamlines the process, making it efficient and secure for businesses to manage their tax documentation. With airSlate SignNow, you can ensure your forms are filled, signed, and submitted without hassle.

-

Is there a cost associated with using airSlate SignNow for the Kentucky Tax Registration Form?

Yes, there is a cost associated with using airSlate SignNow, but we offer flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide value while allowing you to efficiently manage documents like the Kentucky Tax Registration Form. Check our website for specific pricing details and choose a plan that fits your needs.

-

What features does airSlate SignNow offer for handling the Kentucky Tax Registration Form?

airSlate SignNow offers a variety of features to simplify the management of the Kentucky Tax Registration Form, including electronic signatures, document templates, and real-time tracking. These features help businesses ensure compliance and maintain a clear record of their submissions. Our platform is designed to enhance efficiency and reduce paperwork.

-

Can I integrate airSlate SignNow with other tools for the Kentucky Tax Registration Form?

Yes, airSlate SignNow integrates seamlessly with numerous business tools and applications, allowing you to manage your Kentucky Tax Registration Form efficiently. Whether you use CRM systems, cloud storage, or accounting software, our integrations can help streamline your workflows. This connectivity ensures that your tax registration and related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Kentucky Tax Registration Form?

Using airSlate SignNow for documents like the Kentucky Tax Registration Form enhances efficiency and security. Our platform allows for quick electronic signatures, reducing turnaround time, and minimizing the risk of errors. Additionally, you can store and manage all tax-related documents in one place, simplifying your compliance efforts.

-

How secure is airSlate SignNow when handling the Kentucky Tax Registration Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your data. When handling sensitive documents like the Kentucky Tax Registration Form, you can trust that your information is secure from unauthorized access. We continuously update our security measures to ensure the highest level of protection.

Get more for Kentucky Tax Registration Form

Find out other Kentucky Tax Registration Form

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile