About Form 1041, U S Income Tax Return for Estates and TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 2022

What is the About Form 1041, U S Income Tax Return For Estates And Trusts

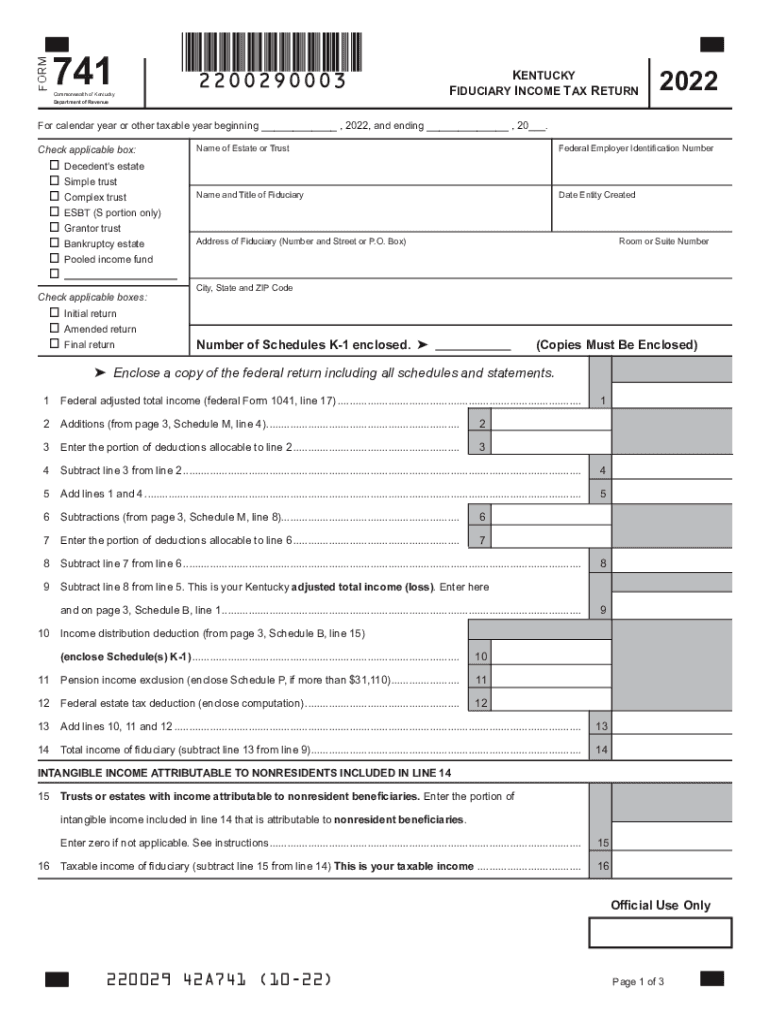

The About Form 1041, U S Income Tax Return for Estates and Trusts, is a crucial document used to report income, deductions, gains, and losses for estates and trusts. This form is essential for fiduciaries managing estates or trusts, as it ensures compliance with federal tax regulations. It allows the fiduciary to calculate the taxable income of the estate or trust and determine the tax liability. The form must be filed annually, and it is important for maintaining transparency and accountability in the management of the estate or trust's financial affairs.

Steps to Complete the About Form 1041

Completing the About Form 1041 involves several key steps:

- Gather necessary information: Collect all financial records related to the estate or trust, including income statements, expense records, and previous tax returns.

- Fill out the form: Accurately enter all required information, including the name and address of the estate or trust, the fiduciary's details, and financial data.

- Calculate tax liability: Use the information provided to determine the taxable income and calculate any taxes owed.

- Review the form: Double-check all entries for accuracy and completeness to avoid potential issues with the IRS.

- Sign and date: Ensure the form is signed by the fiduciary before submission.

Legal Use of the About Form 1041

The About Form 1041 serves as a legally binding document for reporting income and tax obligations for estates and trusts. It is essential for fiduciaries to understand the legal implications of this form. Filing the form accurately and on time is crucial to avoid penalties and ensure compliance with IRS regulations. Additionally, the form must be retained for record-keeping purposes, as it may be required for future audits or inquiries by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the About Form 1041 are typically set by the IRS. Generally, the form must be filed by the 15th day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year basis, this means the form is due by April 15. It is important for fiduciaries to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with tax obligations.

Required Documents for Filing

When preparing to file the About Form 1041, several documents are necessary to ensure accurate reporting. These include:

- Financial statements detailing income and expenses of the estate or trust.

- Documentation of any deductions, such as administrative expenses or distributions to beneficiaries.

- Previous tax returns for the estate or trust, if applicable.

- Any relevant IRS publications or guidelines that may assist in completing the form.

Who Issues the Form

The About Form 1041 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for completing the form, as well as updates to ensure compliance with current tax laws. Fiduciaries should refer to the IRS website or official publications for the most accurate and up-to-date information regarding the form and its requirements.

Quick guide on how to complete about form 1041 us income tax return for estates and trustsincome taxes taxanswers kentuckyincome taxes taxanswers

Effortlessly Prepare About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-centric process today.

How to Alter and Electronically Sign About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 with Ease

- Obtain About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Alter and electronically sign About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1041 us income tax return for estates and trustsincome taxes taxanswers kentuckyincome taxes taxanswers

Create this form in 5 minutes!

How to create an eSignature for the about form 1041 us income tax return for estates and trustsincome taxes taxanswers kentuckyincome taxes taxanswers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 and how is it related to estates and trusts?

Form 1041, U S Income Tax Return For Estates And Trusts, is a tax form used to report income, deductions, gains, and losses for estates and trusts. Understanding 'About Form 1041' is essential for fiduciaries managing these entities, as it ensures compliance with Kentucky Income Taxes and proper reporting to the DEPARTMENT OF REVENUE.

-

How can airSlate SignNow help with managing Form 1041 submissions?

With airSlate SignNow, you can easily send and eSign documents related to Form 1041, making the process of filing the U S Income Tax Return For Estates And Trusts streamlined. This not only saves time but also ensures that your submissions comply with Kentucky Income Taxes regulations.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow includes features such as document templates, eSigning, form customization, and secure cloud storage. These tools are particularly useful for managing Form 1041 and adhering to Kentucky Income Taxes guidelines set by the DEPARTMENT OF REVENUE.

-

Is airSlate SignNow cost-effective for small estates and trusts?

Yes, airSlate SignNow provides an affordable solution that is well-suited for small estates and trusts needing to file Form 1041. By using a cost-effective platform, you can ensure compliance with U S Income Tax Returns without excessive overhead costs related to Kentucky Income Taxes.

-

What integrations does airSlate SignNow support for tax filing?

airSlate SignNow integrates seamlessly with various tax software and business applications, which simplifies the process of handling Form 1041. These integrations help streamline data flow and ensure that your filings meet all necessary Kentucky Income Taxes requirements.

-

How does eSigning improve the process of dealing with Form 1041?

eSigning through airSlate SignNow enables faster approvals and reduces the time spent on paperwork related to Form 1041. By using this feature, you can expedite the filing process and maintain compliance with U S Income Tax Return regulations for estates and trusts in Kentucky.

-

Are there any resources available to learn more about Form 1041?

Absolutely, airSlate SignNow provides a variety of resources, including FAQs, webinars, and articles about Form 1041. These materials help users understand their responsibilities regarding the U S Income Tax Return For Estates And Trusts and comply with Kentucky Income Taxes.

Get more for About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1

Find out other About Form 1041, U S Income Tax Return For Estates And TrustsIncome Taxes TAXANSWERS KentuckyIncome Taxes TAXANSWERS KentuckySC1

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template