FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm 2024-2026

What is the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

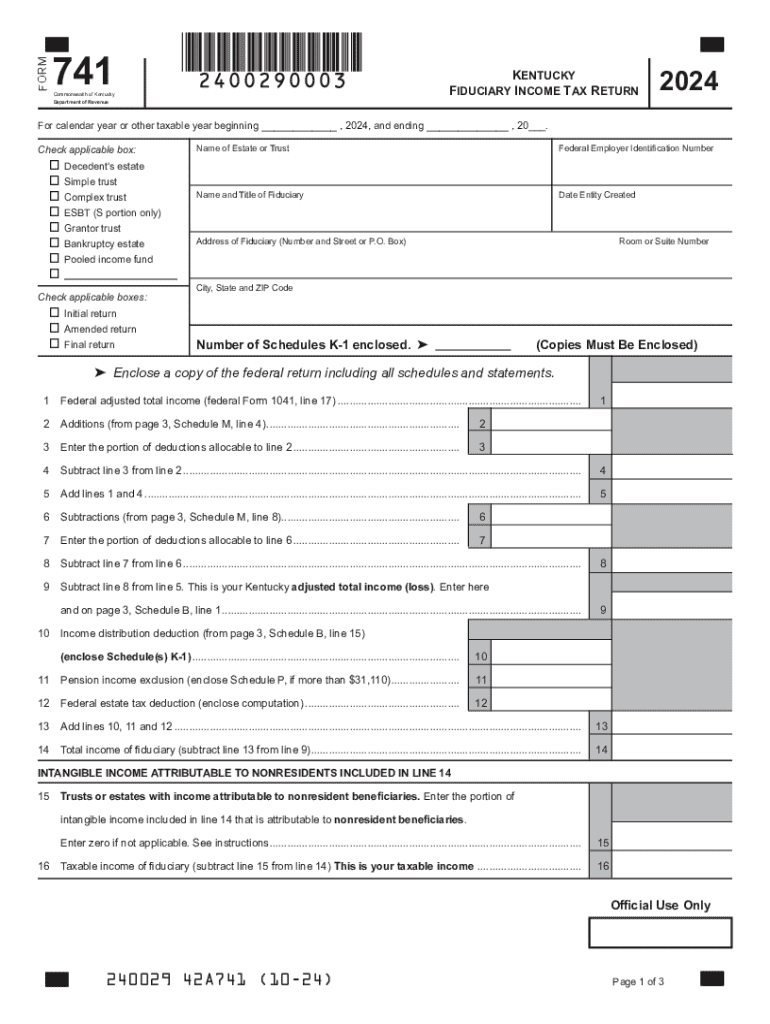

The FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN is a tax form used by fiduciaries to report the income, deductions, and credits of estates and trusts in Kentucky. This form is essential for ensuring compliance with state tax regulations. It allows fiduciaries to calculate the tax owed on behalf of the estate or trust, ensuring that all income generated is properly reported to the Kentucky Department of Revenue.

How to use the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

Using the FORM 741 involves several steps. First, gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and prior tax returns. Next, complete the form by accurately entering all required information, such as the fiduciary's details, income sources, and deductions. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

Completing the FORM 741 requires careful attention to detail. Follow these steps:

- Gather all relevant financial information for the estate or trust.

- Fill in the fiduciary's name, address, and identification number.

- Report all sources of income, including dividends, interest, and rental income.

- List allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total income and tax liability based on the provided instructions.

- Sign and date the form before submission.

Key elements of the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

Key elements of the FORM 741 include sections for reporting income, deductions, and credits. The form requires detailed information about the fiduciary, including their identification number and contact details. Additionally, it includes sections for calculating the total taxable income and the tax owed. Accurate reporting in these sections is crucial for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 741 are typically aligned with the federal tax deadlines. Generally, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For estates and trusts that follow a calendar year, this means the due date is April 15. It is important to be aware of these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The FORM 741 can be submitted in several ways. Taxpayers may choose to file the form electronically through approved software that supports Kentucky tax forms. Alternatively, the form can be printed and mailed to the Kentucky Department of Revenue. In some cases, fiduciaries may also deliver the form in person to a local tax office. Each submission method has its own requirements and processing times.

Create this form in 5 minutes or less

Find and fill out the correct form 741 kentucky fiduciary income tax return comm

Create this form in 5 minutes!

How to create an eSignature for the form 741 kentucky fiduciary income tax return comm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

The FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm. is a tax form used by fiduciaries to report income, deductions, and credits for estates and trusts in Kentucky. It is essential for ensuring compliance with state tax laws and accurately reporting the financial activities of the fiduciary entity.

-

How can airSlate SignNow help with the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

airSlate SignNow simplifies the process of preparing and submitting the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm. by providing an easy-to-use platform for document management and eSigning. This ensures that all necessary signatures are collected efficiently, reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and larger organizations. Each plan provides access to features that streamline the completion and submission of the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm., ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for managing the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

Key features of airSlate SignNow include document templates, customizable workflows, and secure eSigning capabilities. These tools help users efficiently manage the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm., ensuring that all necessary steps are completed accurately and on time.

-

Is airSlate SignNow compliant with Kentucky tax regulations for the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm. Our platform ensures that your documents meet state requirements, providing peace of mind during the filing process.

-

Can I integrate airSlate SignNow with other software for the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm. alongside your existing tools. This seamless integration enhances productivity and ensures that all data is synchronized.

-

What are the benefits of using airSlate SignNow for the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm.?

Using airSlate SignNow for the FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm. provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to focus on your fiduciary responsibilities while we handle the complexities of document management.

Get more for FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

Find out other FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Comm

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe