PDF 741 Kentucky Department of Revenue 2021

What is the PDF 741 Kentucky Department Of Revenue

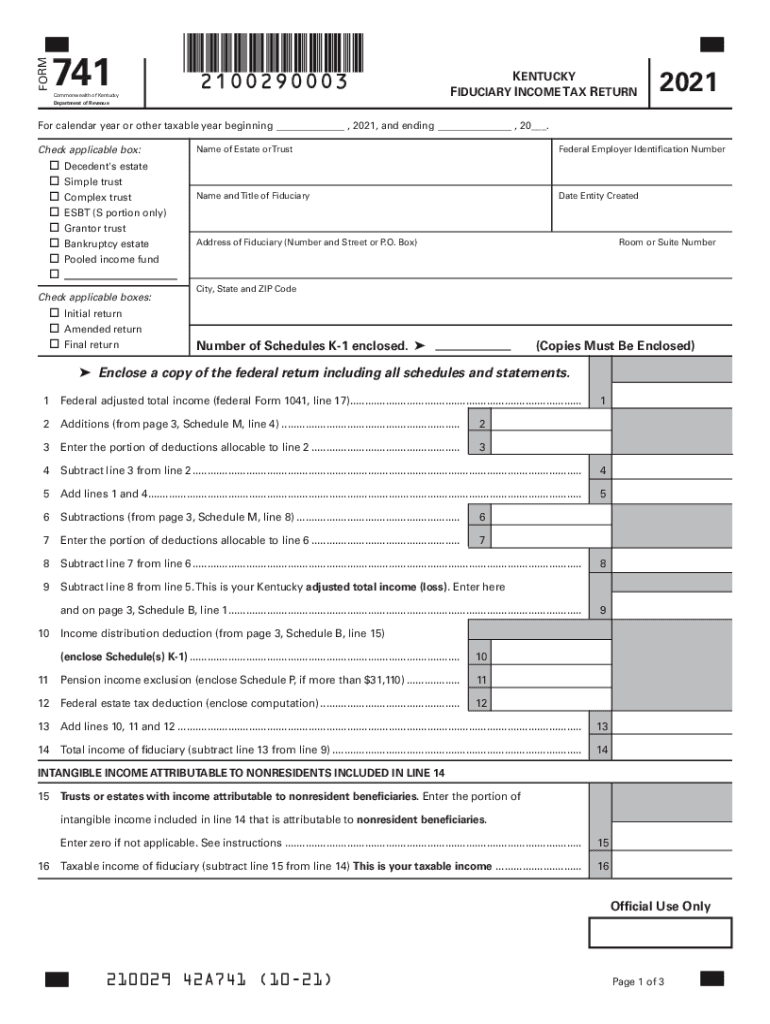

The PDF 741 is a form issued by the Kentucky Department of Revenue, primarily used for tax-related purposes. This form is essential for individuals and businesses to report certain financial information to the state. It is designed to facilitate compliance with state tax laws and regulations, ensuring that taxpayers can accurately report their income and deductions.

How to use the PDF 741 Kentucky Department Of Revenue

To effectively use the PDF 741, start by downloading the form from the Kentucky Department of Revenue's official website. Once you have the form, carefully read the instructions provided to understand the information required. Fill out the form with accurate details, ensuring all necessary sections are completed. After completing the form, review it for any errors before submission to avoid delays in processing.

Steps to complete the PDF 741 Kentucky Department Of Revenue

Completing the PDF 741 involves several key steps:

- Download the PDF 741 form from the Kentucky Department of Revenue website.

- Gather all necessary financial documents, such as income statements and deduction records.

- Fill out the form, ensuring you provide accurate and complete information in each section.

- Double-check your entries for any mistakes or omissions.

- Sign and date the form where required.

- Submit the completed form according to the instructions provided, either online, by mail, or in person.

Legal use of the PDF 741 Kentucky Department Of Revenue

The PDF 741 is legally binding when completed and submitted according to Kentucky state laws. It must be filled out truthfully and accurately, as any discrepancies can lead to legal repercussions, including penalties or audits. Utilizing a reliable electronic signature solution can enhance the legality of the document, ensuring compliance with eSignature laws.

Form Submission Methods

The PDF 741 can be submitted through various methods, accommodating different user preferences. Taxpayers can choose to file the form online via the Kentucky Department of Revenue's e-filing system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate address or delivered in person to a local revenue office, providing flexibility for those who prefer traditional submission methods.

Required Documents

When completing the PDF 741, certain documents may be required to support the information provided. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits claimed.

- Previous tax returns for reference.

- Identification documents, if necessary.

Having these documents ready will streamline the completion process and ensure accuracy in reporting.

Quick guide on how to complete pdf 741 kentucky department of revenue

Easily Create PDF 741 Kentucky Department Of Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and efficiently. Manage PDF 741 Kentucky Department Of Revenue on any device using the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

Edit and eSign PDF 741 Kentucky Department Of Revenue Effortlessly

- Locate PDF 741 Kentucky Department Of Revenue and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign PDF 741 Kentucky Department Of Revenue to ensure superb communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 741 kentucky department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf 741 kentucky department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PDF 741 Kentucky Department Of Revenue used for?

The PDF 741 Kentucky Department Of Revenue is a form used for reporting income and determining tax obligations in Kentucky. It allows taxpayers to accurately assess and submit their tax liabilities through a structured format, streamlining the filing process for both individuals and businesses.

-

How can airSlate SignNow help with the PDF 741 Kentucky Department Of Revenue?

airSlate SignNow simplifies the process of completing and signing the PDF 741 Kentucky Department Of Revenue. With its electronic signature features, users can fill out, sign, and send the form quickly and securely, ensuring compliance and timely submission to the Kentucky Department of Revenue.

-

Is there a cost associated with using airSlate SignNow for the PDF 741 Kentucky Department Of Revenue?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution. Pricing plans vary based on the features needed, but they are structured to ensure businesses of all sizes can easily access and manage documents like the PDF 741 Kentucky Department Of Revenue without breaking the bank.

-

What features does airSlate SignNow offer for handling the PDF 741 Kentucky Department Of Revenue?

airSlate SignNow offers a range of features for managing the PDF 741 Kentucky Department Of Revenue, including electronic signing, templates for repetitive use, and secure cloud storage. These features provide businesses with a streamlined approach to document management, making it easy to edit, sign, and store forms.

-

Can I integrate airSlate SignNow with other software for the PDF 741 Kentucky Department Of Revenue?

Yes, airSlate SignNow integrates with various software applications, enhancing the functionality when working with the PDF 741 Kentucky Department Of Revenue. These integrations enable users to sync data across platforms seamlessly, improving overall efficiency when managing tax documents and workflows.

-

Is it safe to eSign the PDF 741 Kentucky Department Of Revenue using airSlate SignNow?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and authentication, to ensure that eSigning the PDF 741 Kentucky Department Of Revenue is safe and secure. Users can trust that their sensitive information is protected throughout the process.

-

What are the benefits of using airSlate SignNow for the PDF 741 Kentucky Department Of Revenue?

Using airSlate SignNow for the PDF 741 Kentucky Department Of Revenue offers several benefits, including improved efficiency, reduced paperwork, and faster turnaround times. The ability to eSign documents eliminates the need for printing and physical mail, streamlining the entire tax filing process.

Get more for PDF 741 Kentucky Department Of Revenue

- California judgment lien form

- Demand inspection form

- Agreed order granting additional time to plead and respond to interrogatories and requests for production form

- Performance agreement contract

- Letter acknowledgment receipt 497328225 form

- Letter recovery form

- Writ habeas corpus 497328227 form

- Performance agreement

Find out other PDF 741 Kentucky Department Of Revenue

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF