PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill 2022

Understanding the PIT 1 New Mexico Personal Income Tax Return Form

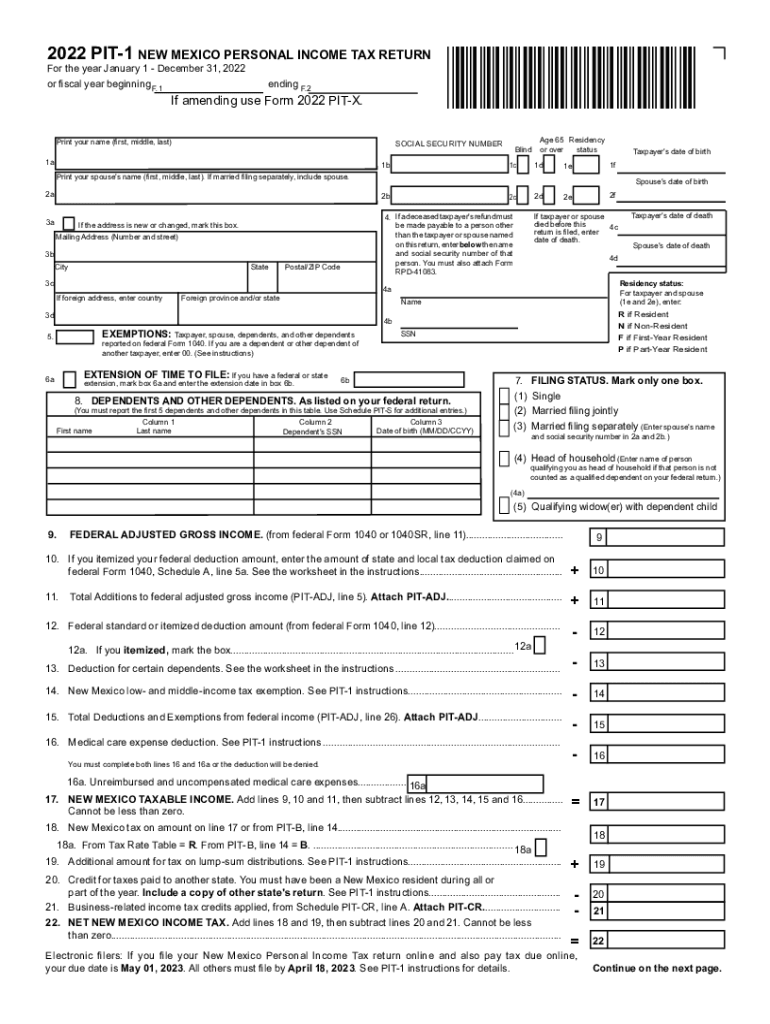

The PIT 1 New Mexico Personal Income Tax Return Form is essential for residents of New Mexico to report their income and calculate their tax obligations. This form is used to determine the amount of state income tax owed or the refund due to the taxpayer. It is important to fill out this form accurately to ensure compliance with state tax laws.

Steps to Complete the PIT 1 New Mexico Personal Income Tax Return Form

Completing the PIT 1 form involves several key steps:

- Gather necessary documents such as W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Calculate deductions and credits applicable to your situation.

- Determine your total tax liability or refund amount.

- Review the form for accuracy before submitting.

How to Obtain the PIT 1 New Mexico Personal Income Tax Return Form

The PIT 1 form can be obtained through various methods:

- Visit the New Mexico Taxation and Revenue Department's website to download the form.

- Request a physical copy by contacting the department directly.

- Access the form at local tax offices or public libraries.

Legal Use of the PIT 1 New Mexico Personal Income Tax Return Form

The PIT 1 form is legally binding once submitted. It must be completed in accordance with New Mexico tax laws. Providing false information can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is crucial to ensure that all information reported is truthful and accurate.

Filing Deadlines and Important Dates

Taxpayers should be aware of important deadlines related to the PIT 1 form:

- The standard filing deadline is typically April 15 of each year.

- Extensions may be available, but they must be requested before the original deadline.

- Late submissions may incur penalties and interest on unpaid taxes.

Form Submission Methods

Taxpayers have several options for submitting the PIT 1 form:

- Online submission through the New Mexico Taxation and Revenue Department's e-filing system.

- Mailing a printed copy of the form to the appropriate address.

- In-person submission at designated tax offices.

Quick guide on how to complete pit 1 new mexico personal income tax return form fill

Effortlessly Prepare PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill on Any Device

Digital document management has gained signNow traction among companies and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill effortlessly

- Obtain PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your edits.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pit 1 new mexico personal income tax return form fill

Create this form in 5 minutes!

How to create an eSignature for the pit 1 new mexico personal income tax return form fill

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NM tax forms, and how can SignNow help?

NM tax forms are documents required for filing taxes in New Mexico. SignNow provides an easy-to-use platform for eSigning and sending these forms, ensuring a faster and more efficient submission process.

-

Are NM tax forms compliant with state regulations?

Yes, SignNow ensures that all NM tax forms processed through our platform meet New Mexico state regulations. We continuously update our templates to comply with the latest requirements for a hassle-free experience.

-

What features does SignNow offer for managing NM tax forms?

SignNow offers numerous features for managing NM tax forms, including eSigning, document templates, customizable workflows, and secure sharing options. These tools simplify the process, allowing users to focus on crucial tasks instead of paperwork.

-

Can I integrate SignNow with other software for NM tax forms?

Absolutely! SignNow integrates seamlessly with various popular software applications, allowing users to manage their NM tax forms efficiently. This interoperability ensures you can streamline your tasks across platforms, enhancing productivity.

-

Is there a cost associated with using SignNow for NM tax forms?

SignNow offers competitive pricing options tailored for businesses needing to handle NM tax forms and other documents. Our cost-effective solution allows users to choose plans based on their needs, ensuring great value.

-

How does SignNow enhance security for NM tax forms?

SignNow prioritizes security, employing encryption and secure access controls to safeguard NM tax forms. This commitment to protecting sensitive information ensures that users can confidently manage their tax documents.

-

Can I access my NM tax forms from anywhere using SignNow?

Yes, SignNow is cloud-based, allowing you to access your NM tax forms from anywhere, at any time. This flexibility is ideal for users who need to manage their documents while on the go or working remotely.

Get more for PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill

- Name affidavit of buyer texas form

- Name affidavit of seller texas form

- Non foreign affidavit under irc 1445 texas form

- Owners or sellers affidavit of no liens texas form

- Texas affidavit financial form

- Complex will with credit shelter marital trust for large estates texas form

- Texas married form

- Civil case form

Find out other PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form Fill

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors