PRINT FORM 2021

Understanding the Arkansas Capital Gains Form

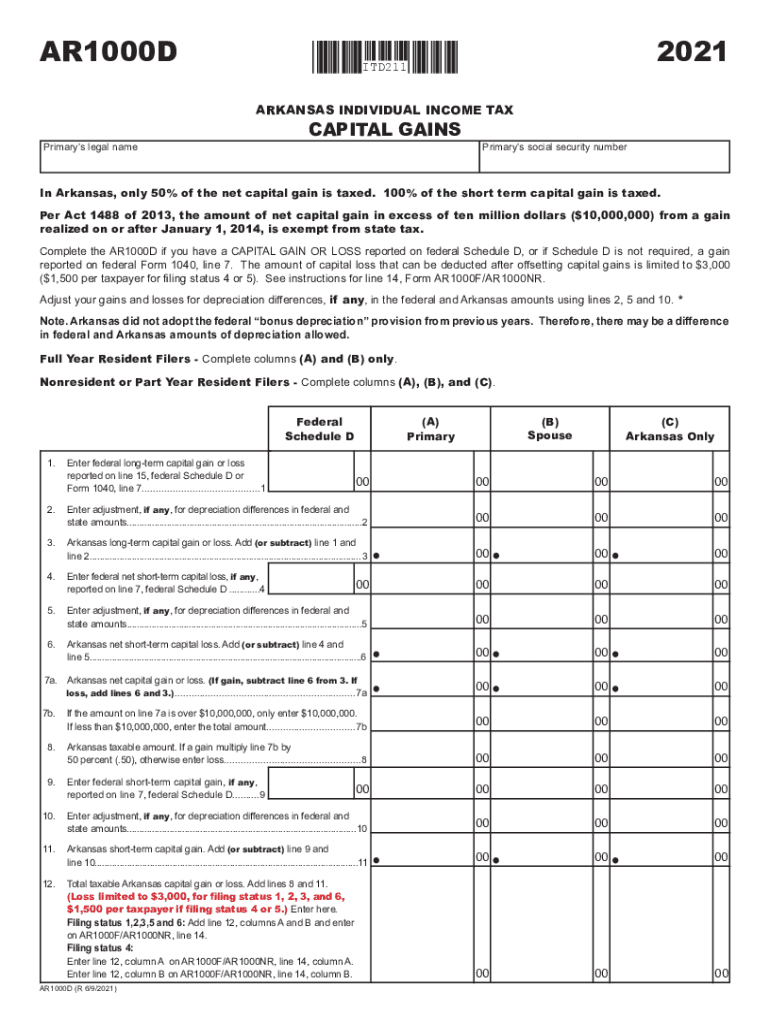

The Arkansas capital gains form, known as the AR1000D, is essential for individuals and entities reporting capital gains or losses from the sale of assets. This form is specifically designed to help taxpayers calculate their taxable capital gains in accordance with Arkansas tax laws. It is crucial for ensuring compliance with state tax obligations and accurately reporting income derived from investments or property sales.

Steps to Complete the Arkansas Capital Gains Form

Completing the AR1000D form involves several key steps:

- Gather all necessary documentation related to the sale of assets, including purchase and sale prices, dates of transactions, and any associated costs.

- Calculate your total capital gains or losses by subtracting the purchase price and associated costs from the sale price.

- Fill out the AR1000D form, ensuring that all calculations are accurate and that you provide all required information.

- Review the form for completeness and accuracy before submission.

Legal Use of the Arkansas Capital Gains Form

The AR1000D form is legally recognized for reporting capital gains in Arkansas. To ensure its legal validity, it must be completed accurately and submitted by the appropriate deadlines. Utilizing electronic signatures through a reliable platform can enhance the legal standing of your submission, as eSignatures are recognized under U.S. law when they meet specific criteria.

Filing Deadlines for the Arkansas Capital Gains Form

It is important to be aware of the filing deadlines associated with the AR1000D form. Typically, the form must be submitted by the tax filing deadline for the tax year in which the capital gains were realized. For most taxpayers, this deadline falls on April 15 of the following year. However, it is advisable to check for any updates or changes to these deadlines annually.

Required Documents for the Arkansas Capital Gains Form

To complete the AR1000D form, you will need the following documents:

- Proof of purchase and sale of the asset, such as receipts or contracts.

- Documentation of any improvements made to the asset that may affect its basis.

- Records of any expenses incurred during the sale process, such as commissions or fees.

Form Submission Methods

The AR1000D form can be submitted through various methods, including:

- Online submission via the Arkansas Department of Finance and Administration's website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, where assistance may be available.

IRS Guidelines for Reporting Capital Gains

While the AR1000D is specific to Arkansas, it is essential to adhere to IRS guidelines when reporting capital gains on your federal tax return. This includes understanding how to categorize gains as short-term or long-term, as each has different tax implications. Ensure that your reporting aligns with IRS requirements to avoid potential issues with your tax filings.

Quick guide on how to complete print form

Effortlessly Prepare PRINT FORM on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Manage PRINT FORM on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign PRINT FORM with minimal effort

- Find PRINT FORM and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign PRINT FORM and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct print form

Create this form in 5 minutes!

How to create an eSignature for the print form

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What are Arkansas capital gains taxes?

Arkansas capital gains taxes are imposed on the profit earned from selling assets such as stocks, bonds, or real estate located in Arkansas. Understanding these taxes is crucial for individuals and businesses to ensure compliance and avoid potential penalties. Proper planning can also help minimize the overall tax burden associated with Arkansas capital gains.

-

How does airSlate SignNow support compliance with Arkansas capital gains reporting?

With airSlate SignNow, businesses can securely send and eSign important tax documents related to Arkansas capital gains. The platform offers templates and workflows that simplify the document preparation process, ensuring that all required information is accurately captured for reporting. This helps users stay compliant with Arkansas state regulations.

-

What features does airSlate SignNow offer for businesses concerned about Arkansas capital gains?

airSlate SignNow provides features like customizable document templates, secure eSigning, and cloud storage to streamline the management of documents related to Arkansas capital gains. These tools help businesses efficiently handle transactions and ensure that all documents are legally compliant. Additionally, the easy-to-use interface means less time is spent on paperwork.

-

Is airSlate SignNow cost-effective for handling documents related to Arkansas capital gains?

Yes, airSlate SignNow is a cost-effective solution for businesses managing documents associated with Arkansas capital gains. By reducing the time spent on document preparation and signing, businesses can lower operational costs. The subscription-based pricing model allows companies of all sizes to benefit without signNow upfront investments.

-

Can airSlate SignNow integrate with financial software for tracking Arkansas capital gains?

Absolutely, airSlate SignNow seamlessly integrates with various financial software solutions to help businesses track Arkansas capital gains effectively. This integration ensures that data flows smoothly between systems, allowing users to manage their financial records and tax obligations more efficiently. Having all information centralized can signNowly improve decision-making.

-

What are the benefits of eSigning with airSlate SignNow for Arkansas capital gains documentation?

eSigning with airSlate SignNow offers numerous benefits for Arkansas capital gains documentation, including enhanced security and faster turnaround times. Users can eSign documents from anywhere, reducing delays and expediting important transactions. Additionally, signed documents are automatically stored securely, simplifying record-keeping.

-

How is airSlate SignNow different from other eSigning solutions for Arkansas capital gains?

airSlate SignNow stands out due to its user-friendly interface and comprehensive features tailored for businesses dealing with Arkansas capital gains. Unlike other eSigning solutions, SignNow provides a robust integration ecosystem and customizable workflows that cater to specific needs. This makes it an ideal choice for businesses of any size looking to streamline their document management process.

Get more for PRINT FORM

Find out other PRINT FORM

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT