Printable Arkansas Form AR1000D Capital Gains Schedule 2020

What is the Printable Arkansas Form AR1000D Capital Gains Schedule

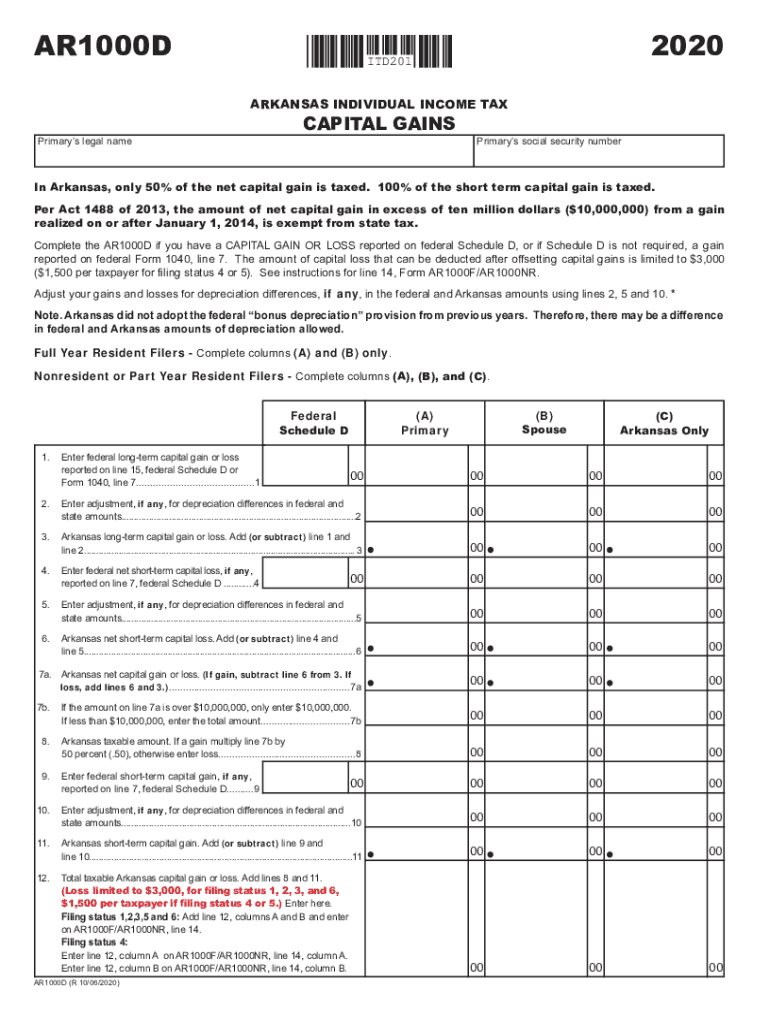

The Printable Arkansas Form AR1000D is a schedule used to report capital gains and losses for Arkansas state tax purposes. This form is essential for taxpayers who have sold assets such as stocks, bonds, or real estate and need to report the financial outcomes of these transactions. It allows individuals to calculate their taxable gains or losses, which directly impact their overall tax liability. Understanding this form is crucial for accurate tax reporting and compliance with state regulations.

How to use the Printable Arkansas Form AR1000D Capital Gains Schedule

Using the Printable Arkansas Form AR1000D involves several steps to ensure accurate reporting of capital gains. First, gather all necessary documentation related to asset sales, including purchase and sale prices, dates, and any associated costs. Next, fill out the form by entering the details of each transaction, including the type of asset, the gain or loss realized, and any applicable adjustments. It is important to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Printable Arkansas Form AR1000D Capital Gains Schedule

Completing the Printable Arkansas Form AR1000D requires attention to detail. Here are the steps to follow:

- Obtain the form from a reliable source, ensuring you have the most current version.

- List each asset sold during the tax year, including the date of sale and acquisition.

- Calculate the gain or loss for each asset by subtracting the purchase price and any selling expenses from the sale price.

- Enter the total capital gains and losses on the designated lines of the form.

- Review the completed form for accuracy before submission.

Legal use of the Printable Arkansas Form AR1000D Capital Gains Schedule

The legal use of the Printable Arkansas Form AR1000D is governed by state tax laws that require accurate reporting of capital gains. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Arkansas Department of Finance and Administration. This includes maintaining accurate records of all transactions and filing the form by the designated deadline. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Arkansas Form AR1000D are aligned with the general state tax return deadlines. Typically, taxpayers must submit their forms by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or extensions that may be announced by the Arkansas Department of Finance and Administration.

Required Documents

To complete the Printable Arkansas Form AR1000D accurately, certain documents are required. These include:

- Records of asset purchases and sales, such as closing statements or brokerage statements.

- Documentation of any improvements or costs associated with the assets sold.

- Previous tax returns that may provide context for capital gains calculations.

Quick guide on how to complete printable 2020 arkansas form ar1000d capital gains schedule

Complete Printable Arkansas Form AR1000D Capital Gains Schedule effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Printable Arkansas Form AR1000D Capital Gains Schedule on any device using the airSlate SignNow apps for Android or iOS and streamline any document-driven process today.

How to edit and eSign Printable Arkansas Form AR1000D Capital Gains Schedule with ease

- Locate Printable Arkansas Form AR1000D Capital Gains Schedule and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Printable Arkansas Form AR1000D Capital Gains Schedule and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 arkansas form ar1000d capital gains schedule

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arkansas form ar1000d capital gains schedule

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform?

The airSlate SignNow platform offers a range of features including eSignature capabilities, document templates, and cloud storage. With the platform's easy navigation, you'll find the 'ar1000d instructions' essential for maximizing your productivity. These features provide a seamless document signing experience for users.

-

How can I access the ar1000d instructions on airSlate SignNow?

To access the ar1000d instructions, simply log in to your airSlate SignNow account and navigate to the help section. Here, you'll find comprehensive guides and resources detailing how to utilize various features effectively. The instructions are designed to enhance your user experience.

-

Is there a pricing plan for using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Choose a plan that allows you to access the full functionality, including the ar1000d instructions to help you understand how to maximize your investment. Cost-effective solutions are available for businesses of all sizes.

-

What integrations does airSlate SignNow support?

airSlate SignNow offers integrations with numerous applications such as Google Drive, Salesforce, and more. These integrations allow you to automate workflows and streamline processes, while the ar1000d instructions guide you on how to set them up effectively. This versatility enhances productivity for your business.

-

How secure is the document signing process on airSlate SignNow?

The document signing process on airSlate SignNow adheres to strict security protocols to ensure your data is safe. Features include encryption and audit trails, making your signing experience secure. The ar1000d instructions will guide you through the security settings available.

-

Can I customize the document templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize document templates to meet your specific requirements. With the help of the ar1000d instructions, you can efficiently create and modify templates that suit your business needs, ensuring a personalized experience.

-

How can I ensure a smooth eSigning experience for my clients?

To ensure a smooth eSigning experience, familiarize yourself with the airSlate SignNow platform and follow the ar1000d instructions. This will help you set up an optimized workflow for your clients, allowing them to sign documents efficiently without any hiccups. Clear communication and an intuitive design contribute to satisfaction.

Get more for Printable Arkansas Form AR1000D Capital Gains Schedule

- Form dsmv30 download fillable pdf or fill online record change

- Department of safety division of motor vehicles 23 hazen form

- Commercial driver training school complaint form

- You may be eligible to renew your drivers license online or by mail if you meet the form

- Lien satisfaction form sc dnr

- Form 30002 density test report nuclear gauge scdot

- Vtr 270 form

- Vtr 340 form

Find out other Printable Arkansas Form AR1000D Capital Gains Schedule

- How To Fax Electronic signature PPT

- How To Complete Electronic signature Word

- Complete Electronic signature Word Free

- Complete Electronic signature Document Free

- Complete Electronic signature Word Fast

- How To Complete Electronic signature PDF

- How Can I Complete Electronic signature Document

- Request Electronic signature Word Online

- How To Request Electronic signature Word

- Request Electronic signature Document Free

- Request Electronic signature Form Easy

- Add Electronic signature PDF Online

- Request Electronic signature Presentation Free

- Add Electronic signature PDF Free

- Add Electronic signature PDF Mac

- How To Add Electronic signature PDF

- How Do I Add Electronic signature PDF

- Add Electronic signature Document Online

- How To Add Electronic signature Document

- Add Electronic signature Word Mac