2024AR1000DBC PDF 2024-2026

Understanding the 2024 AR1000DBC PDF

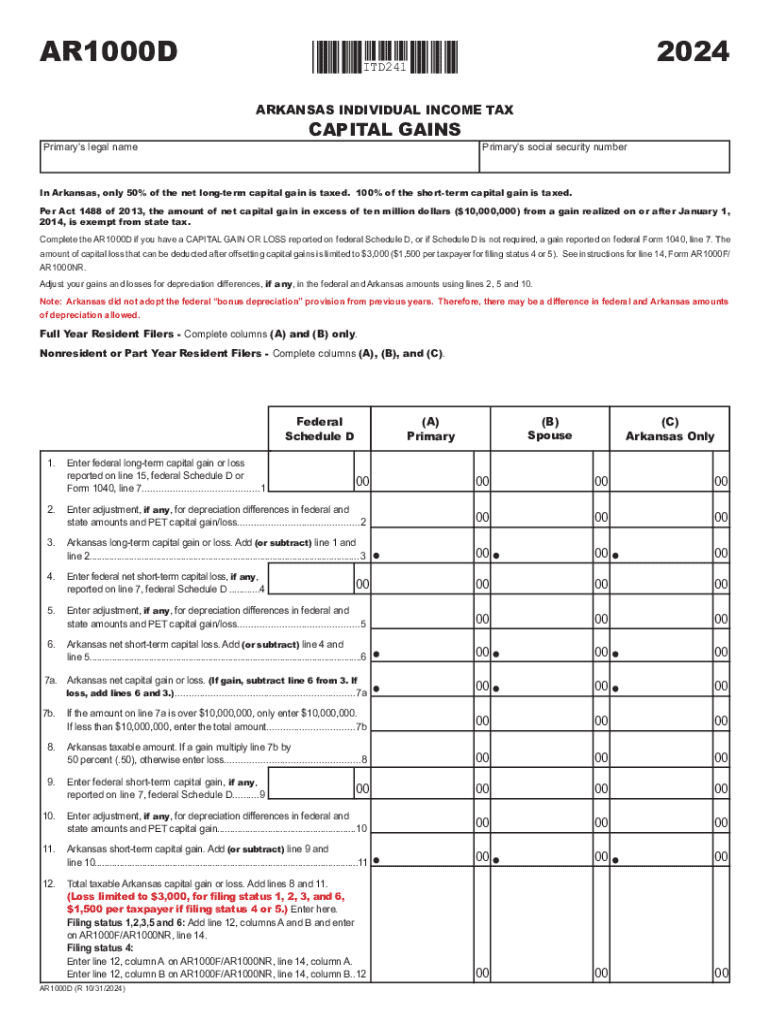

The 2024 AR1000DBC PDF is a crucial document for Arkansas taxpayers, specifically designed for reporting income and calculating tax liabilities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It includes sections for personal information, income details, and deductions, making it a comprehensive tool for accurate tax reporting in Arkansas.

How to Complete the 2024 AR1000DBC PDF

Completing the 2024 AR1000DBC PDF requires careful attention to detail. Begin by gathering all necessary financial documents, including W-2s, 1099s, and records of any deductions or credits you plan to claim. Fill out the form by entering your personal information in the designated fields, followed by your income details. Ensure that all calculations are accurate to avoid errors that could lead to penalties.

Obtaining the 2024 AR1000DBC PDF

The 2024 AR1000DBC PDF can be obtained through the Arkansas Department of Finance and Administration website. It is available for download in a fillable format, allowing taxpayers to complete the form digitally. Additionally, physical copies may be available at local tax offices or public libraries for those who prefer a paper version.

Filing Deadlines for the 2024 AR1000DBC PDF

Timely submission of the 2024 AR1000DBC PDF is crucial to avoid penalties. The filing deadline for most taxpayers is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax season.

Form Submission Methods for the 2024 AR1000DBC PDF

Taxpayers have several options for submitting the 2024 AR1000DBC PDF. The form can be filed electronically through the Arkansas Department of Finance and Administration's online portal, which offers a secure and efficient method. Alternatively, taxpayers may choose to mail their completed forms to the designated tax office or submit them in person at local offices, ensuring that they retain proof of submission.

Key Elements of the 2024 AR1000DBC PDF

Important components of the 2024 AR1000DBC PDF include sections for taxpayer identification, income reporting, and applicable deductions. Each section is designed to guide users through the necessary information required for accurate tax reporting. Understanding these key elements is essential for ensuring that all relevant data is included, which can help maximize potential refunds or minimize tax liabilities.

Create this form in 5 minutes or less

Find and fill out the correct 2024ar1000dbc pdf

Create this form in 5 minutes!

How to create an eSignature for the 2024ar1000dbc pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Arkansas capital?

airSlate SignNow is a powerful eSignature solution that enables businesses in the Arkansas capital to send and sign documents electronically. This user-friendly platform streamlines the signing process, making it easier for companies in Little Rock and beyond to manage their paperwork efficiently.

-

How much does airSlate SignNow cost for businesses in the Arkansas capital?

Pricing for airSlate SignNow is designed to be cost-effective for businesses in the Arkansas capital. We offer various plans that cater to different needs, ensuring that companies of all sizes can find a solution that fits their budget while benefiting from our robust features.

-

What features does airSlate SignNow offer for users in the Arkansas capital?

airSlate SignNow provides a range of features tailored for users in the Arkansas capital, including customizable templates, real-time tracking, and secure cloud storage. These features help businesses streamline their document workflows and enhance productivity.

-

Can airSlate SignNow integrate with other tools commonly used in the Arkansas capital?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that businesses in the Arkansas capital may already be using. This includes popular platforms like Google Drive, Salesforce, and Microsoft Office, allowing for a smooth transition and enhanced functionality.

-

What are the benefits of using airSlate SignNow for businesses in the Arkansas capital?

Using airSlate SignNow offers numerous benefits for businesses in the Arkansas capital, including increased efficiency, reduced turnaround times, and improved document security. By digitizing the signing process, companies can save time and resources while ensuring compliance.

-

Is airSlate SignNow secure for businesses in the Arkansas capital?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents for businesses in the Arkansas capital. Our platform is compliant with industry standards, ensuring that your data remains safe.

-

How can businesses in the Arkansas capital get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for businesses in the Arkansas capital. You can sign up for a free trial on our website, explore the features, and see how our solution can meet your document signing needs before committing to a plan.

Get more for 2024AR1000DBC pdf

- Business permit mandaluyong form

- Labour registration form

- Apprenticeship form for tailoring in nigeria

- Tax preparation checklist 2021 pdf form

- Labcorp test menu form

- 36 apostilas curso completo bacharel em teologia pdf form

- 56 passenger bus seating chart pdf form

- Media feat1 wagov development digital wa gov aundis worker screening check application guide form

Find out other 2024AR1000DBC pdf

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure