Schedule NJ COJ Credit for Income or Wage Taxes Paid to 2022

What is the Schedule NJ COJ Credit For Income Or Wage Taxes Paid To

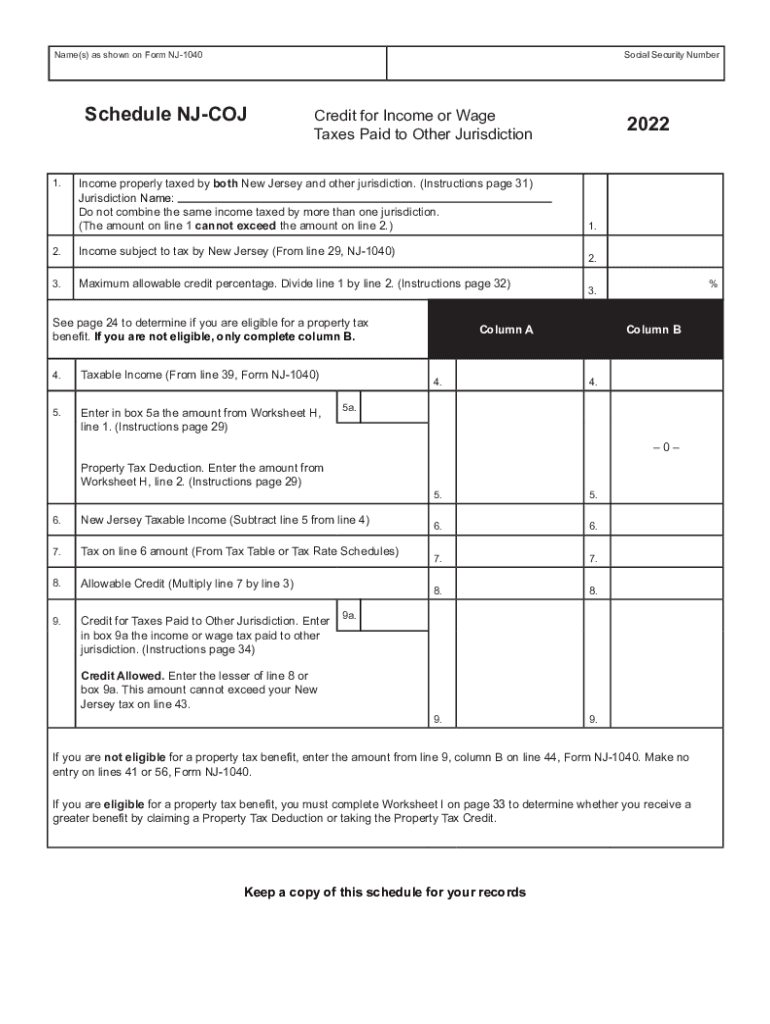

The Schedule NJ COJ is a form used by New Jersey taxpayers to claim a credit for income or wage taxes paid to other jurisdictions. This credit helps to prevent double taxation on income earned in different states. By utilizing this form, residents can offset their New Jersey tax liability based on taxes already paid to other states or localities. Understanding the nuances of this credit is essential for accurate tax reporting and maximizing potential refunds.

How to use the Schedule NJ COJ Credit For Income Or Wage Taxes Paid To

To effectively use the Schedule NJ COJ, taxpayers must first gather information about the income earned in other jurisdictions and the corresponding taxes paid. This includes documentation such as W-2 forms, 1099s, or other tax statements. Once this information is collected, taxpayers can complete the form by accurately reporting their income, the taxes paid, and calculating the credit based on New Jersey's guidelines. It is important to ensure all figures are correct to avoid delays or issues with the tax return.

Steps to complete the Schedule NJ COJ Credit For Income Or Wage Taxes Paid To

Completing the Schedule NJ COJ involves several key steps:

- Gather all relevant documents, including income statements and tax payment records from other jurisdictions.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report the income earned in other states and the amount of taxes paid to those jurisdictions.

- Calculate the credit using the provided instructions, ensuring to follow New Jersey's specific guidelines.

- Review the completed form for accuracy before submitting it with your New Jersey tax return.

Eligibility Criteria

To be eligible for the Schedule NJ COJ credit, taxpayers must meet certain criteria. Primarily, the income must be earned in another jurisdiction where taxes were paid. Additionally, the taxpayer must be a resident of New Jersey during the tax year in question. It is also essential that the taxes paid to other jurisdictions are not refundable, as only non-refundable taxes qualify for the credit. Understanding these criteria can help taxpayers determine their eligibility and ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Timely filing of the Schedule NJ COJ is crucial to avoid penalties and ensure that credits are applied correctly. The standard deadline for filing New Jersey state tax returns, including the Schedule NJ COJ, typically aligns with the federal tax filing deadline, which is April 15. However, taxpayers should verify specific dates each year, as extensions may apply. Keeping track of these deadlines can help prevent last-minute filing issues and ensure that all necessary forms are submitted on time.

Form Submission Methods (Online / Mail / In-Person)

The Schedule NJ COJ can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New Jersey Division of Taxation's e-filing system, which is often the fastest method.

- Mailing a paper copy of the form along with the state tax return to the appropriate address as specified by the New Jersey Division of Taxation.

- In-person submission at designated tax offices, although this may require an appointment and is less common.

Quick guide on how to complete schedule nj coj credit for income or wage taxes paid to

Effortlessly Prepare Schedule NJ COJ Credit For Income Or Wage Taxes Paid To on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle Schedule NJ COJ Credit For Income Or Wage Taxes Paid To on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Schedule NJ COJ Credit For Income Or Wage Taxes Paid To with Ease

- Locate Schedule NJ COJ Credit For Income Or Wage Taxes Paid To and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Schedule NJ COJ Credit For Income Or Wage Taxes Paid To and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule nj coj credit for income or wage taxes paid to

Create this form in 5 minutes!

How to create an eSignature for the schedule nj coj credit for income or wage taxes paid to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new jersey 1040 schedule?

The new jersey 1040 schedule is a form used by taxpayers in New Jersey to report their personal income and calculate their tax liability for the state. It is an essential part of the New Jersey 1040 tax return process, allowing individuals to detail various income sources and deductions. Understanding this form is crucial to ensure compliance and optimize tax savings.

-

How do I complete the new jersey 1040 schedule?

To complete the new jersey 1040 schedule, you need to gather your income information, including wages, interest, and dividends, as well as any deductions and credits you're eligible for. The form requires precise calculations, so using accounting software or consulting a tax professional may help ensure accuracy. Once filled, you can submit it along with your NJ 1040 tax return.

-

Where can I find the latest version of the new jersey 1040 schedule?

The latest version of the new jersey 1040 schedule can be found on the New Jersey Division of Taxation's official website. They provide downloadable PDF forms and instructions for completing your tax filings. It is important to use the most current form to ensure compliance with any new tax regulations.

-

Does airSlate SignNow integrate with the new jersey 1040 schedule forms?

Yes, airSlate SignNow allows users to integrate various document types, including the new jersey 1040 schedule forms, for a streamlined eSignature process. This means you can send, sign, and store your tax documents easily and securely, enhancing your overall tax filing experience. Leveraging this integration can save time and reduce paperwork.

-

What are the benefits of using airSlate SignNow for the new jersey 1040 schedule?

Using airSlate SignNow for the new jersey 1040 schedule provides a cost-effective and efficient way to manage tax documents. With its user-friendly interface, you can quickly send forms for signature, track their status, and securely store them digitally. This not only enhances the filing process but also ensures compliance and record-keeping.

-

Is airSlate SignNow a cost-effective solution for eSigning the new jersey 1040 schedule?

Absolutely, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for eSigning the new jersey 1040 schedule. Depending on your business needs, you can choose a plan that fits your budget while accessing all essential features. This allows you to manage your documents without breaking the bank.

-

Can I access the new jersey 1040 schedule forms on mobile devices with airSlate SignNow?

Yes, you can access the new jersey 1040 schedule forms on mobile devices using airSlate SignNow. The platform offers a mobile-friendly interface, allowing users to send, sign, and manage their documents from anywhere. This flexibility is perfect for individuals on the go who need to tackle their tax filings promptly.

Get more for Schedule NJ COJ Credit For Income Or Wage Taxes Paid To

Find out other Schedule NJ COJ Credit For Income Or Wage Taxes Paid To

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors

- How To Add Electronic signature in Doctors