Impact Fee Receipt Surat Form

What is the Impact Fee Receipt Surat

The Impact Fee Receipt Surat is an official document issued by municipal authorities in Surat, Gujarat, that acknowledges the payment of impact fees. These fees are typically levied on developers and property owners to fund public infrastructure improvements necessitated by new development projects. The receipt serves as proof of payment and is essential for compliance with local regulations. It is crucial for individuals and businesses to retain this document for future reference, particularly when applying for permits or engaging in further development activities.

How to use the Impact Fee Receipt Surat

The Impact Fee Receipt Surat can be utilized in various scenarios, primarily in the context of real estate development and municipal compliance. Once you have obtained the receipt, it is important to keep it accessible for the following purposes:

- Submitting it alongside permit applications to demonstrate compliance with local impact fee requirements.

- Using it as a reference for any future inquiries regarding the status of the fee or related projects.

- Presenting it during audits or inspections conducted by municipal authorities.

How to obtain the Impact Fee Receipt Surat

To obtain the Impact Fee Receipt Surat, follow these steps:

- Complete the impact fee application form, providing all necessary details about your development project.

- Submit the application to the relevant municipal department along with any required documentation.

- Pay the assessed impact fee as determined by the municipality.

- Once the payment is processed, request the Impact Fee Receipt Surat from the municipal office or through their online portal.

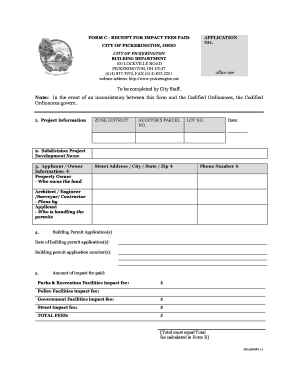

Key elements of the Impact Fee Receipt Surat

The Impact Fee Receipt Surat contains several key elements that validate its authenticity and importance:

- Receipt Number: A unique identifier assigned to the transaction.

- Date of Payment: The date on which the impact fee was paid.

- Amount Paid: The total amount of the impact fee paid.

- Project Details: Information about the development project associated with the fee.

- Municipal Authority Signature: An official signature or stamp that confirms the receipt's validity.

Steps to complete the Impact Fee Receipt Surat

Completing the Impact Fee Receipt Surat involves a few essential steps to ensure accuracy and compliance:

- Gather all necessary information regarding your development project, including location and scope.

- Fill out the impact fee application form with precise details.

- Submit the form along with any required attachments to the municipal authority.

- Make the payment as instructed by the municipality.

- Request the receipt and verify that all details are correctly reflected.

Legal use of the Impact Fee Receipt Surat

The Impact Fee Receipt Surat holds legal significance as it serves as proof of compliance with local regulations regarding impact fees. It can be used in legal proceedings to demonstrate that the necessary fees have been paid, which can protect against potential fines or penalties. Additionally, retaining this document is essential for maintaining good standing with municipal authorities and ensuring that all development activities are legally sanctioned.

Quick guide on how to complete impact fee receipt surat

Complete Impact Fee Receipt Surat effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents promptly without delays. Handle Impact Fee Receipt Surat on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and electronically sign Impact Fee Receipt Surat with ease

- Locate Impact Fee Receipt Surat and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Impact Fee Receipt Surat and maintain excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impact fee receipt surat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an impact fee receipt surat?

An impact fee receipt surat is a document that serves as proof of payment for impact fees associated with property development. These fees are typically charged by local governments to offset the costs of infrastructure improvements. Having an accurate impact fee receipt surat is essential for compliance and future property transactions.

-

How can airSlate SignNow help in managing impact fee receipt surat?

airSlate SignNow offers a streamlined solution for creating, sending, and electronically signing your impact fee receipt surat. With its easy-to-use interface, you can quickly generate customized documents and ensure they are securely signed. This signNowly reduces the time spent on paperwork and enhances efficiency.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans designed for businesses of all sizes. You can choose from monthly or annual subscriptions that include features for managing documents such as the impact fee receipt surat. This allows you to select the plan that best fits your business needs and budget.

-

Are there any specific features for handling impact fee receipt surat?

Yes, airSlate SignNow includes a variety of features tailored for managing impact fee receipt surat, such as customizable templates, document tracking, and status notifications. These features help you stay organized and ensure that all parties have the necessary documentation. Additionally, the platform offers secure cloud storage for easy access.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with popular third-party applications, enhancing your workflow for documents like impact fee receipt surat. This means you can connect it with CRM systems, cloud storage services, and other tools you already use. These integrations help eliminate manual data entry and streamline your document management processes.

-

How does airSlate SignNow ensure the security of my impact fee receipt surat?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and multi-factor authentication to protect your impact fee receipt surat and other sensitive documents. This ensures that your information is safeguarded from unauthorized access, giving you peace of mind.

-

Can I access my impact fee receipt surat from any device?

Absolutely! airSlate SignNow's web-based platform allows you to access your impact fee receipt surat and other documents from any device with an internet connection. This flexibility ensures that you can manage your important paperwork on-the-go, whether from a smartphone, tablet, or computer.

Get more for Impact Fee Receipt Surat

- Gentle procedures toronto form

- Work education agreement work education agreement form

- Toronto green standard version 2 0 checklist for 721 eastern form

- Dr roland sing urologist reviews ampamp ratings form

- Hvcors login form

- Cshc application form fill online printable fillable blank

- Patient name and addressable of birthtelephone h form

- Heavy vehicle competency online reporting system hvcors external user account requestcatalogue no 45071984 form no 1802 heavy

Find out other Impact Fee Receipt Surat

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF