Blank Tax Exempt Form Pennsylvania

What is the Blank Tax Exempt Form Pennsylvania

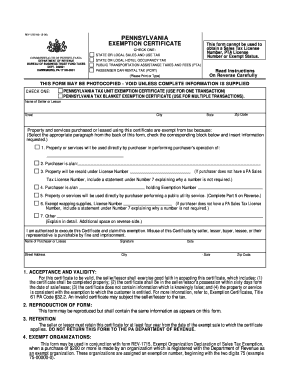

The blank tax exempt form Pennsylvania is a document used by organizations and individuals to claim exemption from sales tax on specific purchases. This form is essential for entities that qualify under certain criteria, such as non-profit organizations, government agencies, and certain educational institutions. By submitting this form, eligible parties can avoid paying sales tax on items related to their exempt purposes.

How to Obtain the Blank Tax Exempt Form Pennsylvania

To obtain the blank tax exempt form Pennsylvania, individuals and organizations can visit the Pennsylvania Department of Revenue's official website. The form is typically available for download in PDF format. Additionally, local tax offices may provide physical copies of the form. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Blank Tax Exempt Form Pennsylvania

Completing the blank tax exempt form Pennsylvania involves several key steps:

- Begin by entering your organization’s name and address at the top of the form.

- Provide the reason for the tax exemption, specifying the applicable tax-exempt status.

- Include any relevant identification numbers, such as the federal employer identification number (EIN).

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, the form can be presented to vendors at the time of purchase to claim the tax exemption.

Legal Use of the Blank Tax Exempt Form Pennsylvania

The legal use of the blank tax exempt form Pennsylvania is governed by state tax laws. Organizations must ensure they meet the eligibility criteria for tax exemption, as misuse of the form can result in penalties. The form should only be used for purchases that directly relate to the exempt purpose of the organization. It is advisable to keep a copy of the completed form for your records, as it may be required for audits or compliance checks.

Key Elements of the Blank Tax Exempt Form Pennsylvania

Key elements of the blank tax exempt form Pennsylvania include:

- Organization Information: Name, address, and contact details of the entity claiming exemption.

- Exemption Reason: A clear statement of the basis for the exemption.

- Tax Identification Numbers: Relevant IDs that verify the organization’s tax status.

- Signature: An authorized representative must sign the form to validate its authenticity.

Examples of Using the Blank Tax Exempt Form Pennsylvania

Examples of using the blank tax exempt form Pennsylvania include:

- A non-profit organization purchasing office supplies for its operations.

- A school acquiring educational materials that qualify for tax exemption.

- A government agency buying equipment necessary for public services.

In each case, presenting the completed form allows these entities to avoid paying sales tax on eligible purchases.

Quick guide on how to complete blank tax exempt form pennsylvania

Effortlessly prepare Blank Tax Exempt Form Pennsylvania on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Blank Tax Exempt Form Pennsylvania across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Blank Tax Exempt Form Pennsylvania with ease

- Obtain Blank Tax Exempt Form Pennsylvania and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Blank Tax Exempt Form Pennsylvania to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank tax exempt form pennsylvania

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank tax exempt form Pennsylvania?

A blank tax exempt form Pennsylvania is a document that allows eligible organizations to purchase goods and services without having to pay sales tax. This form is essential for charities, nonprofits, and other qualifying entities to ensure compliance with state tax regulations while minimizing costs.

-

How can I obtain a blank tax exempt form Pennsylvania?

You can easily obtain a blank tax exempt form Pennsylvania from the official Pennsylvania Department of Revenue website or through various tax-related resources online. Additionally, airSlate SignNow provides a seamless way to access and manage these forms electronically, speeding up the process for your organization.

-

Is there a cost to use airSlate SignNow for the blank tax exempt form Pennsylvania?

airSlate SignNow offers a cost-effective solution for managing your blank tax exempt form Pennsylvania. While there is a subscription fee, you can enjoy unlimited document signing and templates, which can signNowly save your organization time and resources.

-

What features does airSlate SignNow offer for managing tax exempt forms?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure cloud storage for your blank tax exempt form Pennsylvania. With its user-friendly interface, you can easily send, sign, and store documents while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with my existing systems for managing tax exempt forms?

Yes, airSlate SignNow offers various integrations with popular business applications and platforms. This means you can seamlessly incorporate your blank tax exempt form Pennsylvania management into your existing workflow for maximum efficiency.

-

What benefits does using airSlate SignNow provide for handling tax exempt forms?

Using airSlate SignNow for your blank tax exempt form Pennsylvania allows for faster processing times, reduced paperwork, and increased accuracy. Furthermore, the digital nature of the platform enables tracking and storage that enhances your organization's operational efficiency.

-

How secure is airSlate SignNow when handling sensitive documents like tax exempt forms?

airSlate SignNow employs industry-leading security measures to protect sensitive documents, including the blank tax exempt form Pennsylvania. Features like encrypted data storage and secure password protection ensure that your information remains confidential and secure.

Get more for Blank Tax Exempt Form Pennsylvania

- Sd landlord form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497326173 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring south dakota form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings south dakota form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises south dakota form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles south dakota form

- Letter from tenant to landlord about landlords failure to make repairs south dakota form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497326179 form

Find out other Blank Tax Exempt Form Pennsylvania

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed