Saccawu Provident Fund Form

What is the Saccawu Provident Fund

The Saccawu Provident Fund is a retirement savings scheme designed for employees in the retail sector, particularly those affiliated with the South African Commercial, Catering and Allied Workers Union (Saccawu). This fund aims to provide financial security for its members upon retirement or in the event of disability or death. Contributions are made by both employees and employers, ensuring a collective effort towards building a sustainable retirement fund. Understanding the structure and benefits of the Saccawu Provident Fund is crucial for members to maximize their savings and plan for their future.

How to use the Saccawu Provident Fund

Utilizing the Saccawu Provident Fund involves several key steps. Members can access their accounts to check balances, make withdrawals, or submit claims. It is essential to familiarize oneself with the online portal, where members can log in securely to manage their funds. Additionally, understanding the terms and conditions governing the fund will help members make informed decisions regarding their contributions and withdrawals. Regularly reviewing one’s account can also aid in tracking growth and ensuring financial goals are met.

Steps to complete the Saccawu Provident Fund

Completing transactions related to the Saccawu Provident Fund typically involves the following steps:

- Log into the online portal using your credentials.

- Navigate to the relevant section for withdrawals or claims.

- Fill out the necessary forms, ensuring all required information is accurate.

- Submit the forms electronically, if applicable, or follow instructions for mailing.

- Keep a record of your submission for future reference.

Following these steps can streamline the process and help avoid delays in accessing funds.

Required Documents

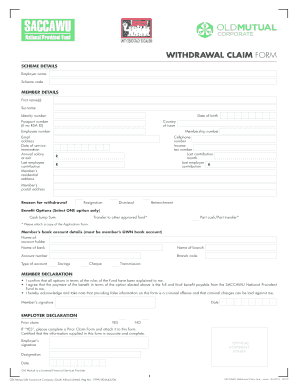

To process a claim or withdrawal from the Saccawu Provident Fund, certain documents are typically required. These may include:

- A completed claim form specific to the Saccawu Provident Fund.

- Proof of identity, such as a government-issued ID.

- Documentation supporting the reason for the claim, such as medical records in case of disability.

- Bank details for fund disbursement.

Ensuring that all documents are accurate and up-to-date can facilitate a smoother transaction process.

Eligibility Criteria

Eligibility for the Saccawu Provident Fund is generally determined by employment status within the retail sector and affiliation with Saccawu. Members must be actively contributing to the fund to qualify for benefits. Specific criteria may include:

- Being a registered member of Saccawu.

- Maintaining a minimum period of contributions.

- Meeting age requirements for retirement benefits.

Understanding these criteria is essential for members to ensure they can access their funds when needed.

Legal use of the Saccawu Provident Fund

The legal framework governing the Saccawu Provident Fund is crucial for ensuring compliance and protection for its members. The fund operates under specific regulations that dictate how contributions are managed, how benefits are distributed, and the rights of members. Adhering to these legal requirements is vital for the fund's integrity and for safeguarding members' interests. Members should be aware of their rights and responsibilities under the fund's rules to ensure they are fully informed about their entitlements.

Quick guide on how to complete saccawu provident fund

Effortlessly prepare Saccawu Provident Fund on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents quickly and without holdups. Handle Saccawu Provident Fund on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Saccawu Provident Fund with ease

- Find Saccawu Provident Fund and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the features that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you'd like to deliver your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Saccawu Provident Fund and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the saccawu provident fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the saccawu provident fund and how does it work?

The saccawu provident fund is a retirement savings plan aimed at providing employees with financial security after retirement. Members contribute a portion of their salary to the fund, which is then invested to grow over time. This ensures that when members retire, they have a reliable source of income.

-

How can I manage my saccawu provident fund contributions?

Managing your saccawu provident fund contributions can be done through our user-friendly platform. With airSlate SignNow, you can easily track your contributions, review your funds, and make necessary adjustments to ensure you signNow your retirement goals. Our solution simplifies the process of managing your financial future.

-

What are the benefits of the saccawu provident fund for employees?

The saccawu provident fund offers employees signNow benefits, including tax deductions on contributions and a stable investment growth opportunity. Additionally, it provides financial security in retirement, allowing employees to have peace of mind during their golden years. These advantages make it an essential part of financial planning.

-

Are there any fees associated with the saccawu provident fund?

Yes, there may be minimal management fees associated with the saccawu provident fund, which are typically used to cover administrative costs. It's important to review these fees during the enrollment process, as they can impact your overall returns. Understanding these costs will help you make informed financial decisions.

-

How does the saccawu provident fund integrate with other financial tools?

The saccawu provident fund is designed to integrate seamlessly with various financial tools and platforms, including payroll systems. By using airSlate SignNow, you can streamline document signing and management for your financial transactions, making it easier to manage contributions and keep everything organized.

-

Can members access their saccawu provident fund accounts online?

Yes, members can access their saccawu provident fund accounts online easily. With airSlate SignNow, you have 24/7 access to your account, allowing you to monitor your contributions, check your investment performance, and download necessary documents at your convenience.

-

What happens to my saccawu provident fund if I change employers?

If you change employers, your saccawu provident fund can typically remain with you, allowing for continuous investment growth. You may also have the option to transfer your fund to a new employer's retirement plan or withdraw the funds, depending on the specific regulations. It's advisable to consult with a financial advisor to understand your best options.

Get more for Saccawu Provident Fund

- Foreign judgment uniform enforcement act

- Utah small form

- Affidavit for transfer of title to motor vehicles in a small estate proceeding utah form

- Utah landlord notices for eviction unlawful detainer forms package utah

- Utah criminal form

- Checklist for victims statement in petition to expunge records utah form

- Utah expungement application form

- Victims statement for expungement request utah form

Find out other Saccawu Provident Fund

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form