Personal Monthly Budget Form

What is the Personal Monthly Budget Form

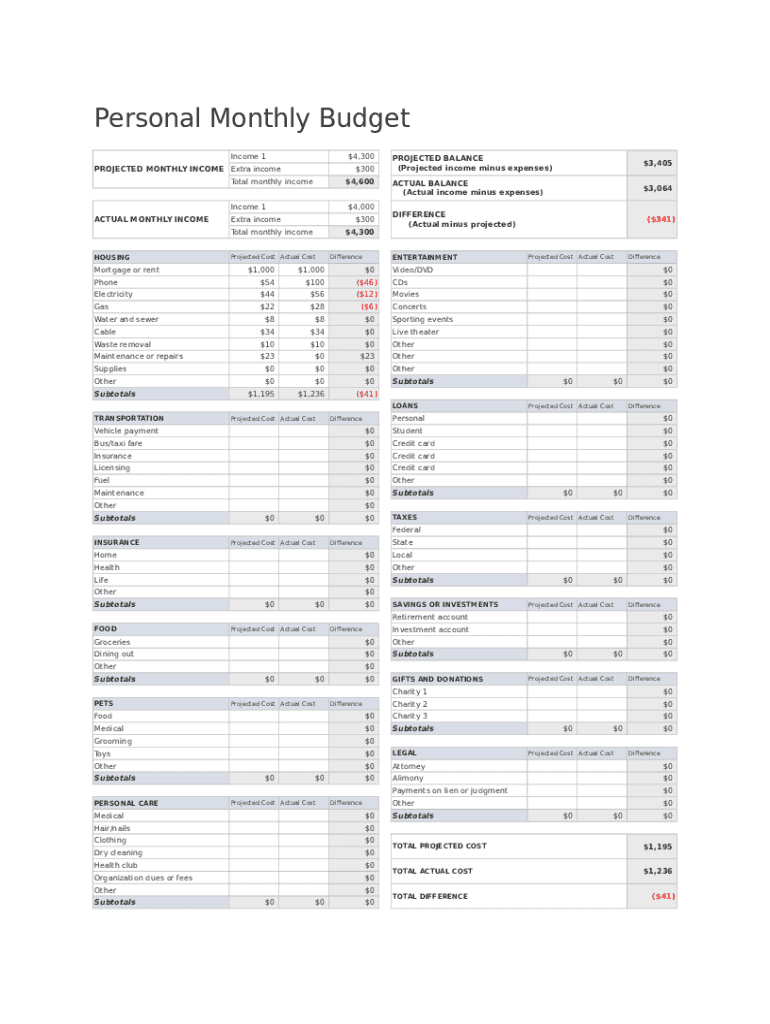

The personal monthly budget form is a structured document designed to help individuals track their income and expenses over a month. This form allows users to categorize their financial activities, providing a clear overview of their financial health. By using this form, individuals can identify spending patterns, set savings goals, and make informed decisions about their finances. It typically includes sections for fixed expenses, variable expenses, savings, and discretionary spending, making it a comprehensive tool for personal financial management.

How to use the Personal Monthly Budget Form

Using the personal monthly budget form involves several straightforward steps. First, gather all relevant financial information, including income sources and monthly bills. Next, fill in the income section of the form, detailing all sources of revenue. After that, list all fixed and variable expenses, ensuring to include categories such as housing, utilities, groceries, and entertainment. Once all information is entered, review the totals to assess whether expenses exceed income. Adjustments can then be made to align spending with financial goals, ensuring a balanced budget.

Steps to complete the Personal Monthly Budget Form

Completing the personal monthly budget form can be broken down into specific steps for clarity:

- Begin by entering your total monthly income.

- List all fixed expenses, such as rent or mortgage payments.

- Detail variable expenses, including groceries, transportation, and entertainment.

- Include savings goals and any debt repayments.

- Calculate total expenses and compare them to your income.

- Make necessary adjustments to ensure your budget is balanced.

Key elements of the Personal Monthly Budget Form

Several key elements are essential for an effective personal monthly budget form. These include:

- Income: All sources of income, including salary, bonuses, and side jobs.

- Fixed Expenses: Regular payments that do not change month-to-month, such as rent or mortgage.

- Variable Expenses: Costs that can fluctuate, such as groceries and entertainment.

- Savings: Allocations for future goals or emergencies.

- Debt Repayment: Any payments made towards loans or credit cards.

Legal use of the Personal Monthly Budget Form

The personal monthly budget form is not typically subject to legal regulations; however, it can play a significant role in financial planning and accountability. While the form itself does not require legal validation, maintaining accurate records can be beneficial for various purposes, such as loan applications or financial counseling. It is important to ensure that the information recorded is truthful and reflects actual financial situations to avoid potential issues in financial assessments.

Digital vs. Paper Version

Choosing between a digital or paper version of the personal monthly budget form depends on personal preference and convenience. Digital forms offer the advantage of easy editing, automatic calculations, and accessibility from multiple devices. They can also be securely stored and backed up. In contrast, paper forms may appeal to those who prefer a tactile approach or want to avoid screen time. Both formats serve the same purpose, so selecting the one that best fits individual habits and needs is essential for effective budgeting.

Quick guide on how to complete personal monthly budget form

Effortlessly prepare Personal Monthly Budget Form on any device

Online document management has gained signNow traction among organizations and individuals. It offers a great eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Personal Monthly Budget Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Personal Monthly Budget Form effortlessly

- Find Personal Monthly Budget Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal standing as a traditional ink signature.

- Review the information and then hit the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Personal Monthly Budget Form and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal monthly budget form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal monthly budget form?

A personal monthly budget form is a template designed to help individuals track their income and expenses on a monthly basis. By using this form, you can systematically analyze your spending habits and identify areas where you can save money. Whether for personal use or as part of a financial plan, this form is an essential tool for achieving financial stability.

-

How can I create a personal monthly budget form with airSlate SignNow?

Creating a personal monthly budget form with airSlate SignNow is straightforward. You can easily customize existing templates or build your own from scratch using our user-friendly interface. Simply add your income sources, expense categories, and any other financial details you want to track.

-

What features does the personal monthly budget form include?

The personal monthly budget form in airSlate SignNow includes customizable fields to input different income and expenses, automated calculations for totals, and the ability to save and share your budget. This ensures you have a comprehensive view of your finances while maintaining a personalized touch.

-

Is the personal monthly budget form easy to share with others?

Yes, the personal monthly budget form created on airSlate SignNow can be easily shared with family members or financial advisors. You can send it via email or share a link, allowing for collaborative budgeting sessions and discussions about financial goals.

-

How does using a personal monthly budget form benefit me?

Using a personal monthly budget form helps you take control of your finances by providing visibility into your spending patterns. It enables you to allocate funds efficiently, plan for future expenses, and work towards financial goals. Ultimately, this form can promote better financial habits and reduce unnecessary expenses.

-

Are there any costs associated with using the personal monthly budget form in airSlate SignNow?

While the personal monthly budget form itself is customizable and easy to use, airSlate SignNow does offer various pricing plans depending on your needs. You can choose from free trials or subscription plans, which provide access to additional features and tools for managing your documents.

-

Can I integrate the personal monthly budget form with other tools?

Yes, airSlate SignNow allows you to integrate your personal monthly budget form with various financial tools and applications. This ability to connect with tools like accounting software or expense tracking apps enhances your budgeting experience, streamlining data management and analysis.

Get more for Personal Monthly Budget Form

Find out other Personal Monthly Budget Form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document