Silent Partner Agreement PDF Form

What is the Silent Partner Agreement PDF

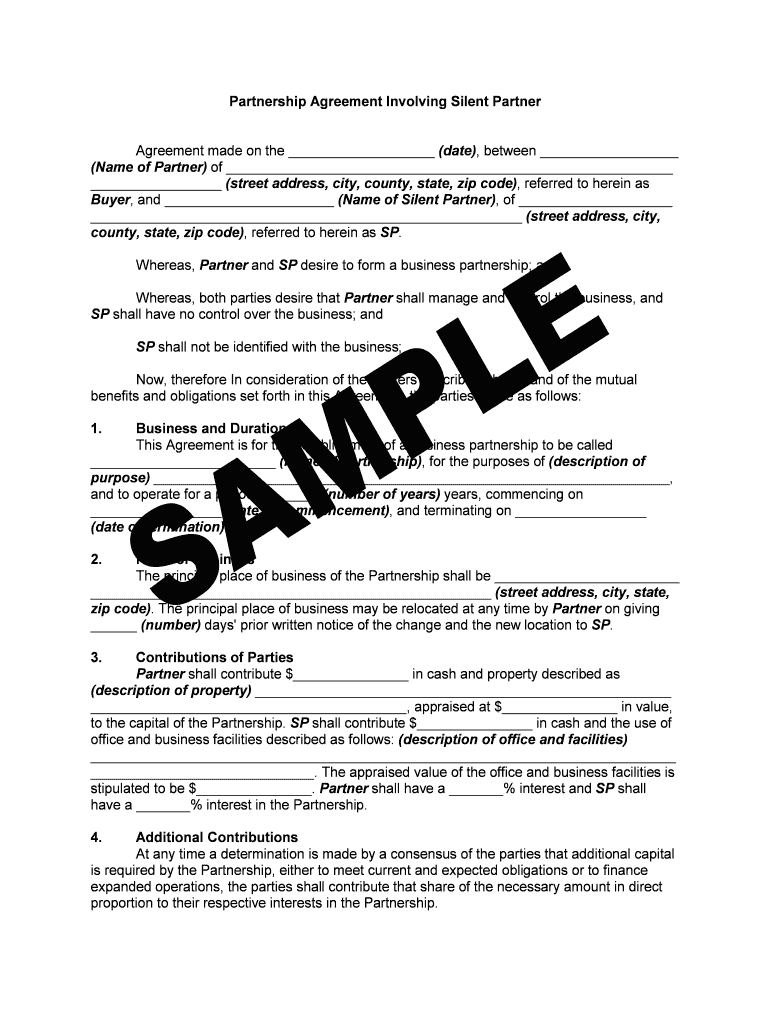

A silent partner agreement is a legal document that outlines the terms and conditions between a business and a silent partner, who typically invests capital but does not participate in day-to-day operations. The silent partner agreement PDF serves as a formal record of this arrangement, detailing each party's rights, responsibilities, and profit-sharing ratios. It is essential for protecting both the business and the silent partner by clearly defining expectations and obligations.

Key Elements of the Silent Partner Agreement PDF

Several critical components should be included in a silent partner agreement PDF to ensure its effectiveness:

- Parties Involved: Clearly identify the business and the silent partner.

- Investment Amount: Specify the financial contribution of the silent partner.

- Profit Sharing: Outline how profits will be distributed between the partners.

- Duration: State the length of the partnership and any conditions for renewal.

- Withdrawal Terms: Describe the process for a partner to exit the agreement.

- Dispute Resolution: Include methods for resolving conflicts that may arise.

Steps to Complete the Silent Partner Agreement PDF

Completing a silent partner agreement PDF involves several important steps:

- Gather Information: Collect all necessary details about the business and the silent partner.

- Draft the Agreement: Use a silent partner agreement template to create a draft, ensuring all key elements are included.

- Review the Document: Both parties should carefully review the agreement to ensure accuracy and clarity.

- Sign the Agreement: Utilize eSignature solutions to sign the document digitally, making it legally binding.

- Store the Document: Keep a secure copy of the signed agreement for future reference.

Legal Use of the Silent Partner Agreement PDF

For a silent partner agreement PDF to be legally valid, it must comply with relevant laws governing partnerships in the United States. This includes adhering to state-specific regulations and ensuring that both parties understand their rights and obligations. The agreement should also be executed with proper signatures, which can be facilitated through digital signature platforms that comply with the ESIGN Act and UETA.

How to Obtain the Silent Partner Agreement PDF

Obtaining a silent partner agreement PDF can be done through various means:

- Templates Online: Many websites offer free or paid templates that can be customized to fit specific needs.

- Legal Services: Consulting with a lawyer can provide tailored agreements that meet legal requirements.

- Business Organizations: Local chambers of commerce or business associations may provide resources or templates.

Examples of Using the Silent Partner Agreement PDF

Silent partner agreements can be applied in various business scenarios, such as:

- A startup seeking capital to launch its operations while allowing an investor to remain uninvolved in daily management.

- A restaurant partnership where one partner provides funding while the other manages the business.

- A technology firm where a silent partner contributes financially but does not engage in technical decisions.

Quick guide on how to complete partnership agreement involving silent partners form

Prepare Silent Partner Agreement Pdf effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly without holdups. Handle Silent Partner Agreement Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to edit and electronically sign Silent Partner Agreement Pdf with ease

- Find Silent Partner Agreement Pdf and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you want to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Silent Partner Agreement Pdf and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

Two founders form a company to start developing tech products. Can one of them claim IP rights of a product even if the partnership agreement is silent about it?

So two techies got together to create tech products but their partnership agreement is silent on who would get credit for what was created? If a lawyer was involved in drafting this agreement, this lawyer should be disbarred. If no lawyer was involved to save some money up front, sounds like two lawyers and hefty legal fees are coming up soon.One of the founders can certainly claim the IP rights to one or more products, but assuming this issue is the US, the two parties must either work out a settlement, or go to court to work it out. Hiring a good lawyer before starting out would have been the cheapest course. Revising the agreement between the founders to settle the matter now would be the next best thing. Find an attorney who is not only familiar with IP law but also knows how to reconcile differences like this.Going to court to fight it out would not only be a huge expense in terms of money and time, but by the time some kind of resolution is worked out the IP may be useless to both parties.

-

How can I "resign" from a partnership agreement without giving notice if I discover that my partner is planning to involve the partnership in fraud?

Say what you need to. Don't worry too much about manners if you are trying to remove yourself from danger. Say what is needed. Lie.But consider giving some notice.You can see how his lack of ethics is already affecting others. You.So make something up and don't let on that you know, keep your good graces with this connection as you don't want him starting shit professionally. But yeah, get out. He lost his privilege to an honesty you can't afford to use.

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What are the ITRs to be filled out by an individual who is a partner in a partnership?

ITR-3. INDIAN INCOME TAX RETURN. [For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship].An individual or an HUF is a partner in a firm AND. where income chargeable to income-tax under the head "Profits or gains of business or profession" does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, due to, or received by him from such firm.

-

How are assets of young LLC company to be divided up if 1 of 3 partners wants to end a partnership which has no oeprating agreement?

When there is no operating agreement, the default rules of the state under whose laws the LLC was formed comes into play.Generally speaking, most states provide that when an LLC is dissolved and wound up, the LLC's assets are divided in accordance with each partner's ownership percentages. So if each person owns 1/3, then each person gets 1/3 of the assets after LLC debts have been paid off.HOWEVER, just because a partner wants to close shop does not mean he can unilaterally. Some states follow the old partnership rule that when one person leaves, the partnership is dissolved; other states say a person can leave without causing the partnership to be dissolved. Some states provide for buyout of the withdrawing partner at fair market value. You will need to check the relevant state's laws to figure out what works.I'm a lawyer, but not your lawyer. This is not legal advice, just general information, so depend on it at your own risk. The internet is a scary place, so don't believe every thing you read. If you need legal advice, hire a lawyer to be your lawyer =)

Create this form in 5 minutes!

How to create an eSignature for the partnership agreement involving silent partners form

How to create an eSignature for your Partnership Agreement Involving Silent Partners Form online

How to make an eSignature for the Partnership Agreement Involving Silent Partners Form in Chrome

How to make an electronic signature for signing the Partnership Agreement Involving Silent Partners Form in Gmail

How to create an electronic signature for the Partnership Agreement Involving Silent Partners Form from your smartphone

How to create an electronic signature for the Partnership Agreement Involving Silent Partners Form on iOS devices

How to generate an eSignature for the Partnership Agreement Involving Silent Partners Form on Android OS

People also ask

-

What is a silent partner agreement template?

A silent partner agreement template is a legal document that outlines the terms and conditions between a business owner and an investor who does not participate in day-to-day operations. This template helps to clearly define each party's responsibilities, profit sharing, and other key elements to avoid misunderstandings. Using a silent partner agreement template ensures that both parties are on the same page.

-

How can I create a silent partner agreement using airSlate SignNow?

Creating a silent partner agreement using airSlate SignNow is straightforward. Simply choose the silent partner agreement template from our library, customize it to fit your specific needs, and send it for eSignature. Our platform simplifies the process, ensuring that your agreement is executed quickly and efficiently.

-

What features does your silent partner agreement template include?

Our silent partner agreement template includes essential features such as customizable fields, clauses for profit sharing, confidentiality terms, and a timeline for investment returns. Additionally, the template is designed to be user-friendly, making it easy to modify and adapt to suit different business models. With airSlate SignNow, you can also track the document's status in real-time.

-

Is the silent partner agreement template cost-effective?

Yes, our silent partner agreement template is a cost-effective solution for businesses looking to formalize partnerships without incurring high legal fees. With airSlate SignNow, you get access to professionally crafted templates that can save time and resources. This ensures that you can focus on growing your business while having peace of mind regarding legal agreements.

-

Can I integrate the silent partner agreement template with other tools?

Absolutely! airSlate SignNow offers integrations with various tools and software, allowing you to seamlessly incorporate your silent partner agreement template into your existing workflows. Whether you need to connect with CRM systems or document management solutions, our platform ensures that your agreements are part of an efficient business process.

-

What are the benefits of using airSlate SignNow for a silent partner agreement?

Using airSlate SignNow for your silent partner agreement offers numerous benefits, including ease of use, quick document turnaround, and enhanced security. Our platform allows you to effectively manage and store documents digitally, ensuring they are accessible whenever needed. Additionally, you can track who has signed the agreement and when, providing transparency in your business relationships.

-

Is eSigning the silent partner agreement template secure?

Yes, eSigning the silent partner agreement template through airSlate SignNow is highly secure. We utilize advanced encryption methods and secure servers to protect your documents and personal information. Furthermore, each signature is timestamped and verifiable, ensuring the integrity of the agreement throughout its lifecycle.

Get more for Silent Partner Agreement Pdf

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497326168 form

- South dakota tenant form

- Letter from tenant to landlord containing notice that doors are broken and demand repair south dakota form

- South dakota windows form

- Sd landlord form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497326173 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring south dakota form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings south dakota form

Find out other Silent Partner Agreement Pdf

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online