Loan Form Nigeria

What is the loan form in Nigeria?

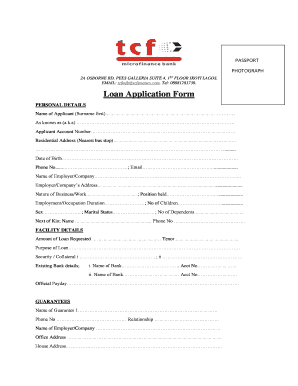

The loan form in Nigeria is a formal document used by individuals or businesses seeking financial assistance from lending institutions. This form typically collects essential information about the applicant, including personal details, employment status, income, and the purpose of the loan. It serves as a crucial first step in the loan application process, allowing lenders to assess the borrower's eligibility and creditworthiness. Understanding the components of this form is vital for anyone looking to secure a loan, as it can significantly impact the approval process.

How to use the loan form in Nigeria

Using the loan form in Nigeria involves several steps. First, applicants should obtain the correct form from their chosen lending institution, whether it is a bank or a microfinance company. Once in possession of the form, applicants need to fill it out accurately, ensuring all required fields are completed. This includes providing personal identification details, financial information, and any supporting documentation that may be required. After completing the form, applicants typically submit it either online or in person, depending on the lender's submission methods.

Steps to complete the loan form in Nigeria

Completing the loan form in Nigeria requires careful attention to detail. Here are the key steps:

- Gather necessary documents: Collect identification, proof of income, and any other required documents.

- Fill in personal information: Provide your full name, address, contact information, and date of birth.

- Detail your financial status: Include your employment details, monthly income, and any existing debts.

- Specify the loan amount: Clearly state how much money you are requesting and the intended use of the funds.

- Review the form: Check for any errors or missing information before submission.

- Submit the form: Follow the lender's instructions for submitting the completed loan form.

Legal use of the loan form in Nigeria

The legal use of the loan form in Nigeria is governed by various regulations that ensure the protection of both the borrower and the lender. For the form to be legally binding, it must be completed accurately and submitted in accordance with the lender's policies. Additionally, the borrower must provide valid identification and proof of income to verify their ability to repay the loan. Understanding these legal requirements is essential to avoid potential disputes and ensure compliance with Nigerian lending laws.

Key elements of the loan form in Nigeria

Several key elements are essential for the loan form in Nigeria. These include:

- Personal Information: Name, address, and contact details.

- Employment Details: Current job title, employer's name, and duration of employment.

- Financial Information: Monthly income, existing loans, and liabilities.

- Loan Purpose: A clear statement of why the loan is needed.

- Loan Amount Requested: The specific amount being applied for.

Examples of using the loan form in Nigeria

Examples of using the loan form in Nigeria can vary widely based on the purpose of the loan. Common scenarios include:

- Personal Loans: Individuals applying for funds to cover unexpected expenses or personal projects.

- Business Loans: Entrepreneurs seeking capital to start or expand their businesses.

- Education Loans: Students applying for financial support to cover tuition and related costs.

Each of these examples illustrates how the loan form serves as a critical tool in accessing financial resources in Nigeria.

Quick guide on how to complete loan form nigeria

Complete Loan Form Nigeria effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Loan Form Nigeria on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Loan Form Nigeria with ease

- Find Loan Form Nigeria and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or obscure sensitive data with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Loan Form Nigeria to ensure exceptional communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan form nigeria

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan form and how can airSlate SignNow help?

A loan form is a document that outlines the terms and conditions of a loan agreement. With airSlate SignNow, you can easily create, send, and eSign your loan forms securely and efficiently. Our platform streamlines the loan documentation process, allowing you to focus on what matters most.

-

What features does airSlate SignNow offer for loan forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and user-friendly eSigning options specifically designed for loan forms. These features help reduce paperwork, enhance accuracy, and speed up the loan approval process, making it easier for businesses to manage their loan documentation.

-

Is there a cost associated with using airSlate SignNow for loan forms?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs when it comes to loan forms. Our plans are cost-effective, providing a range of features designed to enhance your document management experience without breaking the bank. You can choose the plan that fits your requirements the best.

-

Can I customize my loan forms with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your loan forms according to your specific needs. You can add fields, logos, and other branding elements to ensure your loan documents reflect your business identity and comply with any legal requirements.

-

How does airSlate SignNow ensure the security of my loan forms?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and secure access protocols to protect your loan forms from unauthorized access. You can confidently manage sensitive information, knowing that your data is safeguarded at all times.

-

Does airSlate SignNow integrate with other software for loan forms?

Yes, airSlate SignNow offers seamless integrations with various applications and software commonly used in financial services. This means you can easily sync your loan forms with your CRM or accounting software, enhancing your workflow and improving overall efficiency.

-

What benefits does airSlate SignNow provide for managing loan forms?

Using airSlate SignNow to manage your loan forms comes with several benefits, including faster processing times, reduced errors, and improved record-keeping. Our intuitive platform simplifies the loan documentation process, allowing for quick approvals, which ultimately leads to a better experience for your clients.

Get more for Loan Form Nigeria

- Saln form 30814370

- Download death certificate form philippines

- Blotter form

- City of cape town job seekers registration form pdf download

- Georgia birth certificate template form

- Dr 330 notice to employer re childrens medical insurance form

- Dr 800 and dr 805 divorce ffcl and decree 10 15 form

- Mc 110 petition for 30 day commitment form

Find out other Loan Form Nigeria

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now