MI 1040ES, Michigan Estimated Income Tax for Individuals MI 1040ES, Michigan Estimated Income Tax for Individuals 2024

Understanding the MI 1040ES: Michigan Estimated Income Tax for Individuals

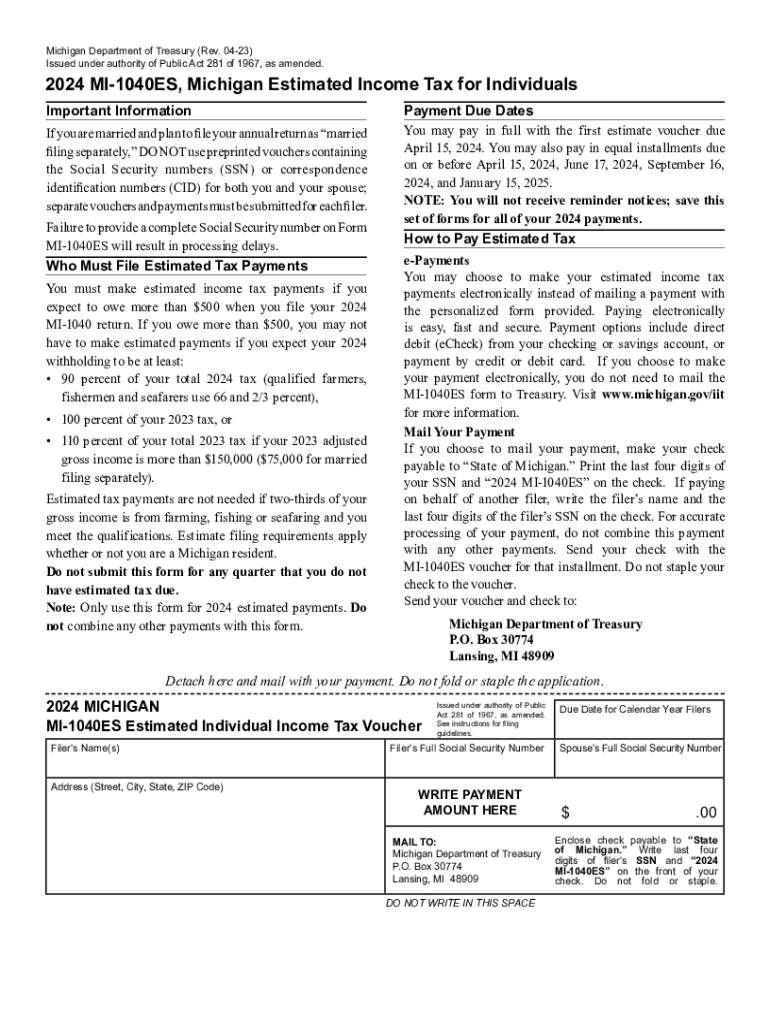

The MI 1040ES is a crucial form for individuals in Michigan who need to pay estimated income tax. This form is designed for taxpayers who expect to owe tax of $500 or more when they file their annual return. It is essential for those who earn income that is not subject to withholding, such as self-employment income, rental income, or investment income. By filing the MI 1040ES, taxpayers can make quarterly payments to avoid penalties and interest on underpayment of taxes.

How to Use the MI 1040ES

Using the MI 1040ES involves several straightforward steps. First, taxpayers must determine their expected income for the year to calculate the estimated tax owed. The form provides a worksheet to help in this calculation. Once the estimated tax is determined, taxpayers should complete the MI 1040ES and submit it along with the payment by the specified quarterly deadlines. It is important to keep track of payments made to ensure compliance and avoid penalties.

Steps to Complete the MI 1040ES

Completing the MI 1040ES requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total income for the current year, considering any deductions or credits.

- Use the provided worksheet on the MI 1040ES to calculate your estimated tax liability.

- Fill out the form accurately, ensuring all information is correct.

- Submit the form along with your payment by the quarterly due dates.

Filing Deadlines for the MI 1040ES

Timely filing of the MI 1040ES is essential to avoid penalties. The deadlines for submitting estimated tax payments are typically:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should mark these dates on their calendars and ensure payments are made on time.

Required Documents for the MI 1040ES

To accurately complete the MI 1040ES, certain documents are necessary. These include:

- Previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Records of any deductions or credits you plan to claim

- Any relevant financial documents related to self-employment or investments

Having these documents on hand can streamline the process and reduce the risk of errors.

Penalties for Non-Compliance with the MI 1040ES

Failing to file the MI 1040ES or making late payments can result in penalties. The state of Michigan imposes interest on unpaid taxes, and penalties can accumulate quickly. Taxpayers may face a penalty of up to twenty-five percent of the amount owed if they do not pay enough tax throughout the year. It is vital to adhere to filing and payment deadlines to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals 718971255

Create this form in 5 minutes!

How to create an eSignature for the mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals 718971255

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Michigan income tax?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those dealing with Michigan income tax, it simplifies the process of signing tax documents and ensures compliance with state regulations.

-

How can airSlate SignNow help with filing Michigan income tax?

Using airSlate SignNow, you can easily prepare and sign your Michigan income tax documents electronically. This streamlines the filing process, reduces paperwork, and helps ensure that your submissions are timely and accurate.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides features that can assist with managing documents related to Michigan income tax, ensuring you find a cost-effective solution.

-

What features does airSlate SignNow offer for managing Michigan income tax documents?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning. These tools are particularly beneficial for managing Michigan income tax documents efficiently and securely.

-

Is airSlate SignNow compliant with Michigan income tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to Michigan income tax. This ensures that your electronic signatures and document submissions meet legal requirements.

-

Can I integrate airSlate SignNow with other software for Michigan income tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration can enhance your workflow when dealing with Michigan income tax, making the process more efficient.

-

What are the benefits of using airSlate SignNow for Michigan income tax?

The primary benefits of using airSlate SignNow for Michigan income tax include increased efficiency, reduced paperwork, and enhanced security. By digitizing your document management, you can focus more on your business and less on administrative tasks.

Get more for MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals

Find out other MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement