Michigan Flow through Entity FTE Tax Overview 2025-2026

Overview of the Michigan Flow Through Entity FTE Tax

The Michigan Flow Through Entity (FTE) Tax is designed for specific business entities, allowing them to pass income through to their owners without being subject to corporate income tax. This tax applies to entities such as partnerships, S corporations, and limited liability companies (LLCs) that elect to be treated as partnerships. Understanding this tax is crucial for compliance and effective financial planning.

Steps to Complete the Michigan Flow Through Entity FTE Tax

Completing the Michigan FTE Tax involves several key steps:

- Determine eligibility based on your business structure.

- Gather necessary financial documentation, including income statements and balance sheets.

- Complete the appropriate tax forms, ensuring all income and deductions are accurately reported.

- Review the completed forms for accuracy and compliance with Michigan tax laws.

- Submit the forms by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for compliance. Typically, the FTE Tax forms must be submitted by the due date of the entity's income tax return. For most entities, this is usually the 15th day of the fourth month following the end of the tax year. It is advisable to verify specific dates annually, as they may vary based on changes in state regulations.

Required Documents for Filing

When preparing to file the Michigan FTE Tax, ensure you have the following documents ready:

- Financial statements for the tax year, including profit and loss statements.

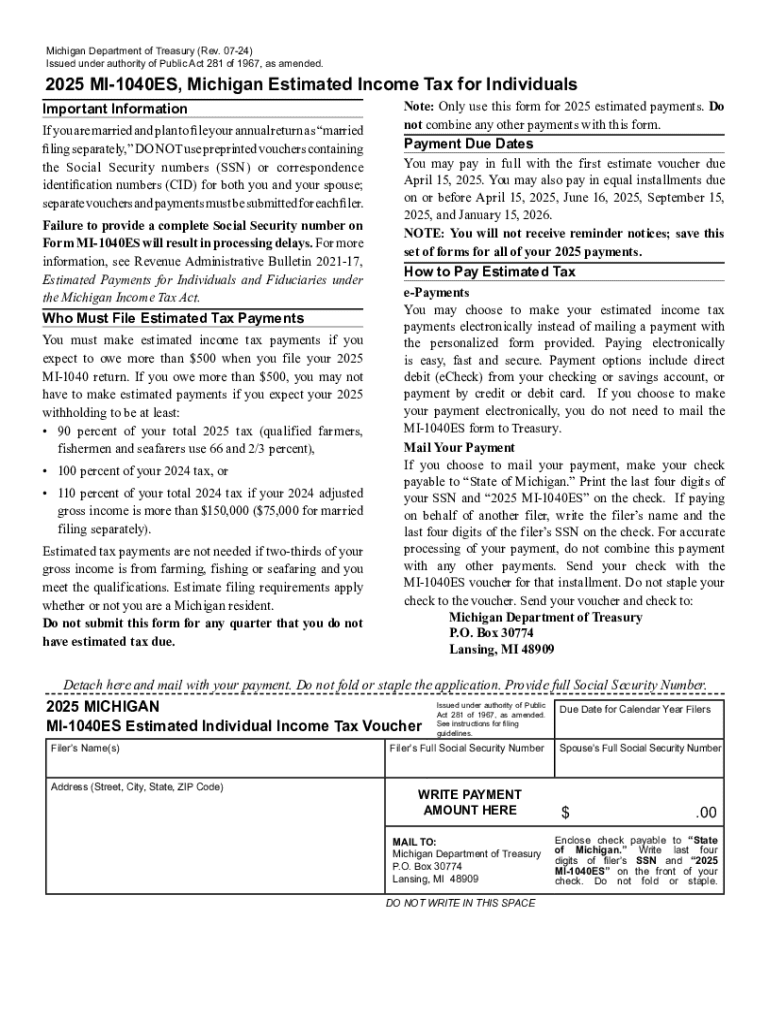

- Form MI-1040ES, if applicable, for estimated tax payments.

- Any previous tax returns that may provide context for current filings.

- Documentation supporting any deductions claimed.

Form Submission Methods

Submitting the Michigan FTE Tax forms can be done through various methods:

- Online submission via the Michigan Department of Treasury's e-filing system.

- Mailing the completed forms to the appropriate state address.

- In-person submission at designated state offices, if necessary.

Penalties for Non-Compliance

Failure to comply with the Michigan FTE Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to file on time and ensure all information is accurate to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct michigan flow through entity fte tax overview

Create this form in 5 minutes!

How to create an eSignature for the michigan flow through entity fte tax overview

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Michigan MI 1040ES form?

The 2024 Michigan MI 1040ES form is used by taxpayers in Michigan to make estimated income tax payments. This form is essential for individuals who expect to owe tax of $500 or more when filing their annual return. Completing the 2024 Michigan MI 1040ES form helps ensure that you meet your tax obligations throughout the year.

-

How can airSlate SignNow help with the 2024 Michigan MI 1040ES form?

airSlate SignNow provides a seamless platform for electronically signing and sending the 2024 Michigan MI 1040ES form. With our user-friendly interface, you can easily fill out and eSign your tax documents, ensuring compliance and saving time. Our solution is designed to simplify the process of managing important tax forms.

-

What are the pricing options for using airSlate SignNow for the 2024 Michigan MI 1040ES form?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are an individual or a business, you can choose a plan that fits your budget while providing access to features for managing the 2024 Michigan MI 1040ES form. Our cost-effective solution ensures you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for the 2024 Michigan MI 1040ES form?

With airSlate SignNow, you can enjoy features such as document templates, secure eSigning, and real-time tracking for the 2024 Michigan MI 1040ES form. These features streamline the process, making it easier to manage your tax documents efficiently. Additionally, our platform ensures that your information is secure and compliant with regulations.

-

Are there any benefits to using airSlate SignNow for tax forms like the 2024 Michigan MI 1040ES form?

Using airSlate SignNow for the 2024 Michigan MI 1040ES form offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to complete and sign documents from anywhere, saving you time and hassle. Furthermore, you can easily store and access your signed forms whenever needed.

-

Can I integrate airSlate SignNow with other software for the 2024 Michigan MI 1040ES form?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the 2024 Michigan MI 1040ES form. Whether you use accounting software or document management systems, our integrations help streamline your processes. This connectivity ensures that you can manage your tax documents efficiently.

-

Is airSlate SignNow secure for handling the 2024 Michigan MI 1040ES form?

Absolutely! airSlate SignNow prioritizes security, ensuring that your 2024 Michigan MI 1040ES form and other documents are protected. We use advanced encryption and comply with industry standards to safeguard your sensitive information. You can trust our platform for secure eSigning and document management.

Get more for Michigan Flow Through Entity FTE Tax Overview

- Letter from tenant to landlord about landlord using unlawful self help to gain possession ohio form

- Letter from tenant to landlord about illegal entry by landlord ohio form

- Letter from landlord to tenant about time of intent to enter premises ohio form

- Letter landlord notice sample form

- Letter from tenant to landlord about sexual harassment ohio form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children ohio form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure ohio form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497322273 form

Find out other Michigan Flow Through Entity FTE Tax Overview

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement