About Form 5471, Information Return of U S Persons IRS 2022

What is Form 5471?

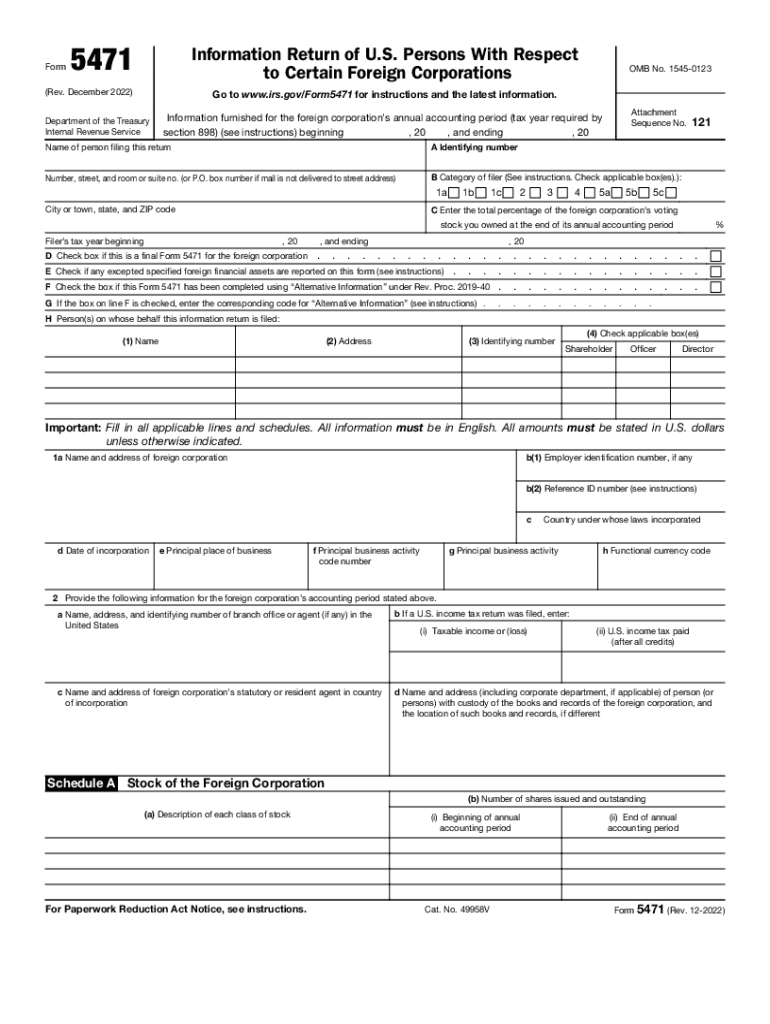

Form 5471, officially known as the Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is a tax form required by the Internal Revenue Service (IRS) for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is crucial for reporting foreign income and ensuring compliance with U.S. tax laws. It helps the IRS track foreign investments and income, preventing tax evasion and ensuring proper taxation of overseas assets.

Steps to Complete Form 5471

Completing the 2018 Form 5471 involves several key steps:

- Gather Required Information: Collect details about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

- Identify Your Filing Category: Determine which category of filer you are, as this affects the specific sections of the form you need to complete.

- Fill Out the Form: Complete the required sections based on your filing category. This may include financial information, ownership details, and income reporting.

- Review and Verify: Double-check all entries for accuracy and completeness to avoid penalties.

- Submit the Form: File the completed Form 5471 with your tax return by the due date, ensuring it is submitted electronically if required.

Filing Deadlines for Form 5471

The filing deadline for Form 5471 typically aligns with the due date of your income tax return. For most taxpayers, this means the form is due on April 15. However, if you file for an extension, Form 5471 must be submitted by the extended deadline. It is essential to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failing to file Form 5471 or submitting it late can result in significant penalties. The IRS imposes a penalty of $10,000 for each failure to file, which can increase if the form remains unfiled for more than 90 days after the IRS sends a notice. Additionally, failure to report foreign income can lead to further tax liabilities and interest charges.

Legal Use of Form 5471

Form 5471 serves a legal purpose by ensuring compliance with U.S. tax laws regarding foreign corporations. It is vital for U.S. persons to accurately report their interests in foreign entities to avoid legal repercussions. The form is legally binding, and the information provided must be truthful and complete to uphold its validity in the eyes of the IRS.

Examples of Using Form 5471

Common scenarios where Form 5471 is required include:

- A U.S. citizen who owns shares in a foreign corporation.

- A U.S. resident who is an officer or director of a foreign corporation.

- A U.S. person who has a controlling interest in a foreign corporation.

These examples highlight the various situations that necessitate the completion and submission of Form 5471 to ensure compliance with U.S. tax regulations.

Quick guide on how to complete about form 5471 information return of us persons irs

Complete About Form 5471, Information Return Of U S Persons IRS effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle About Form 5471, Information Return Of U S Persons IRS on any device through airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign About Form 5471, Information Return Of U S Persons IRS seamlessly

- Locate About Form 5471, Information Return Of U S Persons IRS and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require reprinting. airSlate SignNow meets your needs in document management in just a few clicks from your chosen device. Modify and eSign About Form 5471, Information Return Of U S Persons IRS and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5471 information return of us persons irs

Create this form in 5 minutes!

How to create an eSignature for the about form 5471 information return of us persons irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 2018 form 5471?

The 2018 form 5471 is used for U.S. taxpayers to report interests in foreign corporations. This form helps ensure compliance with U.S. tax regulations and provides information about the foreign entity's income, taxes paid, and share ownership. Filling out the 2018 form 5471 accurately is crucial for avoiding penalties.

-

How can airSlate SignNow assist with the 2018 form 5471?

airSlate SignNow simplifies the process of signing and submitting documents related to the 2018 form 5471. Our platform allows users to upload, edit, and eSign forms securely and efficiently. This means you can ensure your 2018 form 5471 is properly filled out and submitted on time.

-

What features does airSlate SignNow offer for document management related to the 2018 form 5471?

With airSlate SignNow, you get features like drag-and-drop document uploads, customizable templates, and in-app signatures, all of which enhance your experience when managing the 2018 form 5471. You can track document status, set reminders, and collaborate with team members to ensure completion of important tax forms.

-

Is airSlate SignNow cost-effective for handling the 2018 form 5471?

Yes, airSlate SignNow provides a cost-effective solution for managing the 2018 form 5471. Our competitive pricing plans make it affordable for businesses of all sizes to send, sign, and store important documents. This investment can help you save time and reduce the risk of costly errors in your filing.

-

Can airSlate SignNow integrate with other software for processing the 2018 form 5471?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to process the 2018 form 5471. This capability allows you to seamlessly import and export data, ensuring everything you need is in one place for efficient tax preparation.

-

What benefits does using airSlate SignNow provide for eSigning the 2018 form 5471?

Using airSlate SignNow to eSign the 2018 form 5471 maximizes convenience and security. Our platform ensures that all signatures are legally binding and securely stored, signNowly reducing the time it takes to finalize your documents. Moreover, you can sign from anywhere, making it easier to meet your deadlines.

-

Are there tutorial resources available for completing the 2018 form 5471 with airSlate SignNow?

Yes, airSlate SignNow provides a variety of tutorial resources, including guides and how-to videos, to help with completing the 2018 form 5471. These resources are designed to walk you through the process step-by-step, making it easier for users to understand the requirements and ensure their filing is accurate.

Get more for About Form 5471, Information Return Of U S Persons IRS

- The boy kicked the ball noun form

- Printable edd continued claim form

- Classifying matter worksheet pdf form

- Motorcycle visual inventory supplement form

- Go math grade 6 teacher edition pdf form

- Lse acceptance letter form

- Ccis philadelphia online application form

- The man who built america episode 1 worksheet answers form

Find out other About Form 5471, Information Return Of U S Persons IRS

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure