5471 2024-2025 Form

Understanding Form 5471

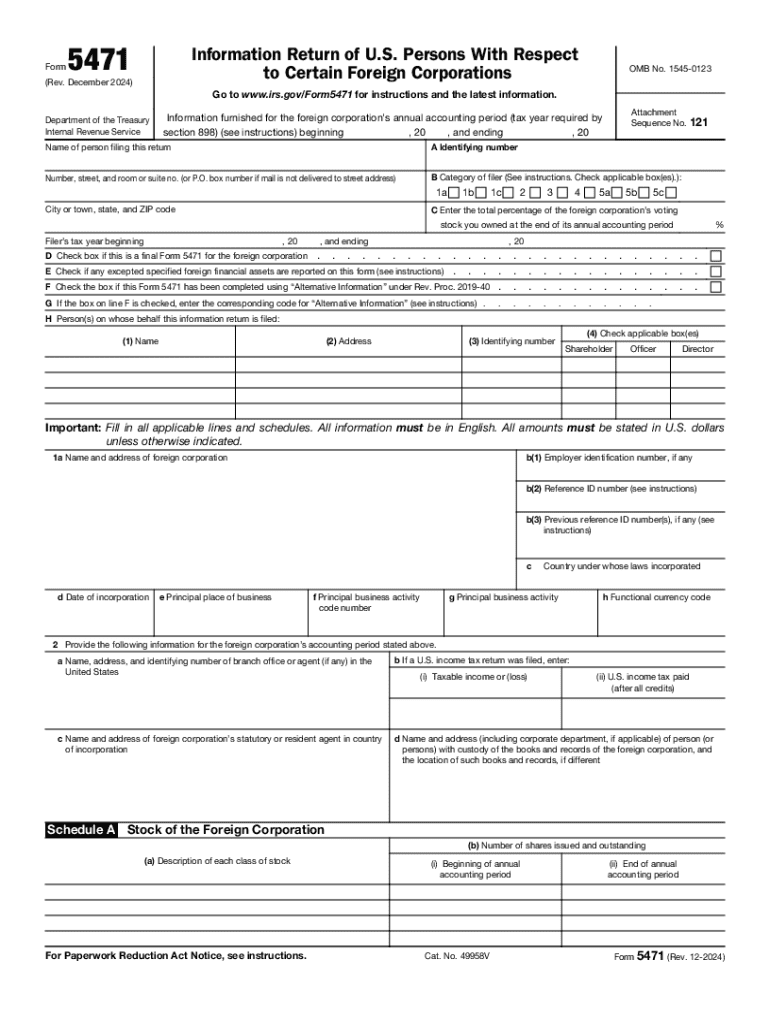

Form 5471 is the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. This form is primarily used by U.S. citizens and residents who have control over foreign corporations or who are shareholders in foreign corporations. The purpose of Form 5471 is to provide the IRS with information regarding the foreign corporation's financial activities, ownership structure, and transactions with U.S. persons. Filing this form is crucial for maintaining compliance with U.S. tax laws and avoiding potential penalties.

Steps to Complete Form 5471

Completing Form 5471 involves several steps that require careful attention to detail. The process typically includes the following:

- Gather necessary information about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

- Determine your filing category based on your relationship with the foreign corporation, as this affects the information you need to provide.

- Complete the required sections of the form, which may include financial statements, ownership details, and transactions with related parties.

- Review the form for accuracy and completeness before submission.

Obtaining Form 5471

Form 5471 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to ensure that you are using the most current version of the form, as updates may occur annually. You can also find instructions for completing the form, which provide valuable guidance on the specific information required and filing requirements.

Filing Deadlines for Form 5471

The filing deadline for Form 5471 generally coincides with the due date of your federal income tax return, including any extensions. For most taxpayers, this means the form is due on April 15, with extensions available until October 15. However, if you are a U.S. person who is a shareholder in a foreign corporation, it is crucial to be aware of any specific deadlines that may apply based on your circumstances.

Penalties for Non-Compliance

Failure to file Form 5471 or filing it inaccurately can result in significant penalties. The IRS imposes a penalty of $10,000 for each form that is not filed correctly or on time. Additionally, continued failure to file can lead to increased penalties, which may escalate to $50,000. Understanding these potential consequences underscores the importance of accurate and timely filing.

Key Elements of Form 5471

Form 5471 includes several key elements that must be completed to ensure compliance. These elements typically include:

- Identification of the foreign corporation and its shareholders.

- Financial information, including income statements and balance sheets.

- Details of ownership interests and transactions between the U.S. persons and the foreign corporation.

- Any other relevant disclosures as required by the IRS.

Create this form in 5 minutes or less

Find and fill out the correct form 5471 2020

Related searches to 5471

Create this form in 5 minutes!

How to create an eSignature for the 5471 form 2020

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 2020 form 5471

-

What is form 5471 and why is it important?

Form 5471 is a tax form required by the IRS for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. It is essential for reporting information about foreign entities and ensuring compliance with U.S. tax laws. Understanding form 5471 is crucial for avoiding penalties and maintaining good standing with the IRS.

-

How can airSlate SignNow help with form 5471?

airSlate SignNow simplifies the process of preparing and signing form 5471 by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their forms, ensuring that all necessary information is accurately captured. This streamlines the filing process and helps users stay organized.

-

What features does airSlate SignNow offer for managing form 5471?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for forms like form 5471. These tools enhance efficiency and ensure that users can complete their forms accurately and on time. Additionally, the platform provides reminders and notifications to keep users informed about deadlines.

-

Is airSlate SignNow cost-effective for filing form 5471?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file form 5471. With flexible pricing plans, users can choose the option that best fits their needs without compromising on features. This affordability makes it accessible for both small businesses and larger enterprises.

-

Can I integrate airSlate SignNow with other software for form 5471?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage form 5471 alongside your other financial documents. This integration capability enhances workflow efficiency and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for form 5471?

Using airSlate SignNow for form 5471 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface allows for quick document preparation and signing, while its secure storage ensures that sensitive information is protected. This ultimately saves time and reduces the risk of errors.

-

How does airSlate SignNow ensure the security of my form 5471?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for all documents, including form 5471. This ensures that your sensitive information is protected from unauthorized access. Additionally, the platform complies with industry standards to maintain the confidentiality and integrity of your data.

Get more for 2020 5471 form

- Decay practice worksheet 1 answer key form

- Georgia psc experience verification form

- Jf 11 cobb county form

- Ihsa skin condition form

- Candy making manual uidahoedu university of idaho extension extension uidaho form

- School safety patrol belts for sale form

- Cook county anti predatory lending form

- Mwrd chicago form

Find out other 2020 5471

- How To Electronic signature Washington Government PDF

- Help Me With Electronic signature Washington Government PDF

- How Can I Electronic signature Washington Government PDF

- Can I Electronic signature Washington Government PDF

- How Do I Electronic signature Washington Government PDF

- Can I Electronic signature Washington Government PDF

- Help Me With Electronic signature Washington Government PDF

- How To Electronic signature Washington Government PDF

- How Do I Electronic signature Washington Government PDF

- How Can I Electronic signature Washington Government PDF

- Help Me With Electronic signature Washington Government PDF

- How Can I Electronic signature Washington Government PDF

- Can I Electronic signature Washington Government PDF

- Can I Electronic signature Washington Government PDF

- How To Electronic signature Washington Government PDF

- How To Electronic signature Washington Government PDF

- How Do I Electronic signature Washington Government PDF

- How Do I Electronic signature Washington Government PDF

- Help Me With Electronic signature Washington Government PDF

- How Can I Electronic signature Washington Government PDF