Form 5471 Rev December Information Return of U S Persons with Respect to Certain Foreign Corporations 2020

What is the Form 5471?

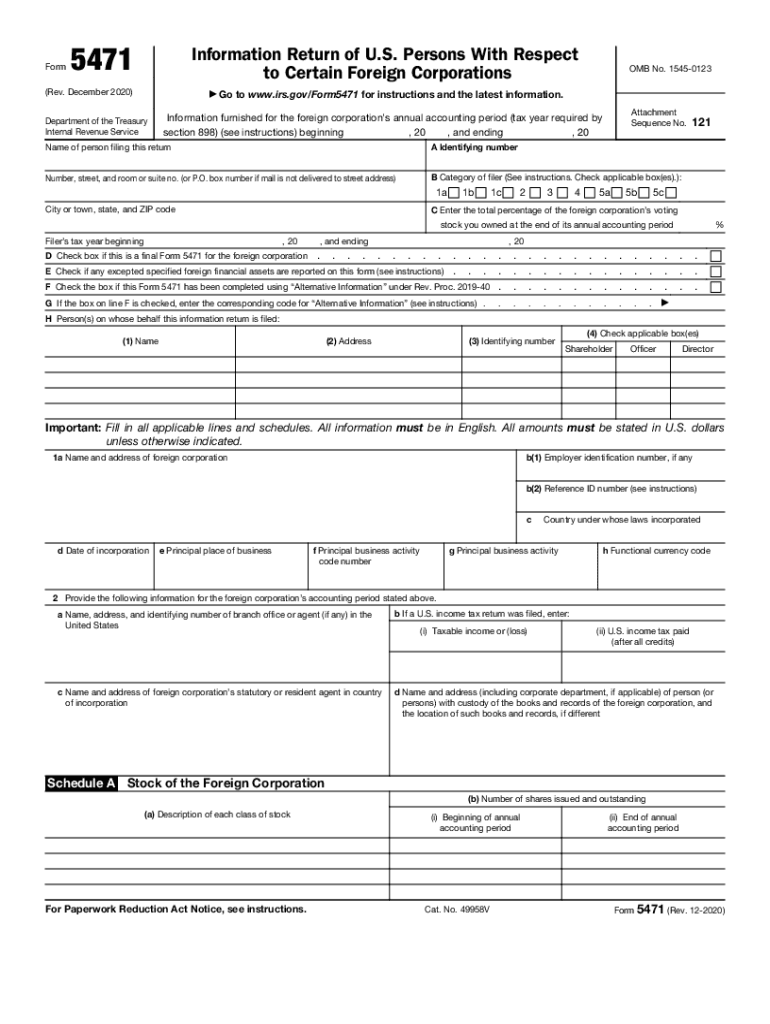

The Form 5471, officially titled the Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is a tax form required by the Internal Revenue Service (IRS) for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is essential for reporting information about foreign corporations in which U.S. persons have an ownership interest. The purpose of the form is to ensure compliance with U.S. tax laws and to prevent tax evasion through foreign entities.

How to Use the Form 5471

Using the Form 5471 involves several steps to ensure accurate reporting of your foreign corporation activities. First, determine if you are required to file based on your ownership interest in the foreign corporation. If required, gather necessary financial information about the corporation, including balance sheets and income statements. Complete the form by providing details about the corporation, its shareholders, and the nature of your ownership. Finally, submit the completed form to the IRS by the appropriate deadline to avoid penalties.

Steps to Complete the Form 5471

Completing the Form 5471 requires careful attention to detail. Follow these steps:

- Identify your filing category based on your relationship with the foreign corporation.

- Collect financial documents related to the foreign corporation, including income statements and balance sheets.

- Fill out the relevant sections of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail to the IRS, adhering to the filing deadlines.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form 5471 to avoid penalties. Generally, the form is due on the same date as your income tax return, including extensions. For most taxpayers, this means the form must be filed by April fifteenth, unless an extension has been granted. If you are a calendar-year taxpayer, ensure that you keep track of these dates each year to maintain compliance.

Penalties for Non-Compliance

Failure to file Form 5471 can result in significant penalties. The IRS imposes a penalty of $10,000 for each form not filed on time, with additional penalties for continued failure to file. If the form is not submitted within 90 days of receiving a notice from the IRS, further penalties may apply. Understanding these consequences is essential for U.S. persons involved with foreign corporations to avoid unnecessary financial burdens.

Digital vs. Paper Version

When filing Form 5471, taxpayers have the option to submit either a digital or paper version. The digital version, often filed through tax software, can streamline the process and reduce errors. Electronic filing also allows for faster processing times. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensure that the form is completed accurately and submitted by the deadline.

Eligibility Criteria

Eligibility to file Form 5471 is determined by specific criteria related to ownership in foreign corporations. U.S. persons who own at least ten percent of a foreign corporation's stock or who are officers or directors of such corporations are typically required to file. Additionally, certain categories of filers, such as controlled foreign corporations, have different requirements. It is important to assess your situation to determine if you need to file this form.

Quick guide on how to complete form 5471 rev december 2020 information return of us persons with respect to certain foreign corporations

Complete Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to generate, alter, and eSign your documents quickly without hurdles. Manage Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations across any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to alter and eSign Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations effortlessly

- Locate Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose how you prefer to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5471 rev december 2020 information return of us persons with respect to certain foreign corporations

Create this form in 5 minutes!

How to create an eSignature for the form 5471 rev december 2020 information return of us persons with respect to certain foreign corporations

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What are 5471 instructions and why are they important?

The 5471 instructions provide detailed guidance on how to complete and file Form 5471, which is essential for U.S. persons with interests in certain foreign corporations. Understanding these instructions is crucial to ensure compliance with IRS regulations and to avoid potential penalties.

-

How can airSlate SignNow assist with completing 5471 instructions?

airSlate SignNow offers a streamlined platform that simplifies the process of eSigning and sending documents, including tax forms like the 5471. With its user-friendly interface, you can easily manage your documents and stay organized while adhering to the 5471 instructions.

-

Are there any costs associated with using airSlate SignNow for 5471 instructions?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes access to essential features that help simplify document processing, including those related to the 5471 instructions, at a competitive price.

-

What features does airSlate SignNow provide for following 5471 instructions?

AirSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning. These features are designed to enhance your ability to efficiently follow the 5471 instructions while ensuring all documents are processed safely and in compliance.

-

Can I integrate airSlate SignNow with other tools while filing 5471 instructions?

Absolutely! airSlate SignNow offers integrations with numerous productivity and cloud storage tools, allowing you to streamline your workflow while managing documents related to 5471 instructions. This means you can easily access your files from various platforms and ensure all necessary documents are in one place.

-

How does airSlate SignNow ensure the security of documents related to 5471 instructions?

AirSlate SignNow prioritizes security by using advanced encryption and secure access protocols. This ensures that your documents, including those related to 5471 instructions, are protected against unauthorized access, providing peace of mind while you manage sensitive information.

-

What support options does airSlate SignNow offer for understanding 5471 instructions?

AirSlate SignNow provides extensive support resources, including tutorials and customer service representatives, to help users understand and apply the 5471 instructions effectively. This support ensures that you can resolve any issues quickly and confidently manage your document signing process.

Get more for Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations

- Phlebotomy is the practice of drawing blood from patients and taking the blood specimens to the laboratory to prepare form

- Ama university form

- Pdf medvantx pharmacy services po box 5736 sioux falls sd form

- Eye care servicesocli vision form

- Pdf william and mary boookstore college of william and form

- Community based supplier registration form city of cape town

- Electricity and energy business unit form

- Inventory form across australia removals

Find out other Form 5471 Rev December Information Return Of U S Persons With Respect To Certain Foreign Corporations

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist