Form 5471 2011

What is the Form 5471

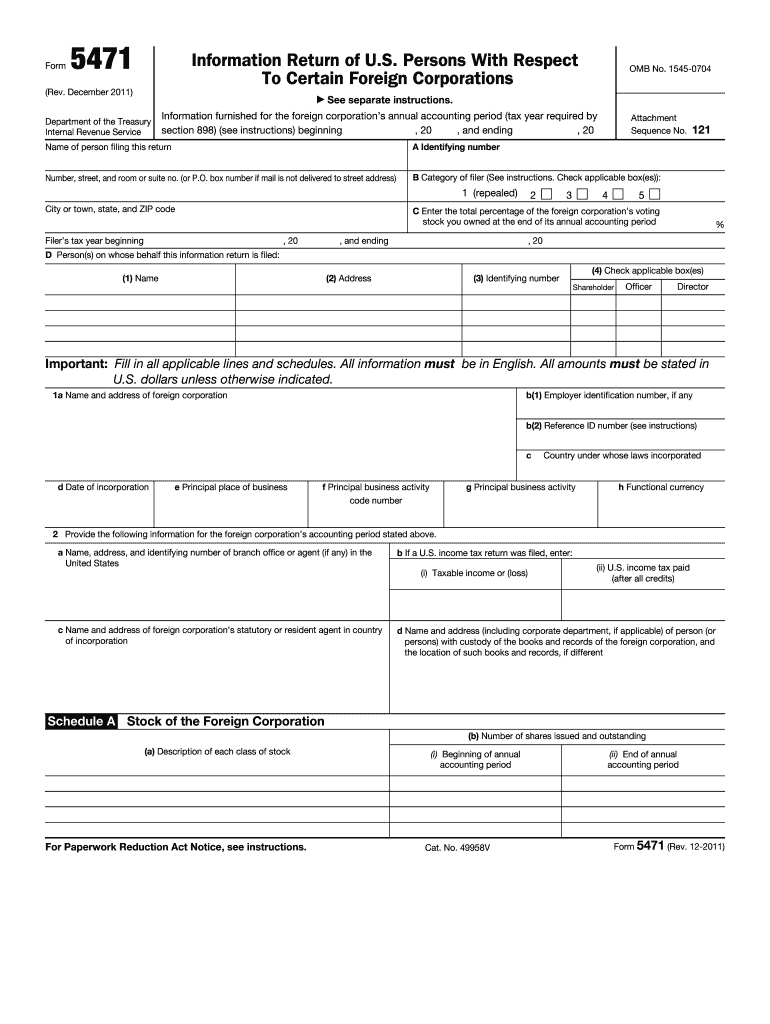

The Form 5471 is a U.S. tax form used by certain U.S. citizens and residents who are officers, directors, or shareholders in foreign corporations. This form is essential for reporting information about foreign corporations in which U.S. persons have an ownership interest. It helps the Internal Revenue Service (IRS) track foreign income and ensure compliance with U.S. tax laws. The form requires detailed information about the foreign corporation's financial activities, ownership structure, and transactions with related parties.

Steps to complete the Form 5471

Completing the Form 5471 involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to the foreign corporation, including balance sheets, income statements, and details of ownership. Next, identify which schedules apply based on your ownership percentage and the type of foreign corporation. Fill out the required sections accurately, providing detailed information about the corporation's activities, financials, and any transactions with U.S. shareholders. Finally, review the completed form for accuracy before submission.

Legal use of the Form 5471

The legal use of the Form 5471 is crucial for compliance with U.S. tax regulations. Filing this form is mandatory for U.S. persons who meet specific criteria regarding ownership in foreign corporations. Failure to file can result in significant penalties, including fines and increased scrutiny from the IRS. It is important to ensure that the form is filled out correctly and submitted on time to avoid legal repercussions. Understanding the legal obligations surrounding the form can help taxpayers maintain compliance and avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5471 are critical for compliance. Typically, the form must be filed on the same date as the taxpayer's income tax return, including extensions. For most individuals, this means the form is due on April 15, with an automatic extension available until October 15. However, if the taxpayer is a corporation, the deadlines may vary based on the corporation's fiscal year. It is essential to be aware of these deadlines to avoid penalties and ensure timely reporting to the IRS.

Required Documents

To complete the Form 5471, several documents are required. Taxpayers should have access to the foreign corporation's financial statements, including balance sheets and income statements. Additionally, documentation regarding ownership interests, such as stock certificates or agreements, is necessary. Records of any transactions between the U.S. shareholder and the foreign corporation also need to be compiled. Having these documents ready can streamline the completion process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Non-compliance with the Form 5471 filing requirements can lead to severe penalties. The IRS imposes fines for failing to file the form or for filing it incorrectly. Penalties can start at $10,000 per form and may increase for continued failure to comply. Additionally, the IRS may impose further penalties for inaccuracies or omissions in the information provided. Understanding these potential penalties emphasizes the importance of timely and accurate filing of the Form 5471.

Examples of using the Form 5471

There are various scenarios where the Form 5471 is applicable. For instance, a U.S. citizen who owns more than ten percent of a foreign corporation must file this form to report their ownership and the corporation's financial activities. Another example includes a U.S. resident who serves as a director of a foreign corporation, requiring them to disclose their involvement and any financial transactions. These examples illustrate the diverse situations that necessitate the use of the Form 5471 for compliance with U.S. tax laws.

Quick guide on how to complete 2011 form 5471

Effortlessly Prepare Form 5471 on Any Device

The management of online documents has become increasingly favored by both organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow supplies all the tools necessary to create, modify, and eSign your documents swiftly and without holdups. Manage Form 5471 across any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

The Easiest Method to Modify and eSign Form 5471 with Ease

- Find Form 5471 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 5471 while ensuring seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 5471

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 5471

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 5471 and why is it important?

Form 5471 is a crucial tax document that U.S. citizens must file when owning shares in a foreign corporation. It provides the IRS with necessary information regarding the foreign entity's financials and ownership structure. Failing to file Form 5471 can lead to signNow penalties, making it essential for compliant tax reporting.

-

How can airSlate SignNow help with Form 5471 filing?

AirSlate SignNow simplifies the document signing process for Form 5471 by allowing users to create, send, and eSign the form digitally. This eliminates the need for physical signatures and speeds up the filing process, ensuring that you meet deadlines with ease. Additionally, our platform offers secure storage for your completed forms.

-

Is there a cost associated with using airSlate SignNow for Form 5471?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that help manage and eSign documents, including Form 5471. You can choose a plan that best fits your budget while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for handling Form 5471?

AirSlate SignNow includes features such as template creation, bulk sending of documents, and built-in reminders to help you manage deadlines related to Form 5471. Our intuitive user interface makes it easy for users to navigate through the process and complete their forms accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for Form 5471 management?

Yes, airSlate SignNow offers several integrations with popular accounting and tax software, making it easier to manage your Form 5471. By integrating with your existing tools, you can streamline your workflow, ensuring that information flows seamlessly between platforms, saving you time and reducing errors.

-

How secure is the data when using airSlate SignNow for Form 5471?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and industry-standard security measures to protect your data when handling sensitive documents like Form 5471. You can trust airSlate SignNow to ensure the confidentiality and integrity of your information.

-

What are the benefits of using airSlate SignNow for Form 5471?

Using airSlate SignNow for Form 5471 offers several benefits, including increased efficiency in document signing and filing, enhanced security, and improved compliance with IRS requirements. Our easy-to-use platform allows you to focus on your business while ensuring that your tax documents are processed effectively and accurately.

Get more for Form 5471

- Demand for payment hawaii form

- Quitclaim deed from individual to llc hawaii form

- Warranty deed from individual to llc hawaii form

- Notice hearing template form

- Hawaii quitclaim deed 497304362 form

- Warranty deed from husband and wife to corporation hawaii form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form hawaii

- Hawaii notice 497304366 form

Find out other Form 5471

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer