Sub Maine Gov 2020-2026

What is the Maine GTR?

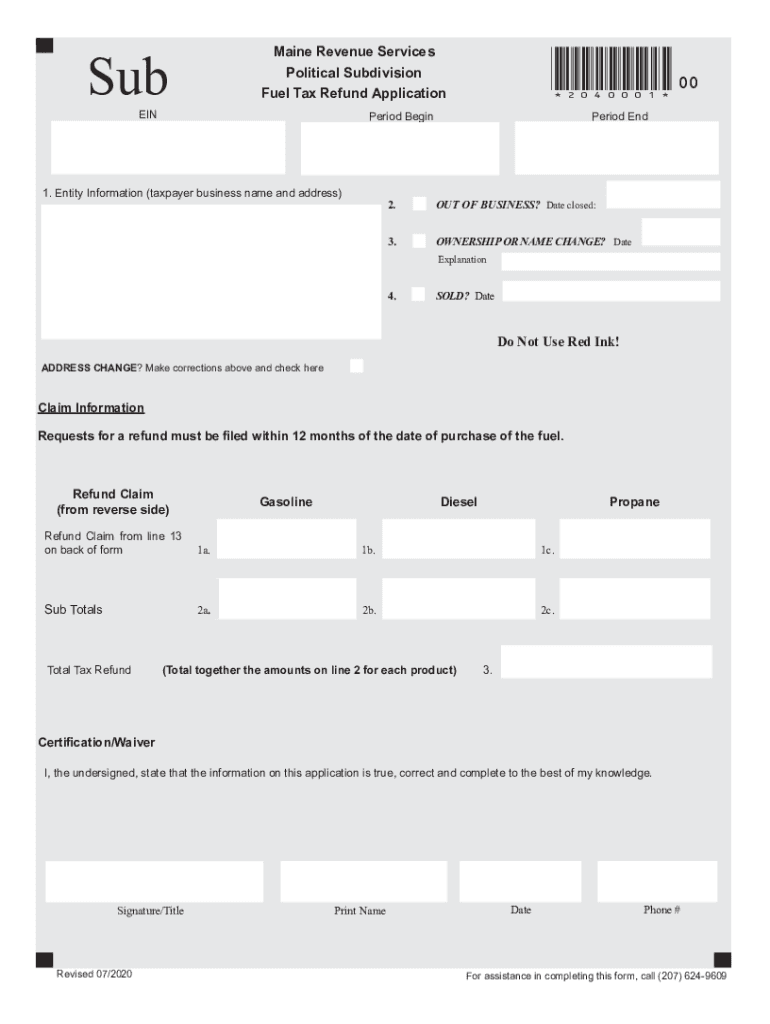

The Maine GTR, or Maine General Tax Refund, is a specific form used by individuals and businesses in the state of Maine to request a refund for overpaid taxes. This form is essential for those who have paid more tax than they owe, allowing them to reclaim the excess amount. The Maine GTR is particularly relevant for individuals who have filed their income tax returns and are eligible for a refund due to various reasons, such as withholding errors or tax credits.

Steps to Complete the Maine GTR

Filling out the Maine GTR involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your previous tax returns and any relevant financial records. Follow these steps:

- Access the Maine GTR form from the official state website or authorized platforms.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the tax year for which you are claiming the refund.

- Provide information regarding the overpayment, including amounts and reasons for the refund request.

- Review the completed form for accuracy before submission.

Legal Use of the Maine GTR

The Maine GTR is legally recognized as a valid request for a tax refund when completed correctly. To ensure its legal standing, it must comply with state regulations governing tax refunds. This includes providing accurate information and adhering to submission deadlines. Utilizing a reliable eSignature tool can enhance the legal validity of your submission by ensuring that all signatures are authenticated and securely stored.

Required Documents for the Maine GTR

To successfully file the Maine GTR, you must include certain documents that support your refund claim. These typically include:

- Your completed Maine GTR form.

- Copies of your tax returns for the relevant year.

- Documentation of any tax payments made, such as W-2 forms or 1099s.

- Any supporting documents for tax credits or deductions claimed.

Form Submission Methods for the Maine GTR

The Maine GTR can be submitted through various methods, ensuring convenience for taxpayers. You can choose to file online through the Maine Revenue Services website, which allows for quick processing. Alternatively, you may opt to mail the completed form to the designated address provided on the form or submit it in person at local tax offices. Each method has its own processing times, so consider your needs when choosing how to submit.

Filing Deadlines for the Maine GTR

Timely submission of the Maine GTR is crucial to ensure you receive your refund without delays. The deadline for filing the GTR typically aligns with the annual tax filing deadline, which is usually April fifteenth. If you miss this deadline, you may forfeit your right to claim a refund for that tax year. It is advisable to keep track of any changes to tax laws or deadlines announced by the Maine Revenue Services.

Quick guide on how to complete sub mainegov

Prepare Sub Maine gov effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, as users can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly and without setbacks. Manage Sub Maine gov across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to alter and eSign Sub Maine gov with ease

- Find Sub Maine gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

No need to stress over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Sub Maine gov and ensure excellent communication at any phase of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sub mainegov

Create this form in 5 minutes!

How to create an eSignature for the sub mainegov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine GTR feature in airSlate SignNow?

The Maine GTR feature in airSlate SignNow allows users to easily manage and track their documents with enhanced security and compliance measures. This feature is particularly valuable for businesses operating in or connected to the state of Maine, ensuring that all electronic signatures meet local legal requirements. By using the Maine GTR, companies can streamline their document workflows without compromising on security.

-

How much does airSlate SignNow cost for Maine GTR users?

Pricing for airSlate SignNow is competitive and varies based on the plan you choose, including specific benefits for Maine GTR users. Our plans offer flexible pricing options to suit different business sizes and needs. Whether you’re a small business or a large corporation, you’ll find a cost-effective solution tailored to your requirements.

-

What benefits does Maine GTR offer for document signing?

Maine GTR enhances document signing by providing an intuitive platform that ensures a seamless user experience. It speeds up the signing process while maintaining compliance with Maine laws. This functionality can signNowly enhance efficiency and improve turnaround times for your business transactions.

-

Are there integrations available with Maine GTR in airSlate SignNow?

Yes, airSlate SignNow offers various integrations that support Maine GTR users. You can easily connect our platform with popular tools such as Google Drive, Salesforce, and more to streamline your document management processes. This integration capability allows you to maintain your existing workflows while enhancing them with seamless e-signature solutions.

-

Is airSlate SignNow compliant with Maine e-signature laws?

Absolutely, airSlate SignNow is fully compliant with Maine e-signature laws, ensuring that all signatures are legally binding and secure. Our Maine GTR feature specifically adheres to local regulations, protecting your business from legal challenges. This compliance gives you peace of mind when handling important documentation.

-

Can I try airSlate SignNow's Maine GTR feature before committing?

Yes, we offer a free trial for prospective users to explore airSlate SignNow, including its Maine GTR features. This trial allows you to experience the ease of use and efficiency of our e-signature solution without any commitment. Take advantage of this opportunity to see how it can benefit your business.

-

What types of businesses benefit from using Maine GTR with airSlate SignNow?

A variety of businesses can benefit from using Maine GTR, especially those that require secure and legally compliant document signing. Whether you're in real estate, finance, healthcare, or any other industry, Maine GTR can enhance your workflow. The solution is tailored for small, medium, and large enterprises, ensuring all organizations can utilize its powerful functionality.

Get more for Sub Maine gov

Find out other Sub Maine gov

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form