PDF Maine Revenue Services Special Fuel and Gasoline Tax Refund 2019

Understanding the Playstation Refund Form

The Playstation refund form is a crucial document for gamers seeking to return digital purchases or request refunds for physical products. This form outlines the necessary information that must be provided to initiate the refund process. It typically includes details such as the purchase date, transaction ID, and the reason for the refund request. Understanding the specific requirements of this form can help ensure a smoother refund process.

Steps to Complete the Playstation Refund Form

Completing the Playstation refund form involves several key steps. First, gather all relevant purchase information, including your account details and transaction history. Next, accurately fill out the form with the required information. Be sure to include any supporting documentation, such as receipts or confirmation emails. Once completed, review the form for accuracy before submitting it through the appropriate channels, either online or via mail.

Eligibility Criteria for Refunds

To qualify for a refund using the Playstation refund form, certain eligibility criteria must be met. Generally, refunds are available for purchases made within a specific time frame, often within fourteen days of purchase. Additionally, the product must be in a condition that allows for a return, such as unopened physical items or unused digital content. Familiarizing yourself with these criteria can help determine if your refund request is likely to be approved.

Required Documents for Submission

When submitting the Playstation refund form, it is essential to include all required documents to support your request. This may include a copy of your purchase receipt, transaction ID, and any correspondence related to the purchase. Providing comprehensive documentation can enhance the chances of a successful refund outcome and expedite the processing time.

Form Submission Methods

The Playstation refund form can typically be submitted through various methods, depending on your preference and the specific instructions provided by Playstation. Common submission methods include online submission via the official Playstation website, mailing a physical copy of the form, or in-person submission at designated service centers. Each method may have different processing times, so it is advisable to choose the one that best fits your needs.

Key Elements of the Refund Process

Understanding the key elements of the refund process can help set expectations for users. This includes knowing the typical processing time for refunds, which can vary based on the method of submission and the specific circumstances of the request. Additionally, being aware of any potential fees or deductions that may apply to the refund amount can provide clarity. Keeping track of your refund status through the Playstation account can also be beneficial.

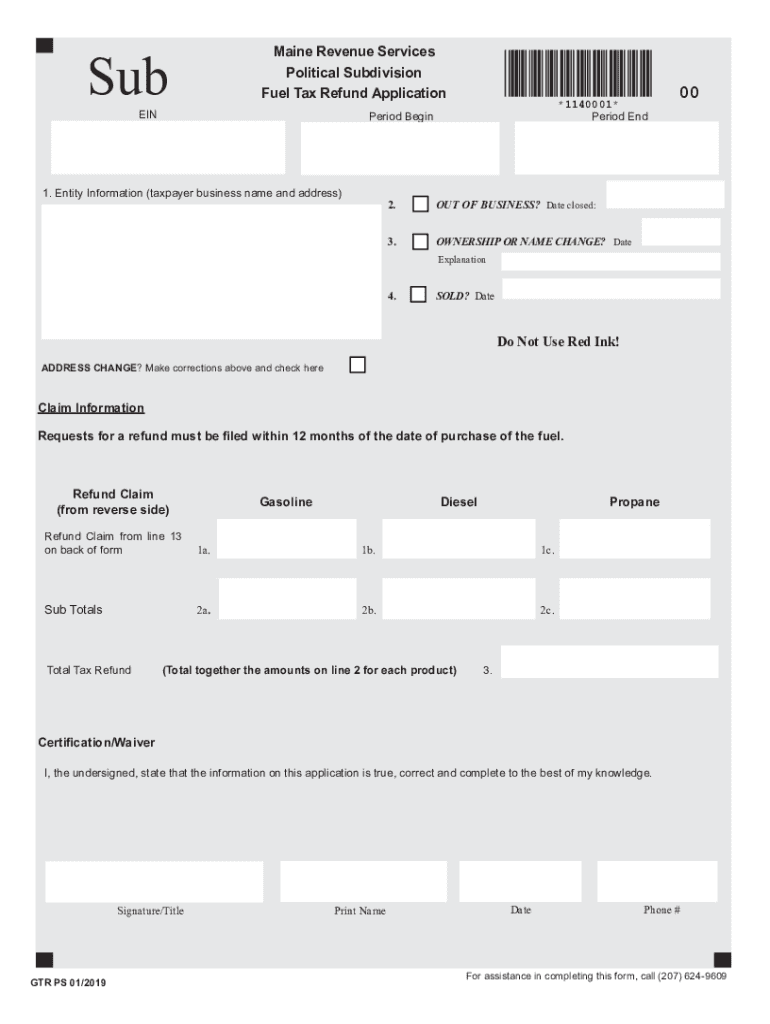

Quick guide on how to complete pdf maine revenue services special fuel and gasoline tax refund

Accomplish PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly and without delays. Manage PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund with ease

- Locate PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your amendments.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and electronically sign PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf maine revenue services special fuel and gasoline tax refund

Create this form in 5 minutes!

How to create an eSignature for the pdf maine revenue services special fuel and gasoline tax refund

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is the purpose of the Playstation refund form?

The Playstation refund form is designed to help users request a refund for their digital purchases on the PlayStation Store. Completing this form allows you to streamline the refund process, ensuring that all necessary information is included for a swift resolution.

-

How can I access the Playstation refund form?

You can easily access the Playstation refund form through the official PlayStation support website. Look for the 'Refunds' section, where you will find the required form to fill out for your refund request.

-

What information do I need to complete the Playstation refund form?

To complete the Playstation refund form, you will typically need your account details, proof of purchase, and a brief explanation of why you're requesting a refund. This information will help expedite the evaluation of your request.

-

Is there a cost associated with submitting the Playstation refund form?

No, there is no cost to submit the Playstation refund form. The process is entirely free, allowing you to request a refund without incurring any additional charges.

-

How long does it take to process a Playstation refund form?

The time it takes to process a Playstation refund form can vary, but often you can expect a response within a few days. Factors such as your payment method and the volume of requests may influence the processing time.

-

Can I use the Playstation refund form for subscriptions?

Yes, the Playstation refund form can also be used for subscription-based services. If you are not satisfied with a subscription, filling out this form allows you to request a refund, subject to the service's policy.

-

What are the benefits of using the Playstation refund form?

Using the Playstation refund form simplifies the refund request process, ensuring that you provide all necessary information upfront. This can lead to faster resolutions and a more user-friendly experience when dealing with issues.

Get more for PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund

Find out other PDF Maine Revenue Services Special Fuel And Gasoline Tax Refund

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe