Maine Form Gtr Ps 2017

What is the Maine Form Gtr Ps

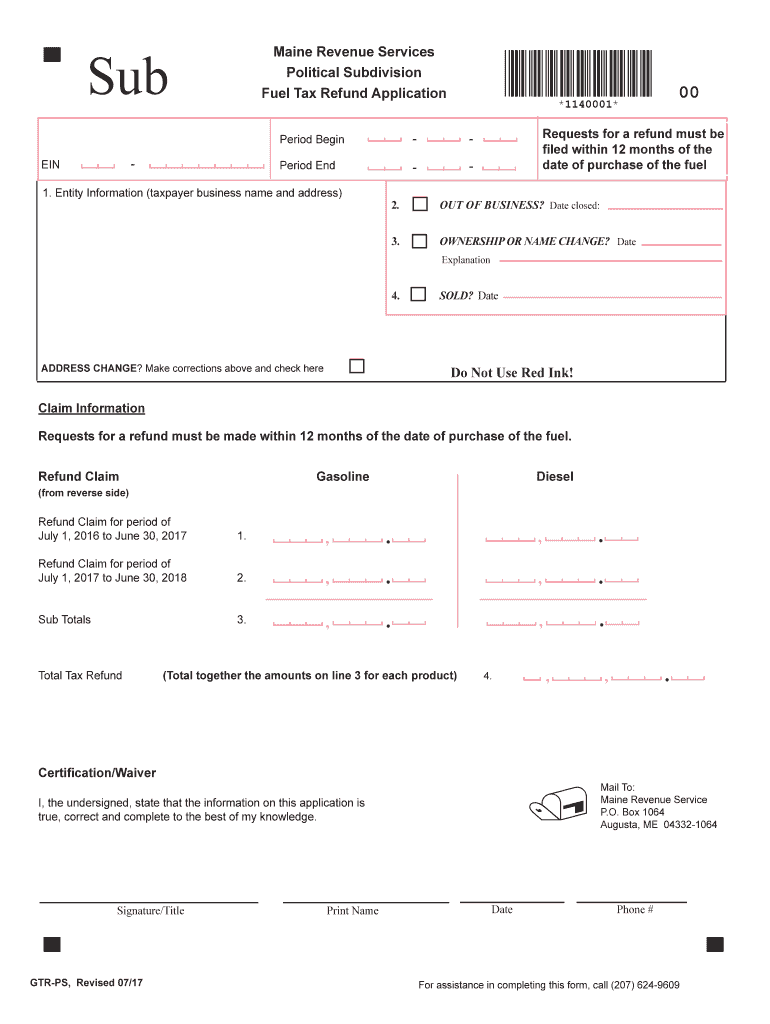

The Maine Form Gtr Ps is a tax document specifically designed for residents of Maine to apply for a refund of sales tax paid on certain purchases. This form is essential for individuals who qualify for tax refunds under specific circumstances outlined by the state. The form allows taxpayers to claim refunds for taxes paid on items such as fuel, utilities, and other eligible goods and services. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax regulations.

How to use the Maine Form Gtr Ps

Using the Maine Form Gtr Ps involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including receipts and proof of purchase, to support your refund claim. Next, fill out the form with accurate personal information and details regarding the purchases for which you are seeking a refund. Ensure that you follow the instructions carefully, as any errors may delay processing. Once completed, you can submit the form either online or by mail, depending on your preference and the guidelines provided by the Maine Revenue Services.

Steps to complete the Maine Form Gtr Ps

Completing the Maine Form Gtr Ps requires attention to detail. Here are the steps to follow:

- Gather all relevant receipts and documentation that prove the sales tax paid on eligible purchases.

- Download the Maine Form Gtr Ps from the official state website or access it through authorized platforms.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details of the purchases, including dates, amounts, and descriptions of the items.

- Calculate the total refund amount based on the sales tax paid.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for a refund using the Maine Form Gtr Ps, taxpayers must meet specific eligibility criteria set by the state. Generally, applicants must be residents of Maine and have paid sales tax on eligible purchases. Additionally, the items for which the refund is claimed must fall under categories defined by the Maine Revenue Services. It is essential to review the detailed guidelines to ensure that your purchases qualify for a refund before submitting the form.

Required Documents

When filing the Maine Form Gtr Ps, certain documents are required to substantiate your claim. These typically include:

- Receipts showing proof of sales tax paid on eligible purchases.

- A copy of your identification, such as a driver's license or state ID.

- Any additional documentation as specified by the Maine Revenue Services related to your refund claim.

Form Submission Methods

The Maine Form Gtr Ps can be submitted through various methods, providing flexibility for taxpayers. You can choose to file the form online via the Maine Revenue Services website, which often expedites processing times. Alternatively, you can print the completed form and mail it to the designated address provided in the instructions. In-person submissions may also be possible at local tax offices, depending on state guidelines.

Quick guide on how to complete political subdivision form gtr ps 2013 2017 2019

Your assistance manual on how to prepare your Maine Form Gtr Ps

If you’re interested in learning how to create and transmit your Maine Form Gtr Ps, here are a few straightforward instructions on how to simplify tax declaration.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally easy-to-use and robust document solution that enables you to edit, create, and finalize your tax documents effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures, and return to modify responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Maine Form Gtr Ps in just a few minutes:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to locate any IRS tax form; browse through variants and schedules.

- Click Obtain form to open your Maine Form Gtr Ps in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to increased return errors and delayed refunds. Obviously, before electronically filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct political subdivision form gtr ps 2013 2017 2019

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the political subdivision form gtr ps 2013 2017 2019

How to create an electronic signature for the Political Subdivision Form Gtr Ps 2013 2017 2019 online

How to make an eSignature for the Political Subdivision Form Gtr Ps 2013 2017 2019 in Chrome

How to make an electronic signature for signing the Political Subdivision Form Gtr Ps 2013 2017 2019 in Gmail

How to create an eSignature for the Political Subdivision Form Gtr Ps 2013 2017 2019 from your smart phone

How to create an electronic signature for the Political Subdivision Form Gtr Ps 2013 2017 2019 on iOS devices

How to generate an eSignature for the Political Subdivision Form Gtr Ps 2013 2017 2019 on Android

People also ask

-

What is the maine revenue ps refund process?

The maine revenue ps refund process involves submitting a request for a refund on overpaid taxes or fees to the Maine Revenue Services. Through our platform, you can effortlessly eSign and send the necessary documentation for your maine revenue ps refund, ensuring that you stay compliant and organized.

-

How can airSlate SignNow help with maine revenue ps refund documentation?

airSlate SignNow simplifies the creation and management of documents required for your maine revenue ps refund. Our electronic signature features allow you to quickly sign and send all necessary forms, reducing processing time and improving efficiency.

-

Is there a subscription fee for using airSlate SignNow for maine revenue ps refund?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs. Each plan is designed to provide maximum value while ensuring you can manage your maine revenue ps refund documentation without breaking the bank.

-

What features does airSlate SignNow offer for maine revenue ps refunds?

airSlate SignNow provides a range of features that support the maine revenue ps refund process, including customizable templates, automated reminders, and secure storage of signed documents. These features enhance productivity and ensure your documents are always compliant.

-

Can I integrate airSlate SignNow with other tools for maine revenue ps refund submission?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easy to manage all aspects of your maine revenue ps refund workflow. Whether it's CRM systems or cloud storage, integrations enhance your operational efficiency.

-

What benefits does airSlate SignNow provide for businesses processing maine revenue ps refunds?

Using airSlate SignNow for maine revenue ps refunds streamlines your documentation process, reduces errors, and saves valuable time. The electronic signature feature allows for quick approvals, meaning you can focus more on your business rather than paperwork.

-

Is the eSignature process legally binding for maine revenue ps refunds?

Yes, the eSignature process through airSlate SignNow is legally binding and compliant with e-signature laws. This ensures that all documents related to your maine revenue ps refund are valid and enforceable.

Get more for Maine Form Gtr Ps

- Application for tenancy tryourrentals com form

- Shamrock foundation cats form

- Janata personal accident proposal form

- Fripp island arb form

- Afps form 9 commutation options afps15 afps05

- Discretionary housing payment application form

- Event safety plan template form

- Bus pass application form for people aged 60 or over

Find out other Maine Form Gtr Ps

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe