About Form W 4V, Voluntary Withholding Request IRS 2023-2026

Understanding the W-4 Form

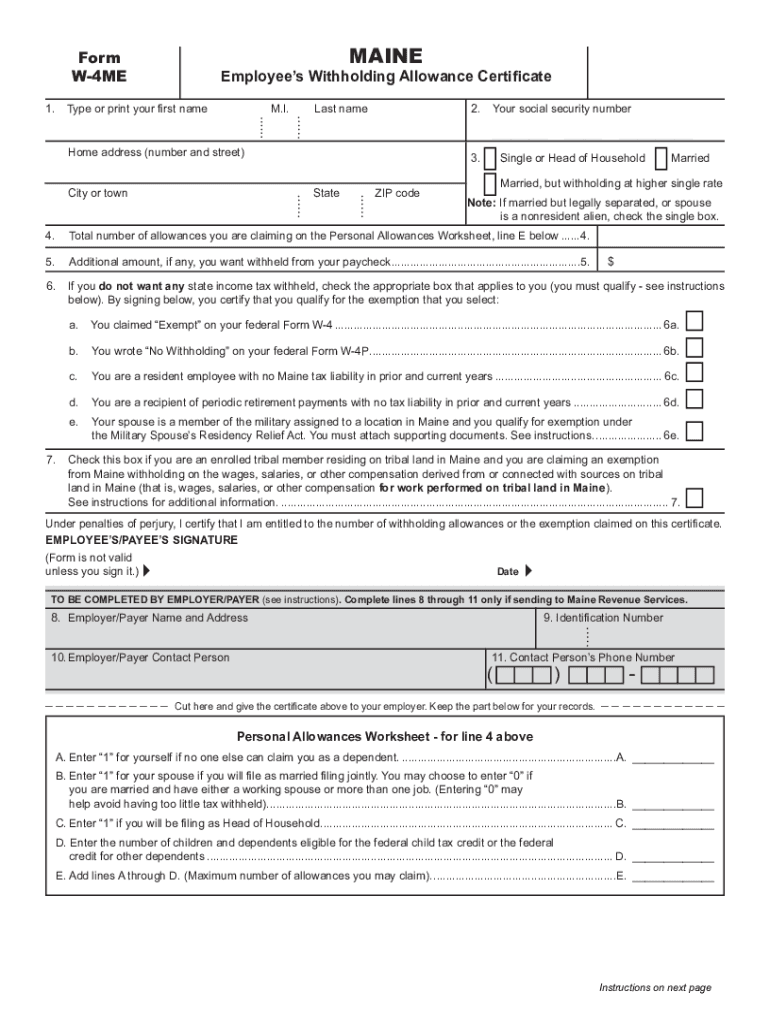

The W-4 form, officially known as the Employee's Withholding Certificate, is a critical document for employees in the United States. It is used to inform employers about the amount of federal income tax to withhold from an employee's paycheck. By accurately completing this form, employees can ensure that the correct amount of taxes is deducted, helping to avoid owing money at tax time or receiving an excessive refund.

Steps to Complete the W-4 Form

Completing the W-4 form involves several straightforward steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: Indicate if you have more than one job or if your spouse works, which may affect your withholding.

- Claim Dependents: If applicable, enter the number of dependents you are claiming for tax purposes.

- Other Adjustments: Specify any additional income or deductions that might impact your tax situation.

- Sign and Date: Finally, sign and date the form to validate it.

Legal Use of the W-4 Form

The W-4 form is legally binding and must be completed accurately to ensure compliance with IRS regulations. Employers are required to keep this form on file for each employee. The information provided on the W-4 determines the amount of federal income tax withheld from your paychecks, which is essential for meeting tax obligations. Failure to submit a W-4 or providing incorrect information can lead to penalties or under-withholding, resulting in tax liabilities.

IRS Guidelines for the W-4 Form

The IRS provides specific guidelines for completing the W-4 form. It is advisable to review the latest version of the form and accompanying instructions, especially after significant life changes such as marriage, divorce, or the birth of a child. The IRS updates the W-4 periodically to reflect changes in tax law, so staying informed is crucial for accurate withholding.

Filing Deadlines and Important Dates

While the W-4 form does not have a specific filing deadline, it should be submitted to your employer as soon as you start a new job or experience a change in your tax situation. It is important to keep your W-4 current to ensure that your tax withholding aligns with your financial circumstances throughout the year.

Form Submission Methods

The W-4 form can be submitted to your employer in various ways. Most commonly, it is provided in person or via email. Some employers may also accept a scanned copy of the signed form. It is essential to follow your employer's specific submission guidelines to ensure timely processing.

Quick guide on how to complete about form w 4v voluntary withholding request irs

Effortlessly Prepare About Form W 4V, Voluntary Withholding Request IRS on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and eSign your documents without any delays. Manage About Form W 4V, Voluntary Withholding Request IRS on any device using the airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to Alter and eSign About Form W 4V, Voluntary Withholding Request IRS with Ease

- Find About Form W 4V, Voluntary Withholding Request IRS and click on Get Form to commence.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign About Form W 4V, Voluntary Withholding Request IRS and ensure excellent communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form w 4v voluntary withholding request irs

Create this form in 5 minutes!

How to create an eSignature for the about form w 4v voluntary withholding request irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4 form and why is it important?

The W4 form is a tax form that employees use to indicate their tax situation to their employer. By completing the W4 form accurately, employees ensure the correct amount of federal income tax is withheld from their paychecks, which helps avoid owing taxes at year-end.

-

How can airSlate SignNow help with signing and managing W4 forms?

With airSlate SignNow, you can easily upload, send, and eSign W4 forms securely online. Our platform simplifies the management of these documents, ensuring that all necessary signatures are collected promptly and efficiently.

-

What features does airSlate SignNow offer for W4 form management?

airSlate SignNow provides features like customizable templates, real-time tracking, and audit trails for W4 forms. These tools guarantee a streamlined signing process and maintain compliance with legal requirements.

-

Is there a free trial available for using airSlate SignNow for W4 forms?

Yes, airSlate SignNow offers a free trial so you can explore our features for managing W4 forms. Test our intuitive platform to see how it can enhance your document signing process without any initial commitment.

-

What are the pricing plans for using airSlate SignNow to process W4 forms?

airSlate SignNow offers various pricing plans tailored to fit different business needs, starting from an economical basic plan. Each plan provides access to essential features necessary for handling W4 forms effectively.

-

Can I integrate airSlate SignNow with other applications for W4 form processing?

Absolutely! airSlate SignNow integrates seamlessly with popular applications, allowing you to manage W4 forms within your existing workflows. This connectivity enhances productivity and ensures a smooth document handling experience.

-

How secure is airSlate SignNow when handling sensitive documents like W4 forms?

AirSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your W4 forms are protected throughout the signing process, ensuring that sensitive information remains confidential.

Get more for About Form W 4V, Voluntary Withholding Request IRS

Find out other About Form W 4V, Voluntary Withholding Request IRS

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile