Maine W4 Form 2013

What is the Maine W4 Form

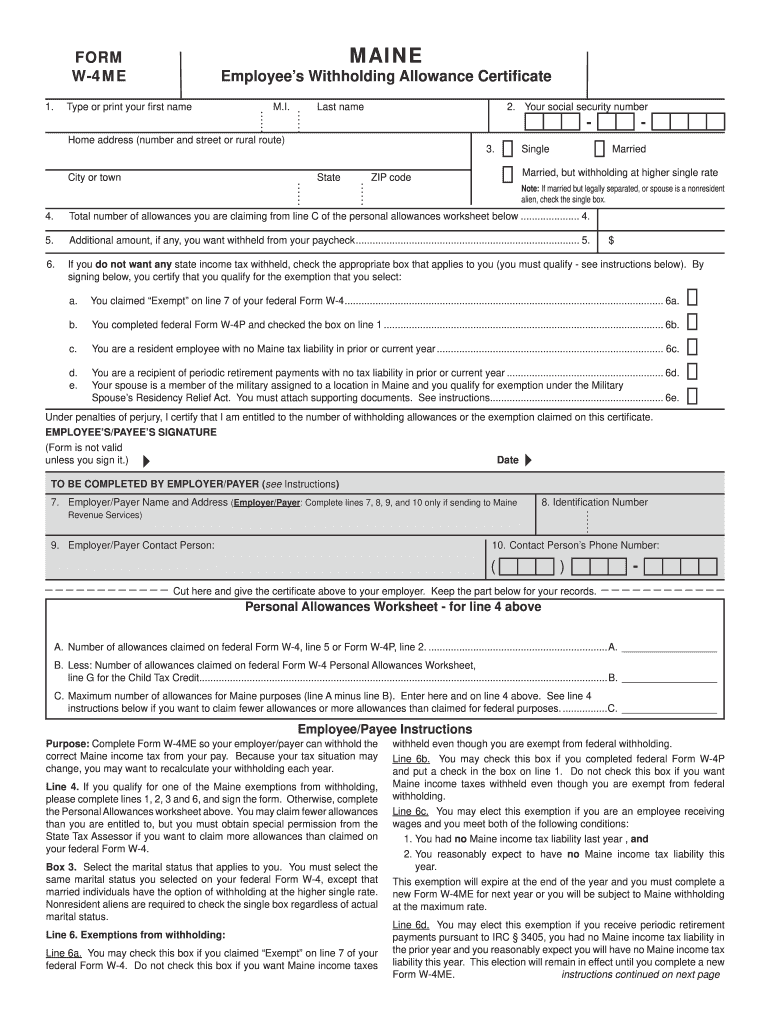

The Maine W4 Form is a state-specific tax form used by employees to indicate their withholding allowances for state income tax purposes. This form is essential for employers to accurately withhold the correct amount of state tax from an employee's paycheck. By providing information such as marital status and the number of dependents, employees can ensure that their tax withholding aligns with their financial situation. Understanding the Maine W4 Form is crucial for both employees and employers to comply with state tax regulations.

How to use the Maine W4 Form

To use the Maine W4 Form, employees need to complete it with accurate personal information, including their name, address, and Social Security number. It is important to review the instructions carefully to determine the appropriate number of allowances to claim. Employees may also choose to have additional amounts withheld if they anticipate owing more taxes. Once completed, the form should be submitted to the employer, who will then use it to adjust the tax withholding on future paychecks.

Steps to complete the Maine W4 Form

Completing the Maine W4 Form involves several straightforward steps:

- Obtain the latest version of the Maine W4 Form from the appropriate source.

- Fill in personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Calculate the number of allowances you are eligible to claim based on your situation.

- Decide if you want to withhold additional amounts beyond the standard calculation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer.

Key elements of the Maine W4 Form

The Maine W4 Form includes several key elements that are vital for accurate tax withholding. These elements consist of:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects the amount withheld.

- Additional Withholding: Option to specify an additional amount to be withheld.

Legal use of the Maine W4 Form

The Maine W4 Form is legally recognized as a valid document for determining state tax withholding. Employers are required to use this form to ensure compliance with state tax laws. It is important for employees to provide accurate information to avoid under-withholding, which could lead to tax liabilities. The form must be signed by the employee, affirming that the details are true and correct, which adds a layer of legal accountability.

Form Submission Methods

Employees can submit the Maine W4 Form to their employers through various methods. The most common methods include:

- In-Person: Handing the completed form directly to the employer or payroll department.

- Mail: Sending the form via postal service to the employer's address.

- Email: Some employers may accept scanned copies of the signed form sent via email.

Quick guide on how to complete maine w4 2013 form

Your assistance manual on how to prepare your Maine W4 Form

If you're eager to learn how to develop and present your Maine W4 Form, here are a few straightforward guidelines to facilitate tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, create, and finalize your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and revisit to adjust answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing options.

Follow the instructions below to complete your Maine W4 Form in just a few minutes:

- Create your account and start managing PDFs in no time.

- Utilize our directory to locate any IRS tax form; navigate through various versions and schedules.

- Press Get form to access your Maine W4 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-binding electronic signature (if necessary).

- Examine your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide for electronically filing your taxes with airSlate SignNow. Please be aware that submitting on paper may lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct maine w4 2013 form

FAQs

-

What is the best way to fill out a W4 form?

Before understanding the best way, we need to understand what is W4 form?To answer this:A W-4 form advises your employer how much tax to withhold from every paycheck. Your employer transmits the tax to the IRS for your sake. Toward the year's end, your employer will send you a W-2 showing (in addition to other things) how much it withheld for you that year.How to fill Form W4:You'll most likely round out a W-4 when you begin an occupation, however you can change your W-4 whenever. Simply download it from the IRS website, round it out and offer it to your HR or finance group.The simple part is providing your name, address, conjugal status and other fundamental individual information. The crucial step is choosing the quantity of allowances to guarantee.Try not to freeze on the off chance that you don't have the foggiest idea how to round out a W-4. The W-4 form accompanies an allowances worksheet that will enable you to make sense of what number to guarantee.The more allowances you guarantee, the less tax will be withheld from your paycheck.What’s the best way to fill out Form W-4?Here’s the general strategy:If you got a huge tax bill in April and don’t want another, you can use Form W-4 to increase your withholding. That’ll help you owe less (or nothing) next April.If you got a huge refund last year, you’re giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.The more allowances you claim, the less tax will be taken out of your paycheck.To know more about W4 form, join this W4 webinar and learn how fill this form.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Do employees need to fill out a w4 every year?

No. Once you initially complete your W-4 form and give it to H.R. , that's it. The only time you want to have it amended or changed is if too much or not enough of your paycheck is being withheld for Federal Income taxes. Thanks for the question.

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

Create this form in 5 minutes!

How to create an eSignature for the maine w4 2013 form

How to make an eSignature for your Maine W4 2013 Form in the online mode

How to create an electronic signature for the Maine W4 2013 Form in Chrome

How to generate an electronic signature for putting it on the Maine W4 2013 Form in Gmail

How to make an electronic signature for the Maine W4 2013 Form right from your smart phone

How to generate an electronic signature for the Maine W4 2013 Form on iOS devices

How to create an electronic signature for the Maine W4 2013 Form on Android

People also ask

-

What is the Maine W4 Form and why is it important?

The Maine W4 Form is a state-specific document that employees in Maine use to report their tax withholding preferences. It's essential for ensuring that the correct amount of state income tax is withheld from your paycheck. By completing the Maine W4 Form accurately, you can avoid underpayment or overpayment of taxes, thus managing your finances effectively.

-

How do I fill out the Maine W4 Form using airSlate SignNow?

Filling out the Maine W4 Form with airSlate SignNow is a straightforward process. Simply upload the form to our platform, fill in your information, and use our easy eSigning feature to sign it electronically. This ensures that your Maine W4 Form is completed quickly and securely, making tax season much simpler.

-

Are there any costs associated with using airSlate SignNow for the Maine W4 Form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans that provide additional features for managing documents like the Maine W4 Form. Our pricing is competitive and designed to be cost-effective for businesses of all sizes. You can choose a plan that best fits your needs, whether you're a solo entrepreneur or part of a larger organization.

-

What features does airSlate SignNow offer for managing the Maine W4 Form?

airSlate SignNow provides several features tailored for managing the Maine W4 Form, including document templates, eSigning capabilities, and secure cloud storage. You can customize your Maine W4 Form, track its status, and ensure compliance with state regulations, all from one easy-to-use platform.

-

Can I integrate airSlate SignNow with other software for handling the Maine W4 Form?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easy to manage the Maine W4 Form alongside your existing software solutions. This seamless integration enhances your workflow, allowing for efficient document management and eSigning without hassle.

-

How secure is my data when using airSlate SignNow for the Maine W4 Form?

Security is a top priority at airSlate SignNow. When you use our platform to handle the Maine W4 Form, your data is protected with advanced encryption and secure storage protocols. This ensures that your sensitive information remains confidential and secure during the eSigning process.

-

What are the benefits of using airSlate SignNow for the Maine W4 Form compared to traditional methods?

Using airSlate SignNow for the Maine W4 Form offers numerous benefits over traditional paper methods, such as increased efficiency, reduced time spent on paperwork, and enhanced security. With our digital solution, you can quickly complete, sign, and send your Maine W4 Form from anywhere, streamlining the entire process and saving valuable resources.

Get more for Maine W4 Form

Find out other Maine W4 Form

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template