Me W4 Form 2020

What is the W-4 Form?

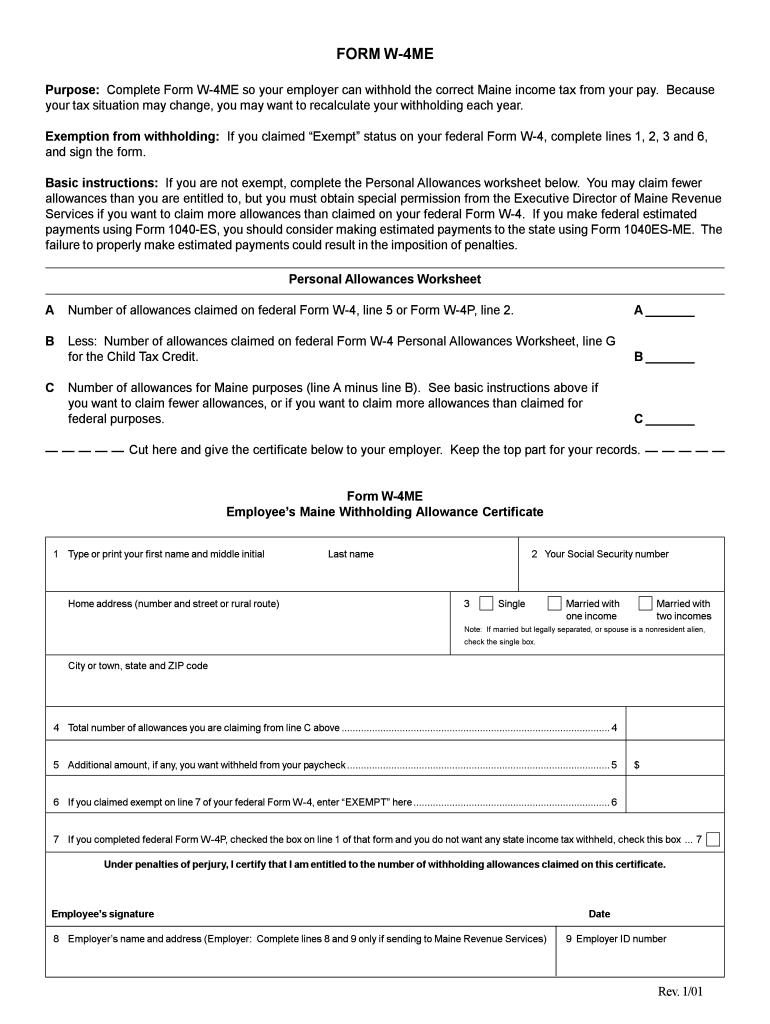

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing the W-4 form, individuals can ensure that they are not overpaying or underpaying their taxes throughout the year. The W-4 form is particularly important for new employees, those who have experienced life changes, or anyone who wants to adjust their withholding for tax purposes.

Steps to Complete the W-4 Form

Completing the W-4 form involves several straightforward steps. First, provide your personal information, including your name, address, Social Security number, and filing status. Next, you will need to indicate the number of allowances you are claiming. This number can affect your tax withholding; generally, the more allowances you claim, the less tax will be withheld. After that, if you have additional income or deductions, you can specify those in the relevant sections. Finally, sign and date the form before submitting it to your employer. It's essential to review your completed form for accuracy to avoid any issues with your tax withholding.

How to Obtain the W-4 Form

The W-4 form can be easily obtained from a variety of sources. The most straightforward way is to download it directly from the Internal Revenue Service (IRS) website in PDF format. Additionally, many employers provide the W-4 form as part of their onboarding process for new hires. If you need a physical copy, you can also request one from your employer's human resources department. Having the most current version of the W-4 form is important, as tax laws and withholding requirements can change from year to year.

Legal Use of the W-4 Form

The W-4 form is legally binding and must be completed accurately to comply with federal tax regulations. Employers are required to honor the information provided on the W-4 when calculating tax withholding. Failure to submit a W-4 form may result in the employer withholding taxes at the highest rate, which could lead to overpayment of taxes. It is essential for employees to understand the legal implications of their W-4 submissions and to update their forms as necessary, especially after significant life changes such as marriage, divorce, or the birth of a child.

Filing Deadlines / Important Dates

While the W-4 form itself does not have a specific filing deadline, it is crucial to submit it to your employer as soon as you start a new job or experience a change in your financial situation. Employers typically need the W-4 form on file before the first paycheck is issued to ensure proper tax withholding. Additionally, it is advisable to review and potentially update your W-4 form at the beginning of each tax year or whenever your circumstances change, such as a change in marital status or the birth of a child.

Form Submission Methods (Online / Mail / In-Person)

The W-4 form can be submitted to your employer through various methods, depending on their policies. Many employers now offer the option to complete and submit the W-4 form electronically through their payroll systems. Alternatively, you can print the completed form and submit it in person or send it via mail to your employer's human resources department. It is important to confirm with your employer the preferred submission method to ensure timely processing of your withholding preferences.

Quick guide on how to complete me w4 form 2001

Effortlessly Prepare Me W4 Form on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the appropriate forms and securely store them online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents swiftly and without complications. Manage Me W4 Form using airSlate SignNow's apps on Android or iOS and enhance any document-related procedure today.

The Simplest Way to Modify and Electronically Sign Me W4 Form with Ease

- Acquire Me W4 Form and click on Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive information using the specific tools offered by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your selected device. Modify and eSign Me W4 Form to guarantee clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct me w4 form 2001

Create this form in 5 minutes!

How to create an eSignature for the me w4 form 2001

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the w 4 form 2023 pdf, and why is it important?

The w 4 form 2023 pdf is an official document used by employees to inform their employers about their tax withholding preferences. Proper completion of this form ensures that the right amount of federal income tax is withheld from your paycheck, helping avoid tax surprises during filing. It's crucial for accurate tax filing, making understanding this form essential for every employee.

-

How can I obtain the w 4 form 2023 pdf?

To obtain the w 4 form 2023 pdf, you can visit the official IRS website, which provides this document for free. Alternatively, airSlate SignNow allows you to create, fill out, and e-sign the w 4 form 2023 pdf directly on our platform, streamlining the process signNowly.

-

Can I fill out the w 4 form 2023 pdf electronically?

Yes, you can fill out the w 4 form 2023 pdf electronically using airSlate SignNow. Our platform provides an intuitive interface that allows you to input your information easily, ensuring your form is completed accurately and efficiently without the hassle of paper.

-

Is there a cost associated with using airSlate SignNow for the w 4 form 2023 pdf?

airSlate SignNow offers various pricing plans, including a free trial option, making it a cost-effective solution for businesses of all sizes. You can e-sign and manage the w 4 form 2023 pdf along with many other documents at a competitive price, giving you great value for your investment.

-

What features does airSlate SignNow offer for managing the w 4 form 2023 pdf?

airSlate SignNow offers a range of features for managing the w 4 form 2023 pdf, including customizable templates, advanced e-signature capabilities, and secure storage. Our platform also enables easy document sharing and tracking, ensuring a smooth workflow for both employees and employers.

-

How does airSlate SignNow ensure the security of my w 4 form 2023 pdf?

airSlate SignNow prioritizes security and uses advanced encryption to protect your documents, including the w 4 form 2023 pdf. With features like two-factor authentication and secure access control, you can trust that your sensitive information is safe with us.

-

Can I integrate airSlate SignNow with other software for handling the w 4 form 2023 pdf?

Yes, airSlate SignNow offers integrations with various software solutions like CRM systems, project management tools, and cloud storage services. This capability allows you to seamlessly manage your w 4 form 2023 pdf within your existing workflow, improving efficiency in document handling.

Get more for Me W4 Form

Find out other Me W4 Form

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement