Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms 2007

What is the Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

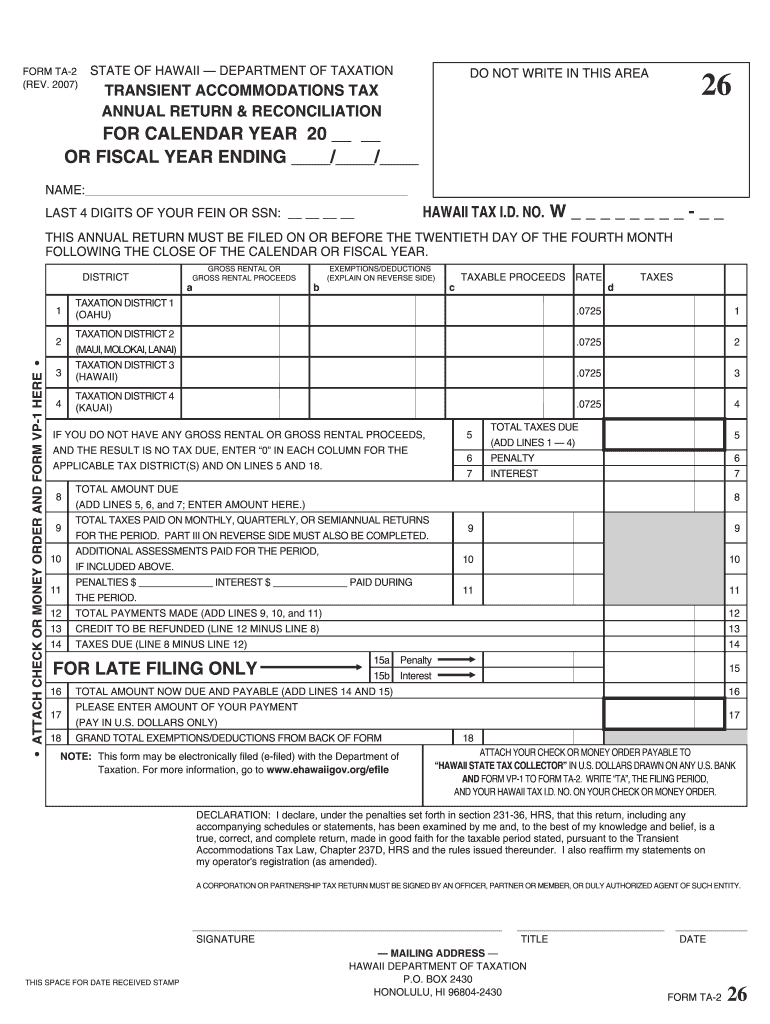

The Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms is a crucial document for businesses that engage in renting transient accommodations. This form is used to report and reconcile the transient accommodations tax, which is typically levied on short-term rentals. It ensures that businesses comply with local tax regulations and accurately report their earnings from transient accommodations. The form is essential for maintaining transparency and accountability in the hospitality industry.

Steps to complete the Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

Completing the Form TA 2, Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to transient accommodations, including rental income and expenses. Next, fill out the form by providing detailed information about the business, such as the name, address, and tax identification number. It's important to accurately report the total amount of transient accommodations tax collected during the reporting period. After completing the form, review it for any errors or omissions before submission.

Legal use of the Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

The legal use of the Form TA 2, Rev is critical for businesses to avoid penalties and ensure compliance with tax laws. This form must be completed and submitted according to the guidelines set forth by state and local tax authorities. Utilizing electronic signature solutions, such as signNow, can enhance the legal standing of the form by ensuring that all signatures are valid and compliant with eSignature laws. Proper use of the form not only fulfills legal obligations but also supports the integrity of the business.

Filing Deadlines / Important Dates

Filing deadlines for the Form TA 2, Rev can vary by jurisdiction, so it is essential to stay informed about specific due dates. Typically, the form must be filed annually, and some states may require quarterly submissions. Missing a deadline can result in penalties or interest on unpaid taxes. Businesses should mark their calendars with important dates to ensure timely filing and avoid any disruptions in compliance.

Required Documents

To complete the Form TA 2, Rev successfully, businesses need to prepare several documents. These include financial statements that outline rental income, expense receipts, and any previous tax returns related to transient accommodations. Having these documents readily available will streamline the completion process and help ensure that all reported figures are accurate and verifiable.

Form Submission Methods (Online / Mail / In-Person)

The Form TA 2, Rev can typically be submitted through various methods, depending on the requirements of the local tax authority. Common submission methods include online filing through designated tax portals, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages, and businesses should choose the one that best fits their operational needs and compliance strategy.

Examples of using the Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

Examples of using the Form TA 2, Rev include situations where a business operates a vacation rental property or a bed-and-breakfast. For instance, a property owner renting out rooms for short stays would need to report the total rental income and the transient accommodations tax collected. This form helps ensure that the business meets its tax obligations while providing a clear record of earnings and tax liabilities.

Quick guide on how to complete form ta 2 rev 2005 transient accommodations tax annual return amp reconciliation forms 2005

Effortlessly Prepare Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and eSign Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms with Ease

- Find Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information carefully and click the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ta 2 rev 2005 transient accommodations tax annual return amp reconciliation forms 2005

Create this form in 5 minutes!

How to create an eSignature for the form ta 2 rev 2005 transient accommodations tax annual return amp reconciliation forms 2005

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Form TA 2, Rev, Transient Accommodations Tax Annual Return & Reconciliation Form?

The Form TA 2, Rev, Transient Accommodations Tax Annual Return & Reconciliation Form is a crucial document required for reporting and reconciling accommodations tax. It helps businesses accurately calculate and remit the transient accommodations tax owed to the state. Using airSlate SignNow makes filling out and submitting this form easier and more efficient.

-

How can airSlate SignNow help with the Form TA 2, Rev?

airSlate SignNow simplifies the process of completing the Form TA 2, Rev by providing easy-to-use templates and e-signing capabilities. This allows businesses to fill out their Transient Accommodations Tax Annual Return & Reconciliation Form electronically and securely. The solution streamlines the entire paperwork process, ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for Form TA 2, Rev?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The pricing provides access to features that assist with managing the Form TA 2, Rev efficiently, making it a cost-effective solution for businesses. By investing in airSlate SignNow, organizations can save time and comply with tax regulations seamlessly.

-

Can I integrate airSlate SignNow with other software for managing Form TA 2, Rev?

Absolutely! airSlate SignNow integrates smoothly with a variety of software systems, enhancing your workflow when handling the Form TA 2, Rev. This includes integrations with accounting and finance software, which can help streamline the reconciliation process for Transient Accommodations Tax Annual Returns. This feature allows for a more cohesive approach to document management.

-

What features does airSlate SignNow provide to facilitate the Form TA 2, Rev process?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and real-time collaboration, all aimed at optimizing the workflow for the Form TA 2, Rev. By providing a user-friendly interface, businesses can easily manage their Transient Accommodations Tax Annual Return & Reconciliation Forms without hassles. These features signNowly reduce errors and enhance compliance.

-

How does airSlate SignNow ensure the security of my Form TA 2, Rev data?

airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect sensitive information related to the Form TA 2, Rev. This ensures that all Transient Accommodations Tax Annual Return & Reconciliation Forms are handled with the utmost confidentiality and integrity. Businesses can trust that their data is safe while using our platform.

-

Is training available for using airSlate SignNow with the Form TA 2, Rev?

Yes, airSlate SignNow offers comprehensive training resources for users to learn how to effectively manage the Form TA 2, Rev. This includes tutorials, webinars, and customer support to assist you in utilizing our platform to its fullest potential. Our resources ensure that businesses are equipped to handle their Transient Accommodations Tax Annual Return & Reconciliation Forms effortlessly.

Get more for Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

Find out other Form TA 2, Rev , Transient Accommodations Tax Annual Return & Reconciliation Forms

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile