C Corporation SC Department of Revenue 2022-2026

What is the C Corporation SC Department Of Revenue

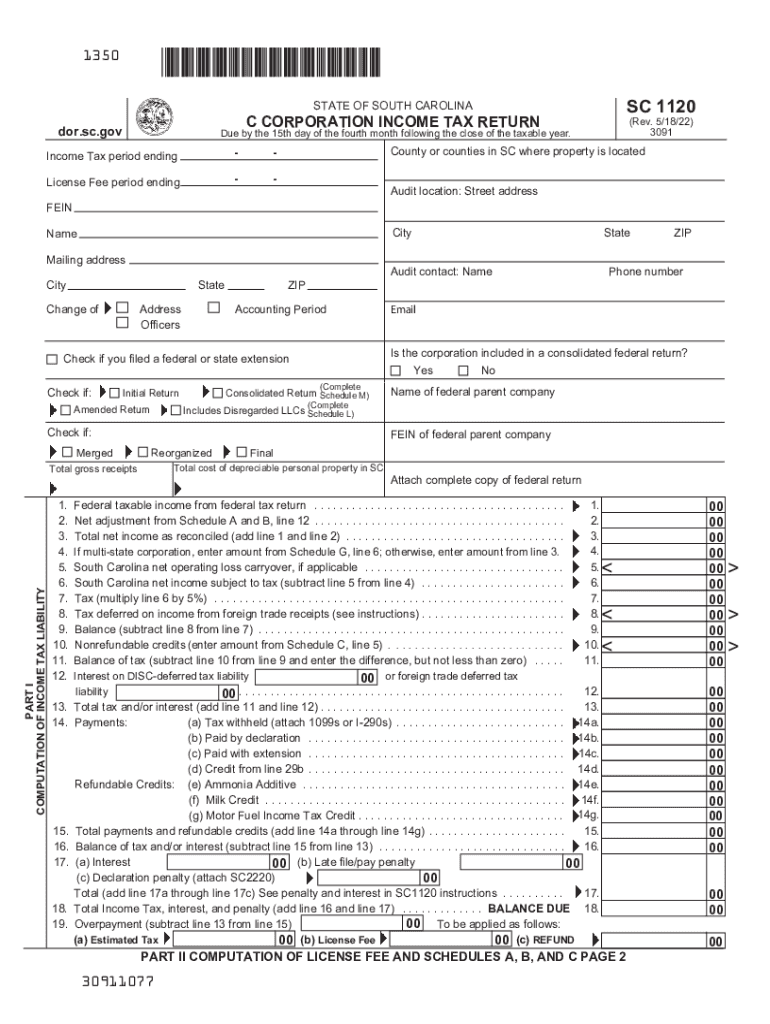

The C Corporation SC Department of Revenue refers to the regulatory body responsible for overseeing the taxation of C Corporations in South Carolina. A C Corporation is a legal entity that is separate from its owners, providing limited liability protection and the ability to raise capital through the sale of stock. This structure is commonly chosen by businesses looking to grow and reinvest profits. Understanding the role of the SC Department of Revenue is crucial for compliance with state tax laws and regulations.

Steps to complete the C Corporation SC Department Of Revenue

Completing the C Corporation tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and any relevant deductions. Next, download the SC 1120 form and its instructions for the 2023 tax year. Fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it. Finally, file the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is essential for C Corporations to be aware of filing deadlines to maintain compliance with South Carolina tax laws. For the 2023 tax year, the SC 1120 form must typically be filed by the fifteenth day of the fourth month following the end of the corporation's tax year. If the corporation operates on a calendar year basis, the deadline will be April 15, 2024. Corporations may also consider filing for an extension if additional time is needed, but this does not extend the time for payment of any taxes owed.

Required Documents

When preparing to file the SC 1120 form, certain documents are required to ensure a complete and accurate submission. These documents typically include financial statements, such as profit and loss statements and balance sheets, as well as records of any deductions, credits, or other adjustments. Additionally, corporations should have documentation related to any income earned, including sales records and investment income. Keeping these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the SC 1120 form can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal consequences for the corporation. It is important for businesses to be aware of these penalties and take proactive measures to ensure timely filing and payment. Understanding the implications of non-compliance can help corporations avoid unnecessary financial burdens.

Legal use of the C Corporation SC Department Of Revenue

The legal use of the C Corporation SC Department of Revenue encompasses adhering to state tax regulations and fulfilling obligations related to corporate income tax. This includes accurately reporting income, claiming allowable deductions, and ensuring that all filings are submitted on time. Corporations must also maintain proper records and documentation to support their tax filings. Compliance with these legal requirements is essential for protecting the corporation's status and avoiding penalties.

Quick guide on how to complete c corporation sc department of revenue

Effortlessly prepare C Corporation SC Department Of Revenue on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle C Corporation SC Department Of Revenue on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign C Corporation SC Department Of Revenue without effort

- Find C Corporation SC Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign C Corporation SC Department Of Revenue and assure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct c corporation sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the c corporation sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the SC 1120 instructions 2023 for completing the form?

The SC 1120 instructions 2023 provide detailed guidance on how to fill out the form, including important deadlines and specific information required. Following these instructions ensures that you complete the form accurately, avoiding any potential issues with your filing. It's essential to review these instructions thoroughly before submission.

-

How can airSlate SignNow help with SC 1120 instructions 2023?

airSlate SignNow simplifies the process of filing your SC 1120 by allowing you to electronically sign and send your documents securely. With our platform, you can manage your important tax forms effortlessly while adhering to the SC 1120 instructions 2023. This ensures a smooth submission process and helps you stay organized during tax season.

-

What pricing options are available for using airSlate SignNow for SC 1120 instructions 2023?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of both individuals and businesses. Our cost-effective solution allows users to access essential features for managing their documents, including those related to SC 1120 instructions 2023. Check our website for detailed pricing tiers and find the best fit for your needs.

-

Are there any additional features in airSlate SignNow that assist with SC 1120 instructions 2023?

Yes, airSlate SignNow offers features such as document templates, customizable workflows, and automated reminders that can help you better manage your SC 1120 instructions 2023. These tools ensure you stay on track with your submissions and follow all necessary steps outlined in the instructions. Our platform enhances your overall document management experience.

-

Does airSlate SignNow integrate with any accounting software related to SC 1120 instructions 2023?

Absolutely! airSlate SignNow integrates seamlessly with several popular accounting software platforms, making it easier to manage your tax filings, including SC 1120 instructions 2023. These integrations help streamline your workflow and ensure that your important documents are always in sync with your accounting tools.

-

What benefits does airSlate SignNow offer for businesses dealing with SC 1120 instructions 2023?

Businesses using airSlate SignNow can benefit from improved efficiency and reduced errors when dealing with SC 1120 instructions 2023. Our platform enables fast document signing and secure sharing, helping you to complete tax filings on time. Additionally, the user-friendly interface reduces the learning curve for team members involved in the process.

-

Is technical support available for users navigating SC 1120 instructions 2023 with airSlate SignNow?

Yes, airSlate SignNow provides robust technical support to assist users with any questions related to SC 1120 instructions 2023. Our knowledgeable support team is available to help you with navigation issues, troubleshooting, and maximizing the features of our platform. We're dedicated to ensuring that your experience is as smooth and efficient as possible.

Get more for C Corporation SC Department Of Revenue

- Special power of attorney sample dfa form

- Jag power of attorney army form

- 7 point container inspection pdf form

- Account closure form

- Buffy rpg character sheet form

- Board of directors application form

- Form 2 claim by supplier road accident fund raf co

- Mom 2 mom sale registration bformb novi community schools

Find out other C Corporation SC Department Of Revenue

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online