Sc 1120 2018

What is the SC 1120?

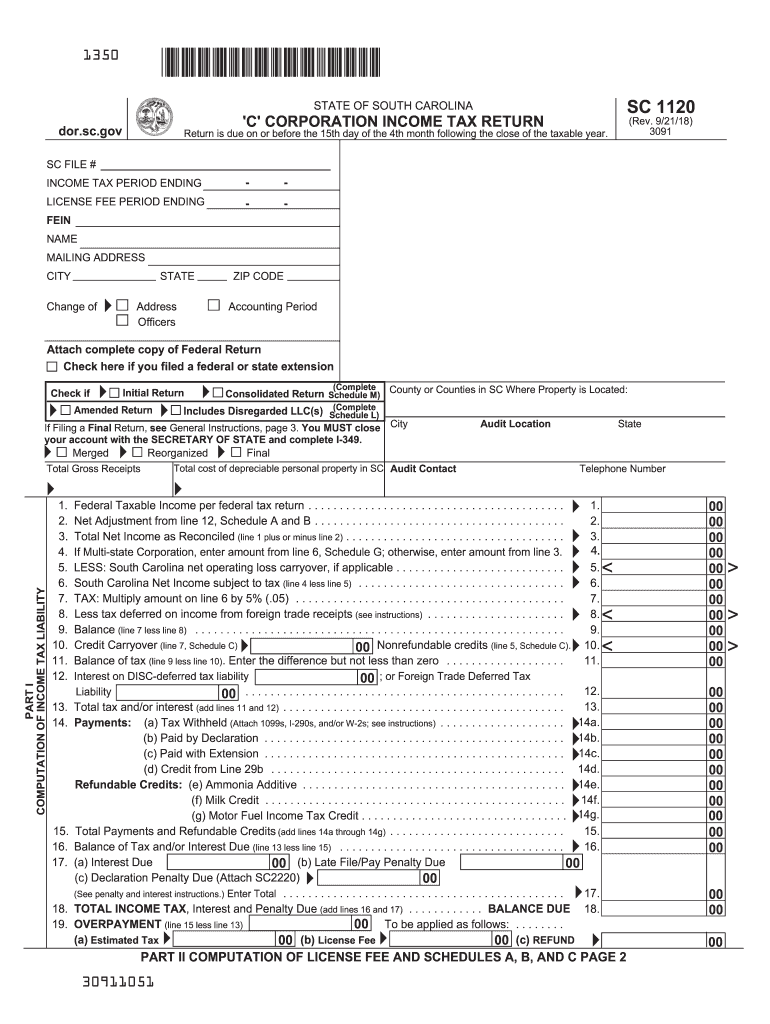

The SC 1120 is the South Carolina corporate income tax return form, specifically designed for corporations operating within the state. This form is used to report income, calculate tax liability, and ensure compliance with state tax regulations. Corporations must accurately complete the SC 1120 to fulfill their tax obligations and avoid penalties. It is essential for businesses to understand the requirements and implications of this form to maintain good standing with the South Carolina Department of Revenue.

Steps to Complete the SC 1120

Filling out the SC 1120 involves several key steps to ensure accuracy and compliance. Here are the primary steps to follow:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Complete the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other sources of revenue.

- Deduct allowable expenses, such as operating costs and depreciation, to calculate taxable income.

- Apply the appropriate tax rate to the taxable income to determine the total tax due.

- Review the form for accuracy and ensure all necessary signatures are included.

- Submit the completed form by the designated deadline.

Legal Use of the SC 1120

The SC 1120 is legally binding when completed and submitted according to South Carolina tax laws. It must be signed by an authorized officer of the corporation, affirming that the information provided is accurate and complete. Failure to comply with the legal requirements associated with the SC 1120 can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is crucial for corporations to avoid potential legal issues.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the SC 1120 to avoid penalties. The standard due date for the SC 1120 is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this typically means the due date is April 15. It is essential for businesses to mark these dates on their calendars and prepare their documents in advance to ensure timely submission.

Required Documents

To complete the SC 1120 accurately, several documents are required. These typically include:

- Financial statements, including income statements and balance sheets.

- Previous year's tax returns for reference.

- Documentation for any deductions or credits claimed.

- Records of any estimated tax payments made throughout the year.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Form Submission Methods

The SC 1120 can be submitted through various methods to accommodate different preferences. Corporations have the option to file electronically, which is often the fastest and most efficient method. Alternatively, businesses can submit the form by mail or in person at designated state offices. Each method has its own processing times, so it is advisable to choose the one that best fits the corporation's needs.

Key Elements of the SC 1120

Understanding the key elements of the SC 1120 is essential for accurate completion. The form includes sections for reporting income, calculating deductions, and determining tax liability. Additionally, it requires information about the corporation's business activities and any applicable credits. Each section must be filled out carefully to ensure compliance with South Carolina tax laws and to avoid potential discrepancies during audits.

Quick guide on how to complete sc 1120 2018 2019 form

Complete Sc 1120 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the features needed to create, adjust, and eSign your documents swiftly without any hold-ups. Manage Sc 1120 on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Sc 1120 with ease

- Find Sc 1120 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sc 1120 and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1120 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the sc 1120 2018 2019 form

How to make an electronic signature for your Sc 1120 2018 2019 Form online

How to generate an eSignature for your Sc 1120 2018 2019 Form in Google Chrome

How to create an electronic signature for putting it on the Sc 1120 2018 2019 Form in Gmail

How to make an electronic signature for the Sc 1120 2018 2019 Form right from your smartphone

How to make an eSignature for the Sc 1120 2018 2019 Form on iOS

How to create an eSignature for the Sc 1120 2018 2019 Form on Android OS

People also ask

-

What is the sc dept of revenue sc1120 v and how does it work?

The sc dept of revenue sc1120 v is a tax form used by businesses in South Carolina for reporting income. airSlate SignNow simplifies the completion and submission of this form, allowing users to fill it out electronically and sign it securely. This streamlines your document management process, ensuring compliance with state regulations efficiently.

-

How can airSlate SignNow help with the sc dept of revenue sc1120 v form?

With airSlate SignNow, users can easily create, sign, and send the sc dept of revenue sc1120 v form electronically. The platform provides templates and tools that facilitate compliance with state requirements while saving time. This digital solution enhances your overall experience in managing business taxes.

-

Is there a cost associated with using airSlate SignNow for the sc dept of revenue sc1120 v?

Yes, airSlate SignNow offers various pricing plans, tailored to different business needs. Pricing varies based on the features you choose, but it remains budget-friendly compared to traditional document handling methods. This makes it a cost-effective solution for efficiently managing the sc dept of revenue sc1120 v form.

-

What features does airSlate SignNow offer for handling the sc dept of revenue sc1120 v?

airSlate SignNow offers features like customizable templates, real-time collaboration, and secure e-signatures specifically designed for forms like the sc dept of revenue sc1120 v. These features optimize the document workflow, ensuring that users can fill out, sign, and send their forms with ease. Additionally, automated reminders enhance compliance and timeliness.

-

Can airSlate SignNow integrate with other software for the sc dept of revenue sc1120 v?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications to enhance the handling of the sc dept of revenue sc1120 v form. This capability allows businesses to streamline their processes by connecting their existing software tools, thus improving efficiency and accuracy in tax reporting.

-

What benefits does eSigning with airSlate SignNow provide for the sc dept of revenue sc1120 v?

Using airSlate SignNow for eSigning the sc dept of revenue sc1120 v brings numerous advantages, including faster turnaround times and enhanced security. Digital signatures are legally binding and help eliminate the potential for errors inherent in paper processes. Furthermore, it provides an audit trail, ensuring all actions are documented and secure.

-

How does airSlate SignNow ensure the security of the sc dept of revenue sc1120 v form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect the sc dept of revenue sc1120 v form. Users can trust that their sensitive tax information is secure, maintaining confidentiality throughout the signing process. This focus on security helps build confidence in using digital solutions for tax-related documents.

Get more for Sc 1120

Find out other Sc 1120

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast