Due by the 15th Day of the Fourth Month Following the Close of the Taxable Year 2020

Filing Deadlines for Form SC 1120

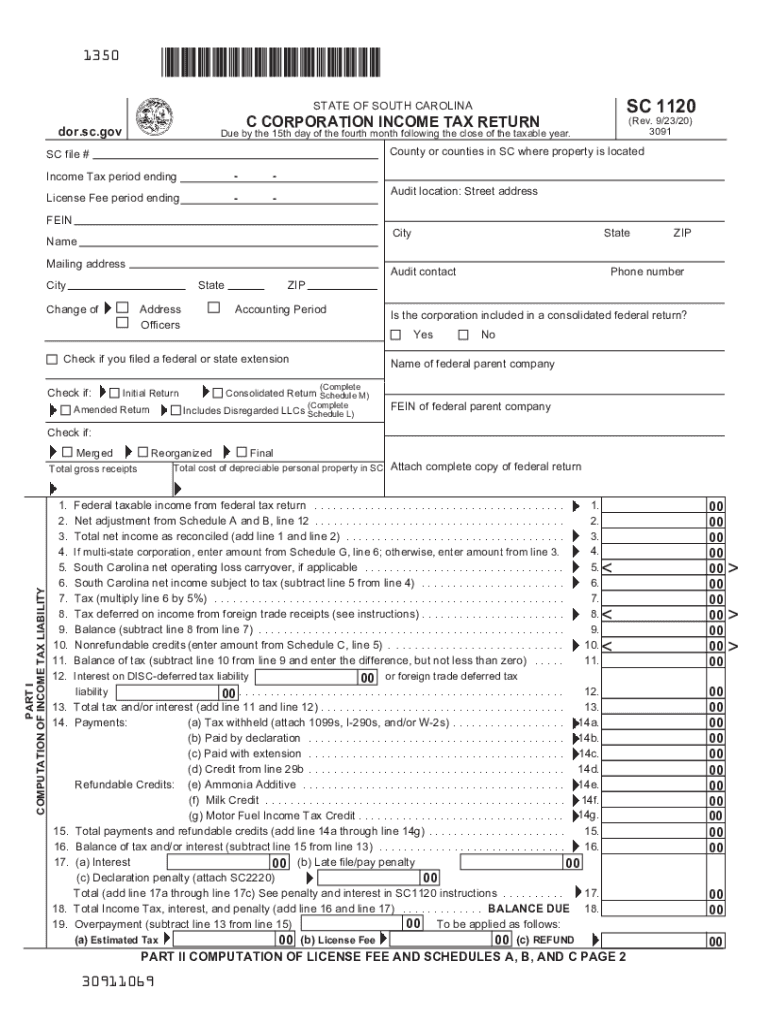

The South Carolina corporate income tax return, known as Form SC 1120, must be filed by the fifteenth day of the fourth month following the close of the taxable year. For most corporations operating on a calendar year, this means the due date is April 15. It is essential to adhere to this timeline to avoid penalties and interest on any taxes owed.

Required Documents for SC 1120

When preparing to file Form SC 1120, certain documents are necessary to ensure accurate reporting. These documents typically include:

- Financial statements, including balance sheets and income statements

- Records of income and expenses for the taxable year

- Any applicable tax credits or deductions documentation

- Prior year tax returns for reference

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Steps to Complete Form SC 1120

Completing Form SC 1120 involves several steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather all required financial documents and records.

- Fill out the form, providing accurate information regarding income, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, ensuring it is sent by the due date.

Following these steps will help ensure that your filing is complete and accurate.

Penalties for Non-Compliance

Failure to file Form SC 1120 by the due date can result in significant penalties. The state of South Carolina imposes a late filing penalty, which can be a percentage of the tax due, as well as interest on any unpaid taxes. It is crucial to file on time to avoid these additional costs and maintain good standing with state tax authorities.

Legal Use of Form SC 1120

Form SC 1120 is legally recognized for reporting corporate income and calculating tax liability in South Carolina. To be considered valid, the form must be completed accurately and submitted in accordance with state regulations. Utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring compliance with eSignature laws such as ESIGN and UETA.

Who Issues the Form SC 1120

The South Carolina Department of Revenue is responsible for issuing Form SC 1120. This state agency oversees the collection of taxes and ensures compliance with tax laws. For any inquiries regarding the form or filing process, the Department of Revenue provides resources and assistance to taxpayers.

Quick guide on how to complete due by the 15th day of the fourth month following the close of the taxable year

Effortlessly Prepare Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and eSign Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year with Ease

- Locate Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes requiring new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct due by the 15th day of the fourth month following the close of the taxable year

Create this form in 5 minutes!

How to create an eSignature for the due by the 15th day of the fourth month following the close of the taxable year

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the SC 1120 form?

The SC 1120 form is used by S corporations to report their income, gains, losses, deductions, and credits. Using airSlate SignNow can streamline the process of filling out and submitting your SC 1120 form, allowing for easy electronic signatures and document management.

-

How does airSlate SignNow help with SC 1120 filing?

airSlate SignNow offers a user-friendly platform to prepare and eSign your SC 1120 form securely and efficiently. With its cost-effective solutions, users can reduce paperwork hassles and ensure timely submission of their SC 1120 to the IRS.

-

What features does airSlate SignNow provide for SC 1120 processing?

airSlate SignNow includes features such as document templates, advanced editing tools, and real-time collaboration. These capabilities make managing your SC 1120 form easier, ensuring that all signatures and necessary documents are processed without delays.

-

Is airSlate SignNow compliant with tax regulations for SC 1120?

Yes, airSlate SignNow is compliant with various tax regulations, including those relevant to the SC 1120 form. Our platform uses encryption and secure servers to protect sensitive data, helping businesses file their SC 1120 forms confidently.

-

What are the pricing options for airSlate SignNow when handling SC 1120 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you are preparing a single SC 1120 form or handling multiple submissions, our scalable pricing ensures you pay only for the features you need.

-

Can airSlate SignNow integrate with other software for handling SC 1120?

Yes, airSlate SignNow integrates seamlessly with various accounting and CRM software to enhance workflow efficiency. By linking other tools with airSlate SignNow, you can effortlessly manage your SC 1120 and related documents within your existing systems.

-

What benefits does airSlate SignNow offer for SC 1120 document management?

Using airSlate SignNow for SC 1120 document management provides multiple benefits, including reduced turnaround time and improved accuracy. Our platform helps minimize errors by allowing for easy editing and eSigning of your SC 1120 forms in a secure environment.

Get more for Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year

Find out other Due By The 15th Day Of The Fourth Month Following The Close Of The Taxable Year

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form