Sc 1120 Form 2017

What is the SC 1120 Form

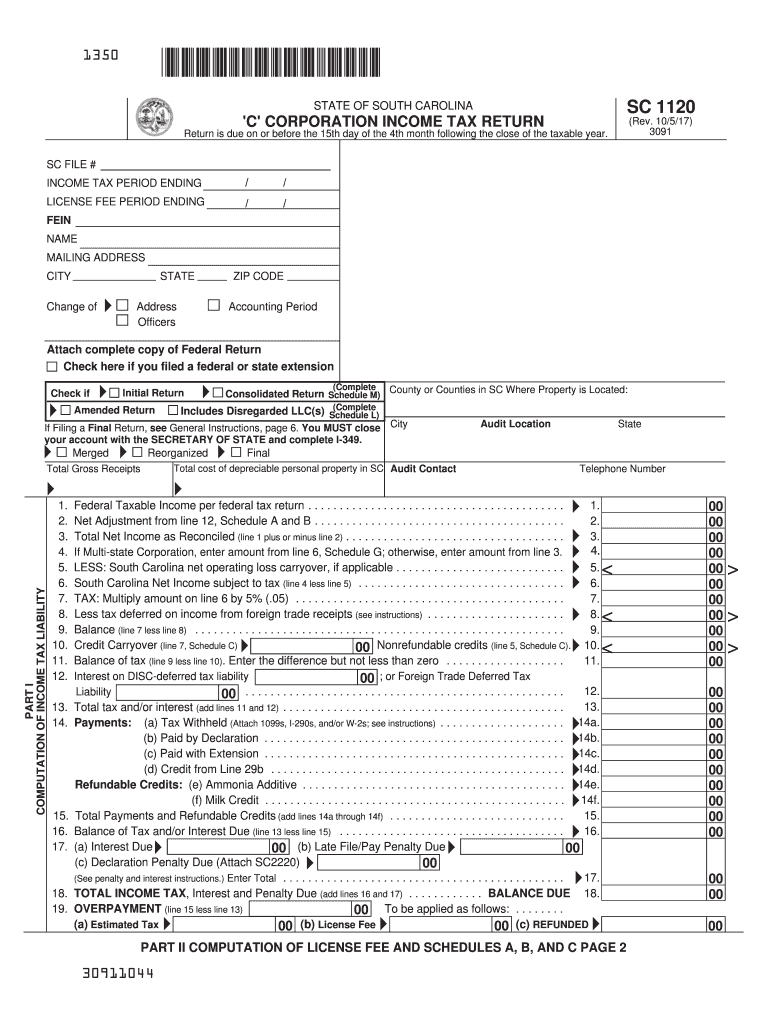

The SC 1120 Form is a tax return specifically designed for corporations operating in South Carolina. It is used to report income, gains, losses, deductions, and credits, ensuring compliance with state tax laws. This form is essential for corporations to calculate their South Carolina corporate income tax liability accurately. Understanding the SC 1120 Form is crucial for business entities to fulfill their tax obligations and maintain good standing with the state.

How to use the SC 1120 Form

To effectively use the SC 1120 Form, corporations must first gather all necessary financial information, including income statements and expense records. The form requires detailed reporting of revenue, deductions, and credits. Each section must be filled out accurately, reflecting the corporation's financial activities for the tax year. It is important to review the instructions provided with the form to ensure all entries are completed correctly, as errors can lead to delays or penalties.

Steps to complete the SC 1120 Form

Completing the SC 1120 Form involves several key steps:

- Gather all financial documents, including profit and loss statements and balance sheets.

- Fill out the identification section, including the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including sales and other revenue sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income by subtracting total deductions from total income.

- Apply any applicable tax credits to reduce the overall tax liability.

- Review the completed form for accuracy before submission.

Legal use of the SC 1120 Form

The SC 1120 Form must be used in accordance with South Carolina tax laws. It is legally binding and serves as an official record of a corporation's financial activities. Accurate completion and timely submission of this form are essential to avoid legal repercussions, including fines or audits. Corporations should ensure that they comply with all state regulations and keep copies of submitted forms for their records.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the SC 1120 Form to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable to check for any updates or changes to deadlines annually, as state regulations may vary.

Form Submission Methods

The SC 1120 Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Corporations can file electronically through the South Carolina Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided in the filing instructions.

- In-Person: Corporations may also choose to deliver the form directly to a local Department of Revenue office.

Quick guide on how to complete sc 1120 2017 2019 form

Manage Sc 1120 Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, alter, and electronically sign your documents swiftly without delays. Manage Sc 1120 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest method to modify and eSign Sc 1120 Form without hassle

- Obtain Sc 1120 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure confidential details with tools that airSlate SignNow offers expressly for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as an original ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Sc 1120 Form and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1120 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the sc 1120 2017 2019 form

How to make an eSignature for the Sc 1120 2017 2019 Form in the online mode

How to make an eSignature for the Sc 1120 2017 2019 Form in Google Chrome

How to generate an electronic signature for signing the Sc 1120 2017 2019 Form in Gmail

How to create an eSignature for the Sc 1120 2017 2019 Form right from your smart phone

How to create an eSignature for the Sc 1120 2017 2019 Form on iOS devices

How to create an eSignature for the Sc 1120 2017 2019 Form on Android

People also ask

-

What is the SC 1120 Form?

The SC 1120 Form is the South Carolina corporate tax return form that corporations must file annually. It is essential for reporting income, deductions, and tax liability to the state of South Carolina. Understanding how to complete the SC 1120 Form accurately is crucial for compliance with state tax laws.

-

How can airSlate SignNow assist with the SC 1120 Form?

airSlate SignNow provides a user-friendly platform that simplifies the eSigning and document management process for your SC 1120 Form. With features that allow for easy collaboration and tracking, you can ensure that all necessary signatures are obtained efficiently. This helps streamline your filing process, saving you time and reducing errors.

-

What features does airSlate SignNow offer for filing the SC 1120 Form?

airSlate SignNow offers features like customizable templates, secure storage, and real-time collaboration specifically designed for forms like the SC 1120 Form. These tools enable you to prepare and send your documents easily while ensuring that they comply with all necessary regulations. You can also use audit trails to track the signing process, which is essential for transparency.

-

Is there a cost involved in using airSlate SignNow for the SC 1120 Form?

Yes, airSlate SignNow operates on a subscription-based pricing model that offers various plans to suit different business needs. The cost can vary based on features and the number of users, but overall, it provides a cost-effective solution for handling documents, including the SC 1120 Form. It's advisable to check the pricing page for detailed information and to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software when preparing the SC 1120 Form?

Absolutely! airSlate SignNow allows for seamless integration with various applications, enhancing your workflow while preparing the SC 1120 Form. Whether you are using accounting software or document management tools, these integrations can help streamline the process and improve collaboration with your team.

-

What are the benefits of using airSlate SignNow for my SC 1120 Form?

Using airSlate SignNow to manage your SC 1120 Form provides several benefits, such as increased efficiency, reduced errors, and enhanced security. The platform's electronic signature capabilities speed up the signing process, ensuring you meet important deadlines. Additionally, all documents are securely stored and easily accessible when needed.

-

Is airSlate SignNow compliant with legal standards for SC 1120 Form submission?

Yes, airSlate SignNow is designed to be compliant with legal standards and regulations for electronic signatures, making it a reliable option for your SC 1120 Form. The platform adheres to stringent security protocols, ensuring that your documents are protected and legally binding. This compliance is crucial for maintaining the integrity of your submissions.

Get more for Sc 1120 Form

Find out other Sc 1120 Form

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later