53 V 2020

What is the 53 V?

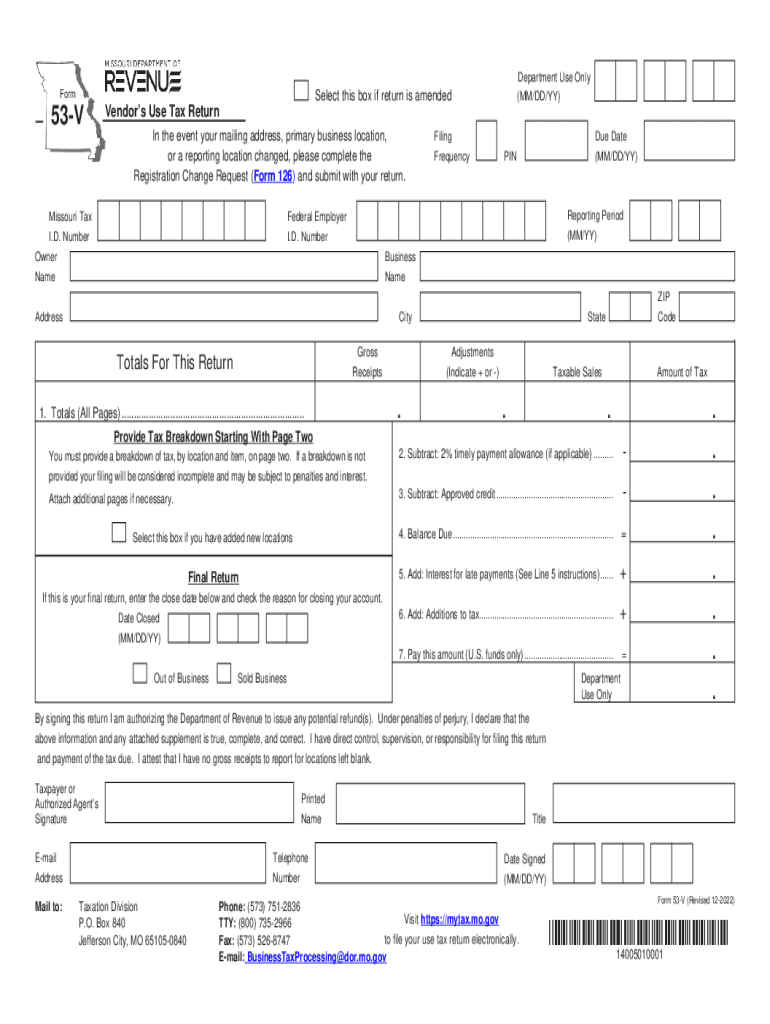

The 53 V, also known as the Missouri Vendor Use Tax Form, is a document utilized by businesses in Missouri to report and pay use tax on items purchased for use in the state. This form is essential for vendors who buy goods from out-of-state sellers and do not pay sales tax at the time of purchase. The 53 V ensures compliance with Missouri tax laws and helps maintain fair competition among local businesses.

How to use the 53 V

To effectively use the 53 V, vendors must first gather all necessary information regarding their purchases. This includes details such as the purchase price, date of purchase, and the seller's information. Once this information is compiled, vendors can fill out the form accurately, ensuring all required fields are completed. After filling out the form, it should be submitted to the Missouri Department of Revenue along with any applicable payment for the use tax owed.

Steps to complete the 53 V

Completing the 53 V involves several key steps:

- Gather purchase documentation, including invoices and receipts.

- Fill out the vendor information section, including your business name and address.

- List each item purchased, along with its purchase price and date.

- Calculate the total use tax owed based on the applicable tax rate.

- Review the completed form for accuracy before submission.

Legal use of the 53 V

The legal use of the 53 V is governed by Missouri tax regulations. Vendors are required to file this form when they purchase taxable items for use in the state without paying sales tax. Failure to file or incorrect reporting can lead to penalties and interest charges. It is crucial for businesses to understand their obligations under Missouri law to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 53 V typically align with the state’s tax reporting schedule. Vendors must submit the form and any tax payments by the end of the month following the reporting period. For example, if a vendor makes purchases in January, the 53 V must be filed by the end of February. Staying aware of these deadlines helps avoid late fees and ensures timely compliance with tax obligations.

Required Documents

When completing the 53 V, vendors should have several documents on hand:

- Invoices or receipts for all purchases made.

- Records of any sales tax paid to out-of-state sellers.

- Previous tax returns, if applicable, for reference.

Having these documents readily available streamlines the completion process and ensures accurate reporting on the form.

Form Submission Methods

The 53 V can be submitted through various methods to accommodate vendors' preferences. Options include:

- Online submission via the Missouri Department of Revenue's website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can enhance efficiency and ensure that the form is processed in a timely manner.

Quick guide on how to complete 53 v

Complete 53 V seamlessly on any device

Online document administration has gained popularity among enterprises and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage 53 V on any device using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign 53 V effortlessly

- Locate 53 V and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from a device of your choice. Edit and eSign 53 V and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 53 v

Create this form in 5 minutes!

How to create an eSignature for the 53 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo form v tax and why is it important?

The mo form v tax is a vital tax form used by Missouri residents to report income and other relevant financial information. It's crucial for compliance with state tax laws, and understanding it can help ensure proper filing and avoid penalties.

-

How can airSlate SignNow help with the mo form v tax process?

airSlate SignNow streamlines the mo form v tax submission process by allowing users to fill out, sign, and send documents electronically. This makes it easier to manage the complexities of tax filing, ensuring that your forms are submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for mo form v tax filing?

Yes, airSlate SignNow offers various pricing plans to fit different budget needs, which can be very cost-effective when handling the mo form v tax. Each plan provides access to essential features that simplify the electronic signing process, making tax preparation more efficient.

-

What features does airSlate SignNow offer for managing the mo form v tax?

airSlate SignNow includes features like easy document editing, templates, and automated reminders that are specifically beneficial for managing the mo form v tax. These tools enhance productivity and reduce the likelihood of errors during tax filing.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to collaborate on the mo form v tax and keep all your financial documents organized in one place. This integration helps streamline your tax filing process.

-

How do I ensure my mo form v tax is secure when using airSlate SignNow?

security is a top priority with airSlate SignNow. The platform utilizes advanced encryption and security protocols to protect your mo form v tax documents, ensuring that all sensitive information remains confidential and secure during submission.

-

What industries can benefit from using airSlate SignNow for mo form v tax?

airSlate SignNow is versatile and can benefit a wide range of industries, including small businesses, freelancers, and larger organizations that need to file a mo form v tax. Its easy-to-use platform caters to any user needing to manage documents efficiently.

Get more for 53 V

Find out other 53 V

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy