CITY of KETTERING INCOME TAX DIVISION P O Box 639 2024-2026

What is the CITY OF KETTERING INCOME TAX DIVISION P O Box 639

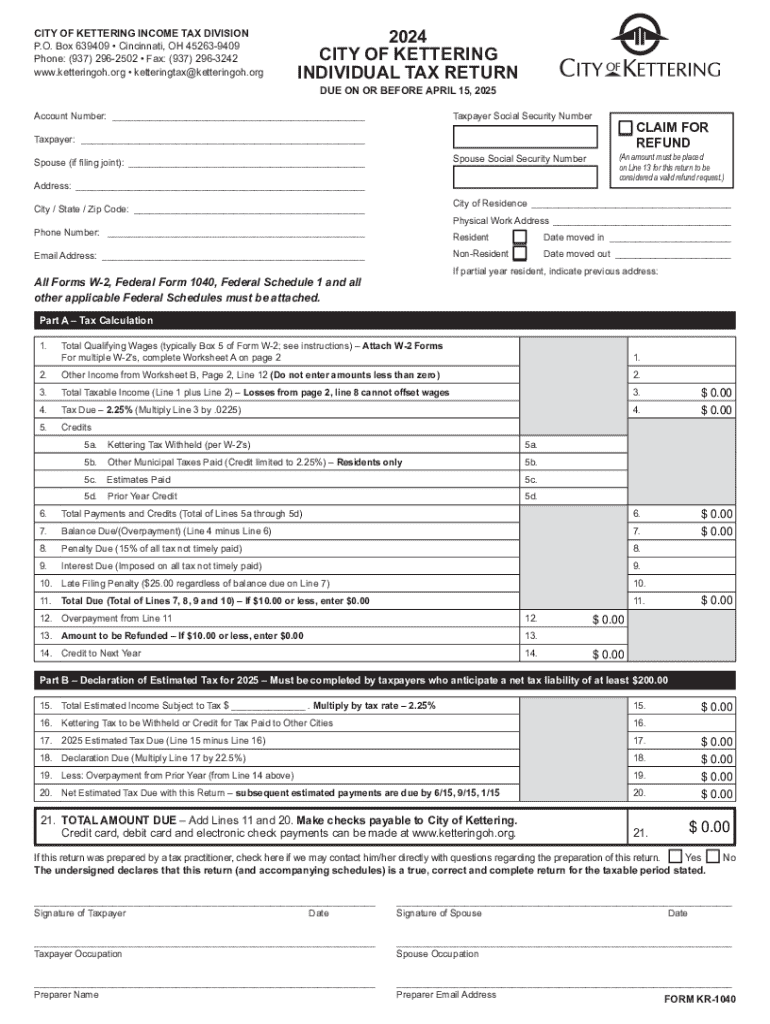

The CITY OF KETTERING INCOME TAX DIVISION P O Box 639 refers to the official mailing address for the income tax division of Kettering, Ohio. This division is responsible for the administration and collection of local income taxes within the city. It serves residents and businesses by providing essential tax services, including tax return processing, payment collection, and compliance enforcement. Understanding the role of this division is crucial for individuals and businesses to meet their tax obligations effectively.

How to use the CITY OF KETTERING INCOME TAX DIVISION P O Box 639

Utilizing the services of the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 involves several steps. Taxpayers can send their completed income tax forms and any required documentation to this address. It is important to ensure that all forms are filled out accurately to avoid delays. Additionally, taxpayers can contact the division for assistance with questions regarding tax rates, filing requirements, and payment options.

Steps to complete the CITY OF KETTERING INCOME TAX DIVISION P O Box 639

Completing the necessary forms for the CITY OF KETTERING INCOME TAX DIVISION involves several key steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Obtain the appropriate income tax forms from the Kettering Income Tax Division.

- Fill out the forms accurately, ensuring all information is correct.

- Review the completed forms for any errors or omissions.

- Submit the forms and any required payments to the address provided.

Required Documents

When filing taxes with the CITY OF KETTERING INCOME TAX DIVISION, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Proof of residency in Kettering

- Any relevant deductions or credits documentation

Having these documents ready can streamline the filing process and ensure compliance with local tax regulations.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the CITY OF KETTERING INCOME TAX DIVISION. Typically, the deadline for filing local income tax returns coincides with the federal tax deadline, which is April 15 each year. However, taxpayers should confirm specific dates with the division, as extensions or changes may occur. Marking these dates on a calendar can help avoid penalties for late submissions.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the CITY OF KETTERING INCOME TAX DIVISION can result in various penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential legal action for persistent non-compliance

Understanding these penalties emphasizes the importance of timely and accurate tax filings to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct city of kettering income tax division p o box 639 772003081

Create this form in 5 minutes!

How to create an eSignature for the city of kettering income tax division p o box 639 772003081

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 provide?

The CITY OF KETTERING INCOME TAX DIVISION P O Box 639 offers a range of services including income tax filing, payment processing, and assistance with tax-related inquiries. They aim to ensure compliance with local tax regulations while providing support to residents and businesses in Kettering.

-

How can I contact the CITY OF KETTERING INCOME TAX DIVISION P O Box 639?

You can contact the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 via phone, email, or by visiting their office. Their contact information is available on their official website, ensuring you can easily signNow out for assistance with your income tax needs.

-

What are the benefits of using the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 services?

Using the services of the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 provides residents with expert guidance on tax matters, ensuring accurate filings and timely payments. This can help avoid penalties and streamline the tax process, making it easier for individuals and businesses to manage their tax obligations.

-

Are there any fees associated with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 services?

The CITY OF KETTERING INCOME TAX DIVISION P O Box 639 may charge fees for certain services, such as late payment penalties or specific tax filings. It's advisable to check their official website or contact them directly for detailed information on any applicable fees.

-

What documents do I need to file my taxes with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639?

To file your taxes with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639, you will typically need your W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, having your previous year's tax return can help streamline the process.

-

Can I file my taxes online with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639?

Yes, the CITY OF KETTERING INCOME TAX DIVISION P O Box 639 offers online filing options for residents. This convenient feature allows you to submit your tax returns electronically, making the process faster and more efficient.

-

What should I do if I have a tax dispute with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639?

If you have a tax dispute with the CITY OF KETTERING INCOME TAX DIVISION P O Box 639, it is recommended to contact them directly to discuss your concerns. They have procedures in place to address disputes and can provide guidance on how to resolve any issues.

Get more for CITY OF KETTERING INCOME TAX DIVISION P O Box 639

Find out other CITY OF KETTERING INCOME TAX DIVISION P O Box 639

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now