West Virginia Nonresident Income Tax Agreement Form

What is the West Virginia Nonresident Income Tax Agreement

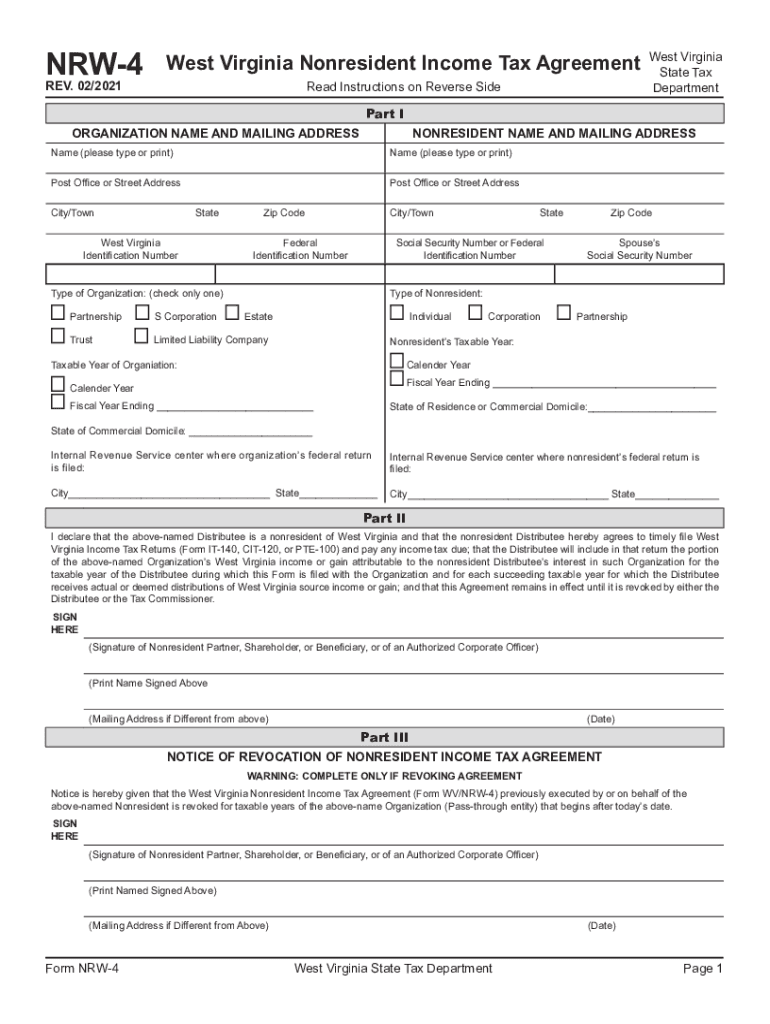

The West Virginia Nonresident Income Tax Agreement, commonly referred to as the NRW-4, is a tax form designed for individuals who earn income in West Virginia but are not residents of the state. This agreement allows nonresidents to report their income and claim any applicable deductions or credits, ensuring compliance with state tax laws. The form is essential for accurately determining the tax obligations of nonresidents who receive income from West Virginia sources.

How to use the West Virginia Nonresident Income Tax Agreement

Using the NRW-4 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant income documentation, including W-2 forms and any other earnings statements. Next, complete the NRW-4 by providing your personal information, income details, and any deductions you wish to claim. Once completed, the form should be submitted to the appropriate state tax authority, either electronically or by mail, depending on your preference and the submission methods available.

Steps to complete the West Virginia Nonresident Income Tax Agreement

Completing the NRW-4 requires careful attention to detail. Follow these steps:

- Collect all necessary income documents, such as W-2s and 1099s.

- Provide your personal information, including your name, address, and Social Security number.

- Report your total income earned from West Virginia sources.

- Claim any applicable deductions or credits that you qualify for.

- Review the form for accuracy before submission.

After ensuring all information is correct, submit the NRW-4 to the West Virginia State Tax Department.

Key elements of the West Virginia Nonresident Income Tax Agreement

The NRW-4 includes several key elements that are crucial for accurate tax reporting. These elements consist of:

- Personal Information: Name, address, and Social Security number of the nonresident.

- Income Reporting: Total income earned from West Virginia sources, including wages and other compensations.

- Deductions and Credits: Any deductions or credits that the nonresident is eligible to claim.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the NRW-4 to avoid penalties. Typically, the form must be submitted by the same deadline as federal tax returns, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these important dates ensures compliance with state tax regulations.

Penalties for Non-Compliance

Failure to file the NRW-4 or inaccuracies in the form can result in significant penalties. Noncompliance may lead to fines, interest on unpaid taxes, and potential legal action from the state tax authority. It is crucial for nonresidents to ensure that their NRW-4 is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete west virginia nonresident income tax agreement

Complete West Virginia Nonresident Income Tax Agreement seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documentation, as you can obtain the necessary form and securely retain it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your papers quickly and without interruptions. Handle West Virginia Nonresident Income Tax Agreement on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign West Virginia Nonresident Income Tax Agreement effortlessly

- Obtain West Virginia Nonresident Income Tax Agreement and then click Get Form to initiate the process.

- Employ the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure confidential information with instruments that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you choose. Modify and eSign West Virginia Nonresident Income Tax Agreement and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia nonresident income tax agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is west virginia nrw 4?

West Virginia nrw 4 refers to a specific regulatory framework relevant to document signing and electronic transactions in West Virginia. This framework ensures that businesses can securely eSign documents while complying with state laws.

-

How does airSlate SignNow support west virginia nrw 4 compliance?

AirSlate SignNow is designed to comply with west virginia nrw 4, offering secure eSigning features that meet regulatory requirements. This ensures that all documents signed through our platform hold up legally in West Virginia.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to different business needs, starting from a basic package to more comprehensive solutions. These plans are tailored to ensure that you receive the best value while complying with west virginia nrw 4.

-

What features does airSlate SignNow provide for west virginia nrw 4 users?

AirSlate SignNow includes features like document templates, in-person signing, and mobile access that are essential for organizations operating under west virginia nrw 4 regulations. These tools enhance the efficiency and security of your document workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

By using airSlate SignNow, businesses benefit from a streamlined eSigning experience that is both user-friendly and compliant with west virginia nrw 4. Increased efficiency, reduced paperwork, and enhanced security are just some of the advantages you will experience.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow can seamlessly integrate with various business applications such as CRM systems and document management software. This ensures that your document workflows under west virginia nrw 4 remain efficient and streamlined across multiple platforms.

-

Is there a trial period available for airSlate SignNow?

AirSlate SignNow offers a free trial period for prospective customers to evaluate the platform's features and compatibility with west virginia nrw 4. This trial allows you to experience firsthand how our solution can meet your eSigning needs.

Get more for West Virginia Nonresident Income Tax Agreement

Find out other West Virginia Nonresident Income Tax Agreement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors