MT DoR DCAC Form 2021-2026

What is the MT DoR DCAC Form

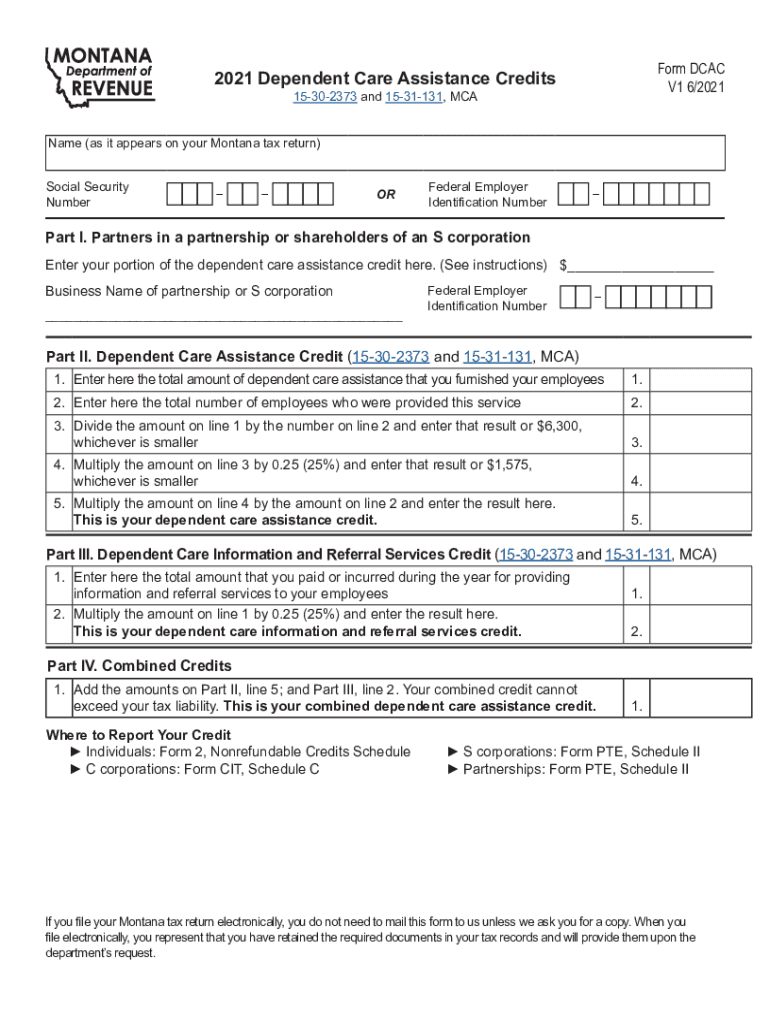

The MT DoR DCAC Form is a document utilized by the Montana Department of Revenue for various tax-related purposes. It is essential for individuals and businesses to ensure compliance with state tax regulations. This form may be required for specific tax exemptions, credits, or to report certain financial information. Understanding the purpose of the MT DoR DCAC Form is vital for accurate tax reporting and adherence to state laws.

How to use the MT DoR DCAC Form

Using the MT DoR DCAC Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the form's requirements. Next, fill out the form carefully, ensuring all sections are completed to avoid delays. Once completed, review the information for accuracy before submitting it to the appropriate department, whether online, by mail, or in person.

Steps to complete the MT DoR DCAC Form

Completing the MT DoR DCAC Form requires a systematic approach:

- Gather necessary documents, such as identification and financial records.

- Access the form from the Montana Department of Revenue website or a trusted source.

- Fill in personal information, including name, address, and tax identification number.

- Provide details regarding the specific tax situation or exemption being claimed.

- Review all entries for accuracy and completeness.

- Submit the form through the designated method, ensuring it is sent to the correct address.

Legal use of the MT DoR DCAC Form

The MT DoR DCAC Form is legally binding when completed and submitted according to state regulations. It is crucial to adhere to all guidelines set forth by the Montana Department of Revenue to ensure that the form is accepted. Failure to comply with the legal requirements may result in penalties or denial of claims. Understanding the legal implications of using this form is essential for maintaining compliance with state tax laws.

Key elements of the MT DoR DCAC Form

Several key elements are critical to the MT DoR DCAC Form:

- Identification Information: Personal details such as name, address, and tax identification number.

- Tax Information: Specific details related to the tax situation or exemption being claimed.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

- Date: The date of submission is important for record-keeping and compliance purposes.

Form Submission Methods

The MT DoR DCAC Form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many forms can be submitted electronically through the Montana Department of Revenue website.

- Mail: Users can print the completed form and send it via postal service to the designated address.

- In-Person: Individuals may also choose to submit the form directly at local tax offices for immediate processing.

Quick guide on how to complete mt dor dcac form

Effortlessly Prepare MT DoR DCAC Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any holdups. Manage MT DoR DCAC Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and Electronically Sign MT DoR DCAC Form with Ease

- Find MT DoR DCAC Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Edit and electronically sign MT DoR DCAC Form to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mt dor dcac form

Create this form in 5 minutes!

How to create an eSignature for the mt dor dcac form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MT DoR DCAC Form and how is it used?

The MT DoR DCAC Form is a document used for declaring, recording, and articulating the details required in certain business processes. It's essential for ensuring compliance and efficient documentation within legal frameworks. Using airSlate SignNow, businesses can easily fill out and eSign the MT DoR DCAC Form digitally, streamlining operations.

-

How can airSlate SignNow help with the MT DoR DCAC Form?

airSlate SignNow provides a user-friendly platform to electronically complete and sign the MT DoR DCAC Form. The intuitive interface allows users to quickly navigate through the process, ensuring that all necessary information is captured accurately and efficiently without the need for physical paperwork.

-

Is there a cost associated with using airSlate SignNow for the MT DoR DCAC Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling documents like the MT DoR DCAC Form. Each plan includes essential features for document management, eSigning, and team collaboration, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for the MT DoR DCAC Form?

airSlate SignNow provides several features for managing the MT DoR DCAC Form, such as templates for quick setup, secure cloud storage, and real-time tracking of document statuses. Additionally, users can integrate various tools and automate workflows to enhance efficiency when dealing with this crucial form.

-

Can I integrate other applications with airSlate SignNow for the MT DoR DCAC Form?

Absolutely! airSlate SignNow supports integrations with numerous applications and services, allowing you to streamline your workflow involving the MT DoR DCAC Form. Whether you're using CRM systems, cloud storage solutions, or project management tools, the integration capabilities help enhance productivity in document handling.

-

What benefits can my business expect from using airSlate SignNow for the MT DoR DCAC Form?

By utilizing airSlate SignNow for the MT DoR DCAC Form, your business can expect increased efficiency, reduced turnaround times, and enhanced accuracy. The digital signing process eliminates manual errors and paperwork, leading to a more organized and faster documentation process that's easily accessible.

-

Is the MT DoR DCAC Form legally binding when signed through airSlate SignNow?

Yes, the MT DoR DCAC Form signed through airSlate SignNow is legally binding, as the platform complies with electronic signature laws such as the ESIGN Act and UETA. This means that eSignatures obtained on this platform hold the same legal weight as traditional handwritten signatures, offering you peace of mind.

Get more for MT DoR DCAC Form

Find out other MT DoR DCAC Form

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word