Printable Montana Form DCAC Dependent Care Assistance Credits 2019

What is the Printable Montana Form DCAC Dependent Care Assistance Credits

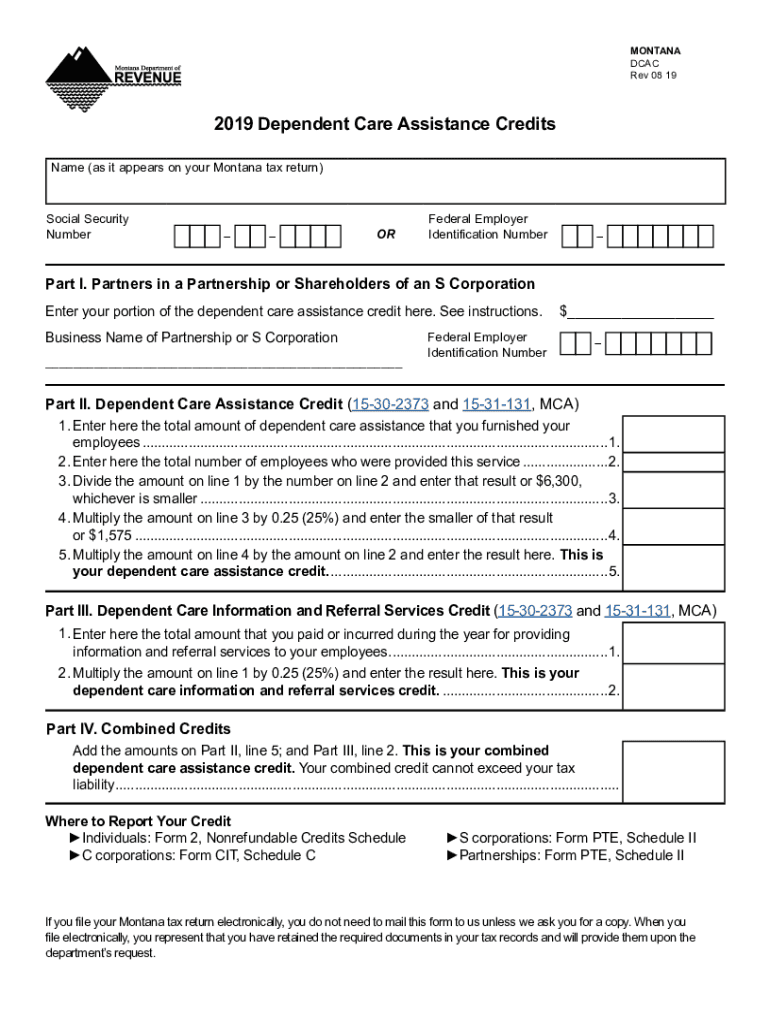

The Printable Montana Form DCAC Dependent Care Assistance Credits is a tax form used by individuals in Montana to claim credits for dependent care expenses. This form is specifically designed for taxpayers who pay for the care of qualifying individuals, allowing them to receive financial relief through tax credits. It is essential for those who seek to offset the costs associated with childcare while they work or look for work. The form captures necessary information regarding the taxpayer, the care provider, and the expenses incurred, ensuring compliance with state tax regulations.

How to use the Printable Montana Form DCAC Dependent Care Assistance Credits

To effectively use the Printable Montana Form DCAC Dependent Care Assistance Credits, individuals should first gather all relevant documentation, including receipts for dependent care expenses and provider information. After downloading and printing the form, fill it out accurately, ensuring that all fields are completed. This includes providing details about the dependent receiving care, the care provider, and the total expenses incurred. Once completed, the form can be submitted according to the specified filing methods, ensuring that all deadlines are met to avoid penalties.

Steps to complete the Printable Montana Form DCAC Dependent Care Assistance Credits

Completing the Printable Montana Form DCAC Dependent Care Assistance Credits involves several steps:

- Gather necessary documents, including care provider information and expense receipts.

- Download and print the form from a reliable source.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about the dependent receiving care, including their name and age.

- List the care provider's name, address, and taxpayer identification number.

- Calculate the total amount of dependent care expenses incurred during the tax year.

- Review the form for accuracy before submission.

Legal use of the Printable Montana Form DCAC Dependent Care Assistance Credits

The Printable Montana Form DCAC Dependent Care Assistance Credits is legally valid when filled out correctly and submitted in accordance with state tax laws. To ensure legal compliance, taxpayers must adhere to the guidelines set forth by the Montana Department of Revenue. This includes providing accurate information, maintaining supporting documentation for all claimed expenses, and submitting the form by the established deadlines. Failure to comply with these regulations may result in penalties or disqualification from receiving credits.

Eligibility Criteria

To qualify for the credits outlined in the Printable Montana Form DCAC Dependent Care Assistance Credits, taxpayers must meet specific eligibility criteria. These criteria typically include:

- The taxpayer must have incurred expenses for the care of a qualifying individual.

- The care must be necessary for the taxpayer to work or actively seek employment.

- The dependent receiving care must be a child under the age of thirteen or a dependent with a disability.

- The care provider must meet specific qualifications, including being a licensed childcare provider.

Form Submission Methods

The Printable Montana Form DCAC Dependent Care Assistance Credits can be submitted through various methods to accommodate different taxpayer preferences. Options typically include:

- Online submission through the Montana Department of Revenue's official website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete printable 2020 montana form dcac dependent care assistance credits

Complete Printable Montana Form DCAC Dependent Care Assistance Credits effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally-friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents promptly without interruptions. Manage Printable Montana Form DCAC Dependent Care Assistance Credits on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Printable Montana Form DCAC Dependent Care Assistance Credits effortlessly

- Obtain Printable Montana Form DCAC Dependent Care Assistance Credits and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Printable Montana Form DCAC Dependent Care Assistance Credits and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 montana form dcac dependent care assistance credits

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 montana form dcac dependent care assistance credits

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Printable Montana Form DCAC Dependent Care Assistance Credits?

The Printable Montana Form DCAC Dependent Care Assistance Credits allows taxpayers to claim credits related to dependent care assistance. This form facilitates the documentation needed to receive credits for qualified dependent care expenses, ultimately reducing your tax liability.

-

How can I obtain the Printable Montana Form DCAC Dependent Care Assistance Credits?

You can easily download the Printable Montana Form DCAC Dependent Care Assistance Credits from the official state tax website or through various tax preparation software. airSlate SignNow also offers a streamlined process to eSign and send the form electronically.

-

Is there a cost associated with using the Printable Montana Form DCAC Dependent Care Assistance Credits?

Accessing and filling out the Printable Montana Form DCAC Dependent Care Assistance Credits is free. However, if you choose to utilize airSlate SignNow for eSigning or document routing, there may be associated service fees, which are typically cost-effective and transparent.

-

What features does airSlate SignNow offer for managing the Printable Montana Form DCAC Dependent Care Assistance Credits?

airSlate SignNow provides a user-friendly platform that allows for easy creation, eSigning, and sharing of the Printable Montana Form DCAC Dependent Care Assistance Credits. With features like templates, document tracking, and secure cloud storage, managing your forms has never been simpler.

-

Can I store my Printable Montana Form DCAC Dependent Care Assistance Credits securely?

Yes, airSlate SignNow offers secure cloud storage for all of your important documents, including the Printable Montana Form DCAC Dependent Care Assistance Credits. Your data is protected with industry-leading encryption and security measures to ensure confidentiality.

-

Are there any benefits to using airSlate SignNow for the Printable Montana Form DCAC Dependent Care Assistance Credits?

Using airSlate SignNow for the Printable Montana Form DCAC Dependent Care Assistance Credits streamlines the filing process, reduces paperwork, and ensures compliance. Additionally, the convenience of electronic signatures saves time and effort compared to traditional methods.

-

Is integration with other tools possible when using the Printable Montana Form DCAC Dependent Care Assistance Credits?

Yes, airSlate SignNow integrates seamlessly with various productivity and accounting tools. This allows you to import, export, and manage the Printable Montana Form DCAC Dependent Care Assistance Credits alongside your other essential documents and workflows.

Get more for Printable Montana Form DCAC Dependent Care Assistance Credits

Find out other Printable Montana Form DCAC Dependent Care Assistance Credits

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement