Fillable Form Dcac Dependent Care Assistance Credits 2020

What is the Fillable Form Dcac Dependent Care Assistance Credits

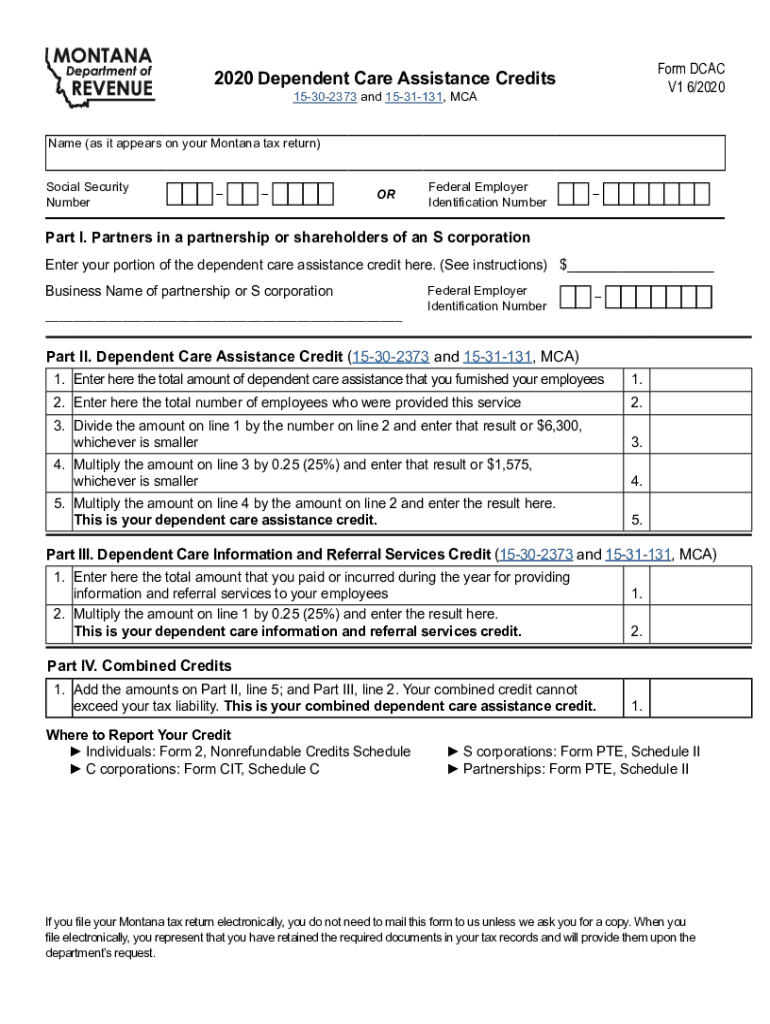

The Fillable Form Dcac Dependent Care Assistance Credits is a tax form used by individuals to claim credits for dependent care expenses. This form is essential for those who pay for child care or care for dependents while they work or look for work. It allows taxpayers to report eligible expenses and potentially reduce their tax liability. Understanding this form is crucial for maximizing available tax benefits related to dependent care.

How to use the Fillable Form Dcac Dependent Care Assistance Credits

Using the Fillable Form Dcac Dependent Care Assistance Credits involves several straightforward steps. First, gather all necessary documentation related to your dependent care expenses, including receipts and provider information. Next, access the fillable form online, ensuring you have a compatible PDF reader. Fill in the required fields, providing accurate details about your dependents and the care provided. Once completed, review the information for accuracy before proceeding to submit the form as per the guidelines.

Steps to complete the Fillable Form Dcac Dependent Care Assistance Credits

Completing the Fillable Form Dcac Dependent Care Assistance Credits requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including provider names and amounts paid.

- Access the fillable form and begin entering your personal information.

- Input details about your dependents, including their names and Social Security numbers.

- Enter the total amount spent on dependent care services during the tax year.

- Review all entries for accuracy and completeness.

- Save the completed form securely before submission.

Legal use of the Fillable Form Dcac Dependent Care Assistance Credits

The Fillable Form Dcac Dependent Care Assistance Credits is legally recognized when filled out accurately and submitted according to IRS guidelines. To ensure its legal validity, it is essential to provide truthful information and retain supporting documents for your claims. Compliance with tax laws is critical, as inaccuracies or fraudulent claims may lead to penalties or audits.

Eligibility Criteria

To qualify for the credits reported on the Fillable Form Dcac Dependent Care Assistance Credits, taxpayers must meet specific eligibility criteria. Generally, the taxpayer must have incurred expenses for the care of a qualifying individual, such as a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. Additionally, the taxpayer must be working or actively seeking employment during the time care is provided.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Form Dcac Dependent Care Assistance Credits align with the annual tax filing schedule. Typically, the deadline for submitting your federal tax return is April fifteenth. It is important to keep track of any changes to these dates, as extensions may be available under certain circumstances. Always verify the current year's deadlines to ensure timely submission.

Quick guide on how to complete fillable form dcac dependent care assistance credits

Effortlessly prepare Fillable Form Dcac Dependent Care Assistance Credits on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Fillable Form Dcac Dependent Care Assistance Credits on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Fillable Form Dcac Dependent Care Assistance Credits with ease

- Obtain Fillable Form Dcac Dependent Care Assistance Credits and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Fillable Form Dcac Dependent Care Assistance Credits to ensure outstanding communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form dcac dependent care assistance credits

Create this form in 5 minutes!

How to create an eSignature for the fillable form dcac dependent care assistance credits

The best way to make an e-signature for a PDF file in the online mode

The best way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Fillable Form Dcac Dependent Care Assistance Credits?

The Fillable Form Dcac Dependent Care Assistance Credits is an online resource that allows taxpayers to apply for dependent care credits effectively. This form helps calculate and claim eligible expenses while ensuring compliance with IRS regulations. By using the fillable form, users can simplify their tax preparation process.

-

How can I access the Fillable Form Dcac Dependent Care Assistance Credits?

You can easily access the Fillable Form Dcac Dependent Care Assistance Credits through our airSlate SignNow platform. Simply navigate to our forms section and locate the dependent care assistance credit form. This seamless process allows you to fill out the form online, saving you time and effort.

-

Are there any fees associated with the Fillable Form Dcac Dependent Care Assistance Credits?

Accessing the Fillable Form Dcac Dependent Care Assistance Credits on airSlate SignNow is part of our comprehensive services, which features cost-effective pricing plans. Depending on your subscription, you may have free access or a nominal fee for premium features. Always check our pricing page for the latest offerings.

-

What are the benefits of using the Fillable Form Dcac Dependent Care Assistance Credits?

Using the Fillable Form Dcac Dependent Care Assistance Credits can streamline your tax filing process and help maximize your eligible credits. This form is designed to ensure accuracy and compliance, which minimizes the risk of delays in processing your tax return. Furthermore, our platform allows easy edits and saves your progress seamlessly.

-

Can I integrate the Fillable Form Dcac Dependent Care Assistance Credits with other software?

Yes, the Fillable Form Dcac Dependent Care Assistance Credits can be integrated with various accounting and software solutions via airSlate SignNow's API. This integration allows for streamlined data transfer and enhanced productivity, providing a comprehensive solution for managing your tax forms alongside your business documents.

-

Is the Fillable Form Dcac Dependent Care Assistance Credits user-friendly?

Absolutely! The Fillable Form Dcac Dependent Care Assistance Credits is designed with user experience in mind. Its simple interface allows anyone, regardless of technical knowledge, to fill out the form easily and efficiently, ensuring you can concentrate on getting your credit without hassle.

-

How do I submit the Fillable Form Dcac Dependent Care Assistance Credits once completed?

Once you've filled out the Fillable Form Dcac Dependent Care Assistance Credits on airSlate SignNow, you can electronically sign and submit the document directly through the platform. The digital submission is not only easy and secure but also provides you with a confirmation of receipt for your records.

Get more for Fillable Form Dcac Dependent Care Assistance Credits

Find out other Fillable Form Dcac Dependent Care Assistance Credits

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document