OH Form R I City of Dayton 2022

What is the Ohio Form R I City of Dayton?

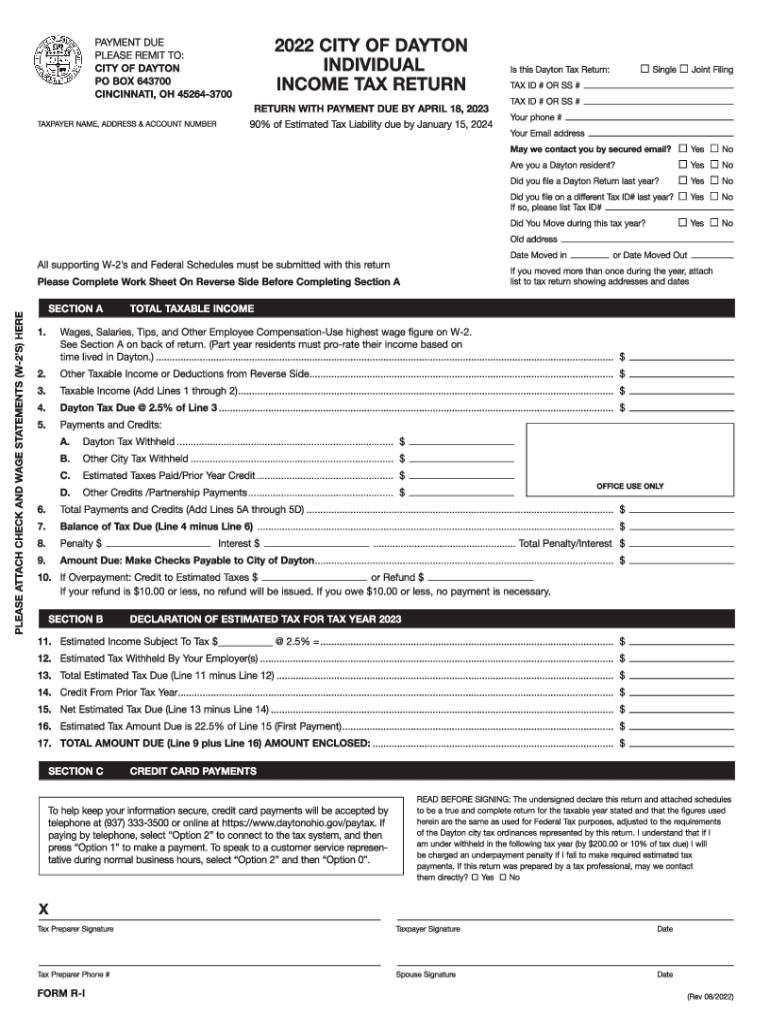

The Ohio Form R I is a tax return specifically designed for individuals residing in the City of Dayton. This form is used to report income earned within the city and calculate the corresponding city income tax liability. It is essential for residents to accurately complete this form to ensure compliance with local tax regulations. The form typically requires information regarding total income, deductions, and any applicable credits that may reduce the overall tax owed.

Steps to Complete the Ohio Form R I City of Dayton

Completing the Ohio Form R I involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. Then, report your total income and applicable deductions. Be sure to calculate the city tax based on the rates provided for Dayton. Finally, review the form for accuracy, sign it, and prepare it for submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Ohio Form R I to avoid penalties. Generally, the deadline for submitting the form is April 15 of each year, coinciding with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Residents should also be mindful of any extensions that may be available and ensure they adhere to any specific local regulations regarding late submissions.

Required Documents

When preparing to complete the Ohio Form R I, certain documents are essential to ensure accurate reporting. Key documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income

- Documentation for any deductions claimed, such as mortgage interest or charitable contributions

Having these documents ready will facilitate a smoother and more efficient filing process.

Legal Use of the Ohio Form R I City of Dayton

The Ohio Form R I is legally recognized for reporting city income tax obligations. To ensure the form's validity, it must be completed accurately and submitted by the designated deadline. The form must also comply with local tax laws and regulations established by the City of Dayton. Failure to adhere to these legal requirements may result in penalties or additional tax liabilities.

Form Submission Methods (Online / Mail / In-Person)

Residents have several options for submitting the Ohio Form R I. The form can be filed online through the City of Dayton's tax portal, which provides a convenient and efficient way to submit your return. Alternatively, individuals can print the completed form and mail it to the appropriate tax office. For those who prefer face-to-face interaction, in-person submissions are also accepted at designated city tax offices. Each method has its own advantages, so choose the one that best fits your needs.

Quick guide on how to complete oh form r i city of dayton

Complete OH Form R I City Of Dayton seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage OH Form R I City Of Dayton on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign OH Form R I City Of Dayton effortlessly

- Find OH Form R I City Of Dayton and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign OH Form R I City Of Dayton and guarantee outstanding communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oh form r i city of dayton

Create this form in 5 minutes!

How to create an eSignature for the oh form r i city of dayton

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ohio income tax return individual?

An Ohio income tax return individual is a tax form that residents of Ohio must file to report their earnings and calculate the amount of income tax owed to the state. This form includes various sections to capture income information, deductions, and credits, ensuring compliance with Ohio tax laws.

-

How can airSlate SignNow help with filing my Ohio income tax return individual?

airSlate SignNow offers an efficient way to eSign and send your Ohio income tax return individual. With our simple process, you can quickly prepare documents, obtain necessary signatures, and submit your tax return seamlessly, ensuring you meet all deadlines.

-

What are the costs associated with using airSlate SignNow for my Ohio income tax return individual?

AirSlate SignNow provides a cost-effective solution for managing documents, including your Ohio income tax return individual. Our pricing plans are designed to accommodate both individuals and businesses, making it affordable to streamline tax filing processes.

-

Can I integrate airSlate SignNow with accounting software for my Ohio income tax return individual?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms, allowing you to enhance your workflow for your Ohio income tax return individual. This integration helps ensure that your financial data is synchronized and easily accessible when preparing taxes.

-

What features of airSlate SignNow are beneficial for my Ohio income tax return individual?

AirSlate SignNow offers features such as document editing, eSigning, and team collaboration tools, which are incredibly beneficial for submitting your Ohio income tax return individual. These features facilitate a streamlined and secure process for preparing and filing your taxes.

-

Is airSlate SignNow secure for filing my Ohio income tax return individual?

Absolutely, airSlate SignNow prioritizes the security of your documents and personal information. Our platform uses advanced encryption and secure storage practices to ensure that your Ohio income tax return individual and other sensitive data are protected throughout the filing process.

-

Do I need to create an account to use airSlate SignNow for my Ohio income tax return individual?

Yes, creating an account with airSlate SignNow is necessary to utilize our services for your Ohio income tax return individual. This account provides you with access to all features and ensures that your documents are stored securely for easy reference.

Get more for OH Form R I City Of Dayton

- Va form 29 336b

- W8ben td ameritrade form

- Tsc checklist form

- Printable home health care timesheets form

- Pr sd nh 1 form

- Saraswat bank neft form download

- Declaration of income pag ibig fund form

- Florida lady bird deed form pdf florida lady bird deed form pdf the florida lady bird case form is a relatively new type of

Find out other OH Form R I City Of Dayton

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple