Dayton Individual Return 23 2023

What is the Dayton Individual Return 23

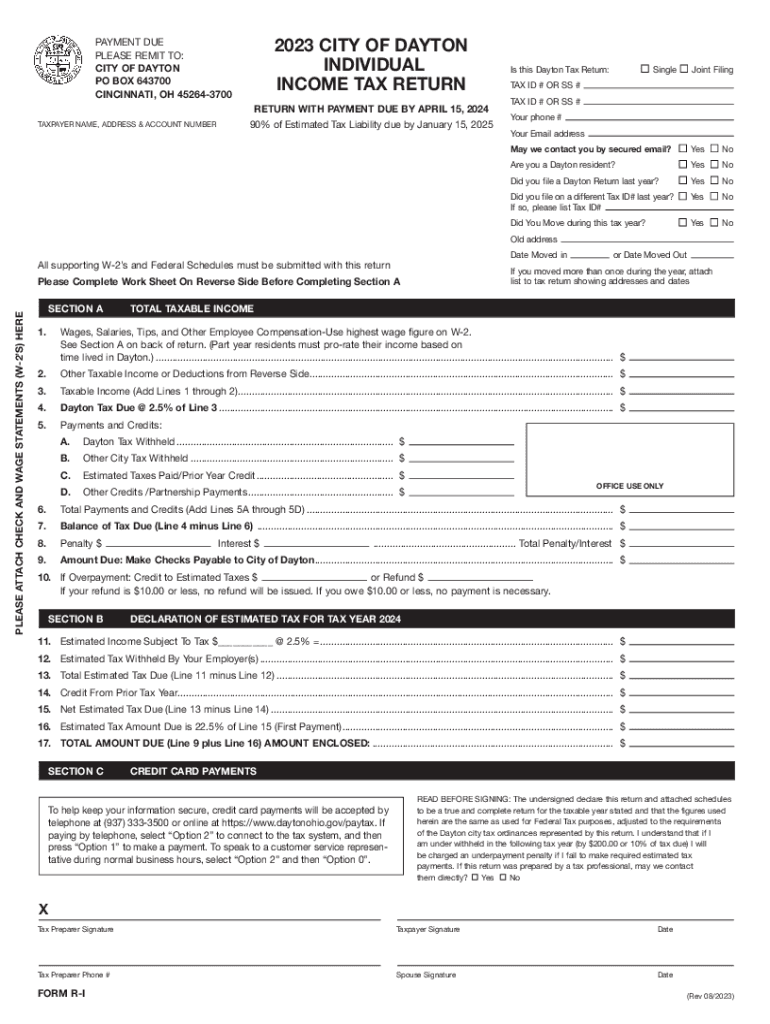

The Dayton Individual Return 23 is a specific tax form used by residents of Dayton, Ohio, to report their income and calculate their city income tax obligations. This form is essential for individuals who earn income within the city limits, ensuring compliance with local tax regulations. The return captures various income sources, including wages, self-employment income, and other earnings, allowing the city to assess the appropriate tax amount owed by the taxpayer.

Steps to complete the Dayton Individual Return 23

Completing the Dayton Individual Return 23 involves several key steps:

- Gather necessary documentation, such as W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately on the form.

- Calculate any deductions or credits applicable to your situation.

- Determine the total tax liability based on the provided income and deductions.

- Sign and date the form to certify that the information is true and complete.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Dayton Individual Return 23. Typically, the deadline for submission aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check for any updates or changes to the filing schedule each tax year to ensure timely submission.

Required Documents

To accurately complete the Dayton Individual Return 23, taxpayers should prepare the following documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income sources

- Documentation for deductions, such as receipts for business expenses

- Previous year’s tax return for reference

Form Submission Methods

Taxpayers have several options for submitting the Dayton Individual Return 23. The form can be filed online through the city’s tax portal, mailed to the appropriate tax office, or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the taxpayer's needs and preferences.

Penalties for Non-Compliance

Failure to file the Dayton Individual Return 23 by the deadline may result in penalties and interest on any unpaid taxes. The city of Dayton imposes fines for late submissions, which can accumulate over time. Additionally, taxpayers who do not report their income accurately may face further penalties, including audits and additional tax assessments. Understanding these consequences can motivate timely and accurate filing.

Quick guide on how to complete dayton individual return 23

Complete Dayton Individual Return 23 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Dayton Individual Return 23 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign Dayton Individual Return 23 effortlessly

- Find Dayton Individual Return 23 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Dayton Individual Return 23 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dayton individual return 23

Create this form in 5 minutes!

How to create an eSignature for the dayton individual return 23

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio City tax return form?

The Ohio City tax return form is a document required for individuals and businesses to report their income and calculate their city tax liability. This form ensures compliance with local tax regulations and is essential for accurate financial reporting in Ohio. Utilizing airSlate SignNow can streamline the completion and submission of this form.

-

How can airSlate SignNow help with the Ohio City tax return form?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending the Ohio City tax return form. Our solution simplifies document management, allowing users to complete and submit tax forms quickly and securely. This accelerates the filing process and helps ensure accuracy in your submissions.

-

Are there any fees associated with using airSlate SignNow for Ohio City tax return forms?

Yes, airSlate SignNow operates on a subscription model, with various pricing tiers to fit your needs. These fees cover the comprehensive features we offer, such as cloud storage, electronic signatures, and secure document delivery for the Ohio City tax return form. For a detailed breakdown of our pricing plans, visit our website.

-

What features does airSlate SignNow offer for handling the Ohio City tax return form?

airSlate SignNow provides features like customizable templates, cloud storage, and advanced security measures for managing the Ohio City tax return form. Users can also enjoy real-time tracking of document status and easy collaboration with team members. These features simplify the tax filing process and enhance overall efficiency.

-

Is airSlate SignNow compliant with Ohio tax laws for the city tax return form?

Yes, airSlate SignNow is designed to comply with various state and local tax regulations, including those governing the Ohio City tax return form. Our platform adheres to legal standards for electronic signatures, ensuring that your filings are valid and accepted by authorities. You can trust us to manage your tax documents securely.

-

Can I integrate airSlate SignNow with other applications for managing my Ohio City tax return forms?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and more, which can help streamline your workflow for the Ohio City tax return form. This flexibility enables you to manage your documents efficiently alongside your existing tools, enhancing productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the Ohio City tax return form?

Using airSlate SignNow for your Ohio City tax return form offers numerous benefits, including increased speed and accuracy in document handling. Our platform minimizes transcription errors and speeds up the approval process with electronic signatures. This results in timely submissions and peace of mind when filing your taxes.

Get more for Dayton Individual Return 23

- Send this completed form with a letter of support to homelesscourthsd

- Pr 4 fillable form 2005

- Marriage and family therapist experience verification for hours gained before 2010 form

- Iampa mileage form 2009

- Medical baseline application pdf southern california edison form

- Contra costa county community homeless court cchealth form

- Ihss direct deposit 2011 form

- Cdph 110b form

Find out other Dayton Individual Return 23

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy