Withholding Tax on SalariesBusiness Guichet Lu 2022

Understanding the Withholding Tax on Salaries

The withholding tax on salaries is a crucial aspect of payroll management for businesses in the United States. It refers to the amount of income tax that employers are required to withhold from their employees' wages and remit to the federal government. This tax is calculated based on the employee's earnings and the information provided on their W-4 form, which includes details about their filing status and any allowances claimed. Understanding this tax is essential for both employers and employees to ensure compliance with tax regulations.

Steps to Complete the Withholding Tax on Salaries

Completing the withholding tax on salaries involves several key steps:

- Gather necessary employee information, including their W-4 form.

- Determine the employee's gross pay for the pay period.

- Consult the IRS withholding tables to calculate the appropriate withholding amount based on the employee's earnings and filing status.

- Deduct the calculated withholding amount from the employee's gross pay.

- Remit the withheld amounts to the IRS along with any employer contributions, such as Social Security and Medicare taxes.

Legal Use of the Withholding Tax on Salaries

The legal framework surrounding the withholding tax on salaries is governed by federal and state tax laws. Employers must comply with these regulations to avoid penalties and ensure that their employees' tax obligations are met. Failure to withhold the correct amount can lead to significant fines for the employer. Additionally, employees have the right to review their withholding amounts and request adjustments if necessary, ensuring transparency and compliance with tax laws.

IRS Guidelines for Withholding Tax

The IRS provides clear guidelines regarding the withholding tax on salaries. Employers are encouraged to regularly review these guidelines to stay updated on any changes. Key points include:

- Employers must use the IRS Publication 15 (Circular E) to understand payroll tax responsibilities.

- Employers should ensure that employees complete their W-4 forms accurately to reflect their current tax situation.

- Employers are required to report withheld taxes on their quarterly and annual tax returns.

Filing Deadlines and Important Dates

Timely filing of withheld taxes is essential for compliance. Employers must adhere to specific deadlines, including:

- Monthly or semi-weekly deposit schedules for withholding taxes, depending on the amount withheld.

- Quarterly filing deadlines for Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld.

- Annual filing of Form W-2 for each employee, summarizing their earnings and tax withholdings for the year.

Penalties for Non-Compliance

Failure to comply with withholding tax regulations can result in severe penalties for employers. These may include:

- Fines for late payments or underpayment of withheld taxes.

- Interest charges on unpaid tax amounts.

- Potential legal action for willful failure to comply with tax laws.

Eligibility Criteria for Withholding Tax Compliance

All employers in the United States are required to comply with withholding tax regulations. However, certain criteria may affect how withholding is calculated, including:

- The employee's filing status (single, married, etc.).

- The number of allowances claimed on the W-4 form.

- Any additional amounts the employee wishes to withhold.

Quick guide on how to complete withholding tax on salariesbusiness guichetlu

Complete Withholding Tax On SalariesBusiness Guichet lu effortlessly on any device

Digital document management has become popular with businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Withholding Tax On SalariesBusiness Guichet lu on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Withholding Tax On SalariesBusiness Guichet lu effortlessly

- Obtain Withholding Tax On SalariesBusiness Guichet lu and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or a shareable link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Withholding Tax On SalariesBusiness Guichet lu and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax on salariesbusiness guichetlu

Create this form in 5 minutes!

How to create an eSignature for the withholding tax on salariesbusiness guichetlu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

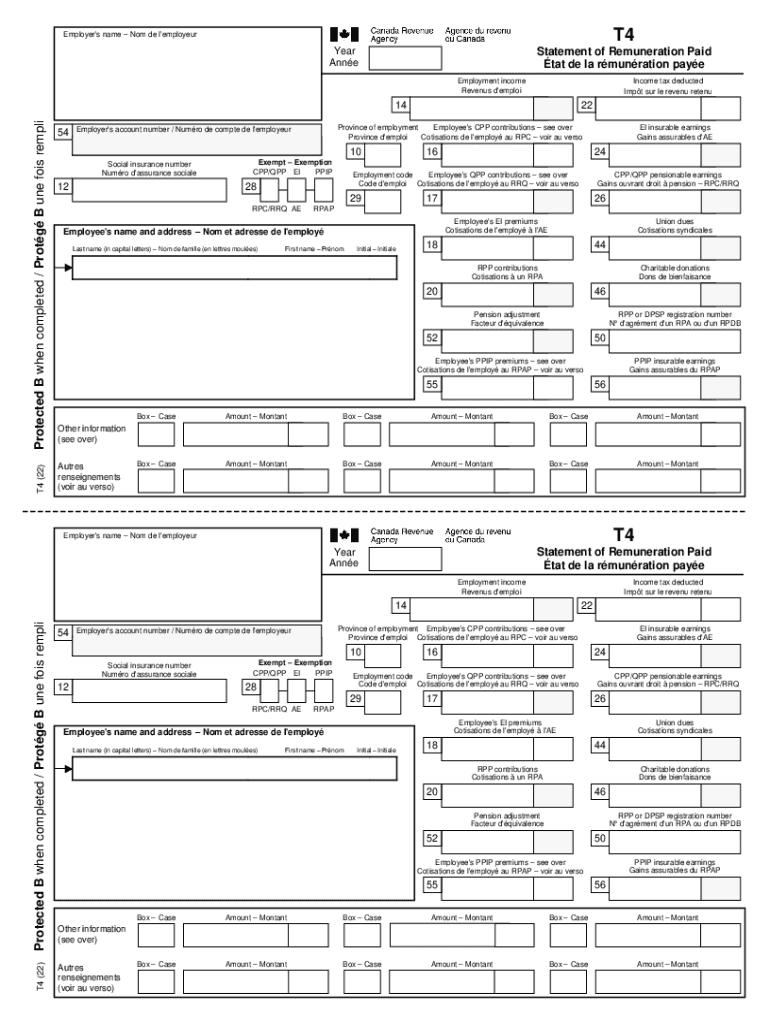

What is a t4 fillable form?

A t4 fillable form is a digital version of the T4 slip that allows users to enter and manage employee income and tax information easily. With airSlate SignNow, you can create and send t4 fillable forms to streamline payroll processes and ensure accuracy without the hassle of paper forms.

-

How does airSlate SignNow simplify the creation of t4 fillable forms?

airSlate SignNow simplifies the creation of t4 fillable forms by providing intuitive templates and customizable fields. Users can easily drag and drop elements to create forms that meet specific needs while ensuring that all necessary information is captured efficiently.

-

Are t4 fillable forms compliant with Canadian tax regulations?

Yes, t4 fillable forms created through airSlate SignNow are designed to comply with Canadian tax regulations. Our platform adheres to the latest guidelines, ensuring that your t4 fillable forms are accurate and legally compliant, helping you avoid penalties.

-

What features does airSlate SignNow offer for managing t4 fillable forms?

airSlate SignNow offers numerous features for managing t4 fillable forms, including eSignature capabilities, secure cloud storage, and easy access to complete audit trails. This ensures that your forms are not only easy to create but also secure and traceable throughout the signing process.

-

Can I integrate airSlate SignNow with other software to manage my t4 fillable forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRM and accounting platforms. This integration allows you to automatically populate t4 fillable forms with relevant data, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for t4 fillable forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, providing access to features for creating and managing t4 fillable forms. You can choose a plan based on your needs, whether you are a small business or a larger enterprise.

-

How does using t4 fillable forms benefit my business?

Using t4 fillable forms can greatly benefit your business by reducing paperwork, increasing accuracy, and speeding up the payroll process. With airSlate SignNow, you can ensure timely submission while enhancing the overall efficiency of your document management.

Get more for Withholding Tax On SalariesBusiness Guichet lu

Find out other Withholding Tax On SalariesBusiness Guichet lu

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online