T4 Statement of Remuneration Paid Canada Fill Online 2020

What is the T4 Statement of Remuneration Paid?

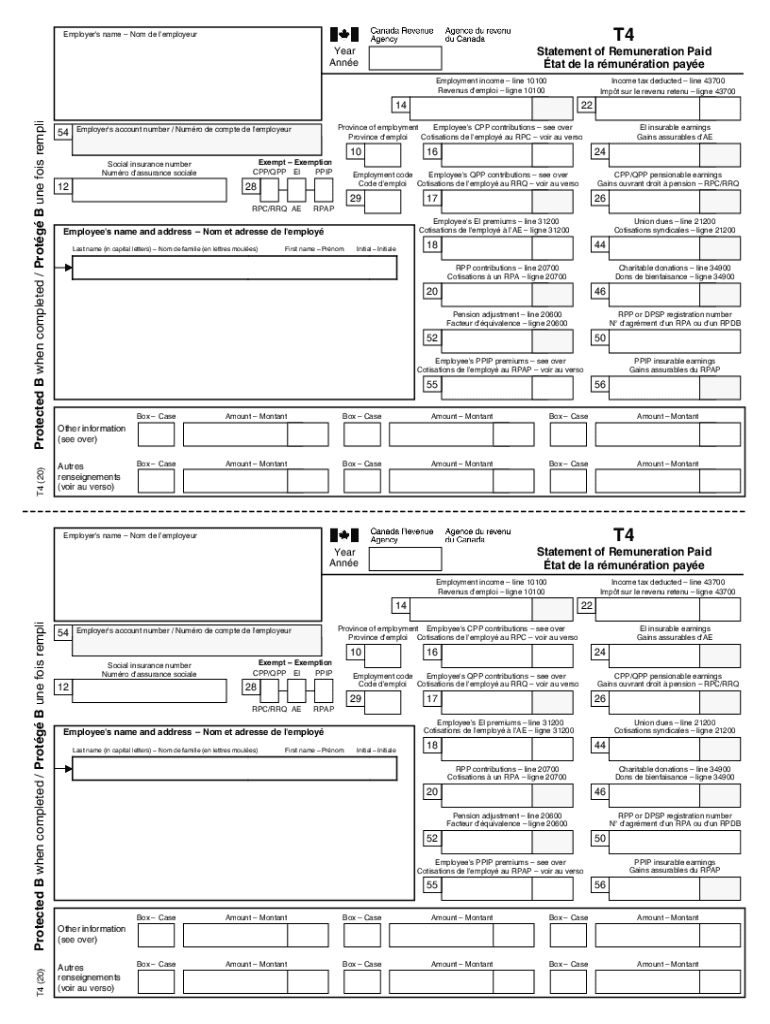

The T4 Statement of Remuneration Paid is a crucial document in Canada, used primarily for reporting employment income and deductions. Employers issue this form to employees to summarize their earnings and any taxes withheld during the tax year. It includes essential information such as the employee's name, address, Social Insurance Number (SIN), and total earnings, along with deductions for income tax, Canada Pension Plan (CPP), and Employment Insurance (EI). This form is vital for employees when filing their annual income tax returns, ensuring they accurately report their income and claim any eligible deductions.

Steps to Complete the T4 Statement of Remuneration Paid

Completing the T4 Statement of Remuneration Paid involves several straightforward steps:

- Gather necessary information: Collect all relevant details, including the employee's name, address, SIN, and total earnings for the year.

- Calculate total earnings: Sum up all payments made to the employee, including salary, bonuses, and any other forms of remuneration.

- Determine deductions: Calculate the total amounts for income tax, CPP contributions, and EI premiums that were withheld from the employee's pay.

- Fill out the form: Enter the gathered information into the T4 form accurately, ensuring all fields are completed as required.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to complications during tax filing.

- Distribute the form: Provide copies of the completed T4 to the employee and submit the necessary information to the Canada Revenue Agency (CRA).

Legal Use of the T4 Statement of Remuneration Paid

The T4 Statement of Remuneration Paid holds significant legal importance in Canada. It serves as an official record of employment income and tax deductions, which can be referenced in case of audits or disputes with the CRA. Employers are legally obligated to issue this form to all employees who received remuneration during the tax year. Failure to provide a T4 can result in penalties for the employer and complications for the employee when filing taxes. Therefore, ensuring compliance with the issuance of this form is crucial for both parties.

Key Elements of the T4 Statement of Remuneration Paid

Several key elements must be included in the T4 Statement of Remuneration Paid to ensure its validity:

- Employee Information: Full name, address, and Social Insurance Number (SIN).

- Employer Information: Name, address, and Business Number (BN).

- Income Details: Total earnings, including salary, bonuses, and any other remuneration.

- Deductions: Total amounts withheld for income tax, CPP, and EI.

- Tax Year: The calendar year for which the earnings and deductions are reported.

How to Obtain the T4 Statement of Remuneration Paid

Employees can obtain their T4 Statement of Remuneration Paid directly from their employer. Employers are required to provide this form by the end of February following the tax year. In some cases, employers may offer electronic access to T4 forms through secure online portals. If an employee does not receive their T4 in a timely manner, they should contact their employer to request a copy. It is important for employees to keep this document safe, as it is necessary for accurate tax filing.

Examples of Using the T4 Statement of Remuneration Paid

The T4 Statement of Remuneration Paid is used in various scenarios:

- Annual Tax Filing: Employees use the T4 to report their income when filing their personal income tax returns.

- Loan Applications: Financial institutions may require a copy of the T4 to verify income when assessing loan applications.

- Employment Verification: New employers may request a T4 as proof of previous employment and income.

Quick guide on how to complete t4 statement of remuneration paid canada fill online

Effortlessly Prepare T4 Statement Of Remuneration Paid Canada Fill Online on Any Device

Managing documents online has gained traction among businesses and users. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle T4 Statement Of Remuneration Paid Canada Fill Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign T4 Statement Of Remuneration Paid Canada Fill Online

- Locate T4 Statement Of Remuneration Paid Canada Fill Online and click on Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight key sections of the documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign T4 Statement Of Remuneration Paid Canada Fill Online to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t4 statement of remuneration paid canada fill online

Create this form in 5 minutes!

How to create an eSignature for the t4 statement of remuneration paid canada fill online

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a T4 statement remuneration?

A T4 statement remuneration is a document issued by employers in Canada that summarizes an employee's earnings and deductions for the tax year. It includes important information such as the employee's total taxable income and any taxes withheld. Understanding your T4 statement remuneration is essential for accurate tax filing.

-

How can airSlate SignNow help with T4 statement remuneration?

airSlate SignNow simplifies the process of managing T4 statement remuneration by allowing businesses to securely eSign and send documents quickly. This saves time and ensures compliance with Canada’s tax regulations. Additionally, the platform helps reduce errors by allowing for easy revision and tracking of changes.

-

What features does airSlate SignNow offer for handling T4 statements?

airSlate SignNow offers features like customizable templates, secure electronic signatures, and document tracking specifically for T4 statement remuneration. These features enhance efficiency in managing payroll documents and ensure that every T4 is accurately filled out and submitted. The ease of access to past documents also streamlines the audit process.

-

Is airSlate SignNow cost-effective for managing T4 statement remuneration?

Yes, airSlate SignNow is a cost-effective solution for managing T4 statement remuneration. By automating the document signing process, businesses can save both time and money on administrative tasks. The pricing model is designed to support companies of all sizes, ensuring affordability for effective document management.

-

Can airSlate SignNow integrate with accounting software for T4 statements?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools, making it easier to generate and manage T4 statement remuneration. This integration allows for automatic population of data, reducing manual entry errors and ensuring that your payroll processes are efficient and accurate.

-

What are the benefits of using airSlate SignNow for T4 statements?

Using airSlate SignNow for T4 statement remuneration offers numerous benefits, including enhanced security, ease of use, and improved compliance. The platform’s electronic signature capabilities ensure that documents are signed promptly, which is critical during tax season. Additionally, better document management reduces the risk of lost paperwork.

-

How does airSlate SignNow ensure the security of my T4 statement remuneration?

airSlate SignNow prioritizes security for T4 statement remuneration by utilizing advanced encryption protocols and secure cloud storage. All documents are protected against unauthorized access, ensuring that sensitive employee data remains confidential. This commitment to security also helps businesses comply with regulatory requirements.

Get more for T4 Statement Of Remuneration Paid Canada Fill Online

Find out other T4 Statement Of Remuneration Paid Canada Fill Online

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy