990 2023

What is the 990?

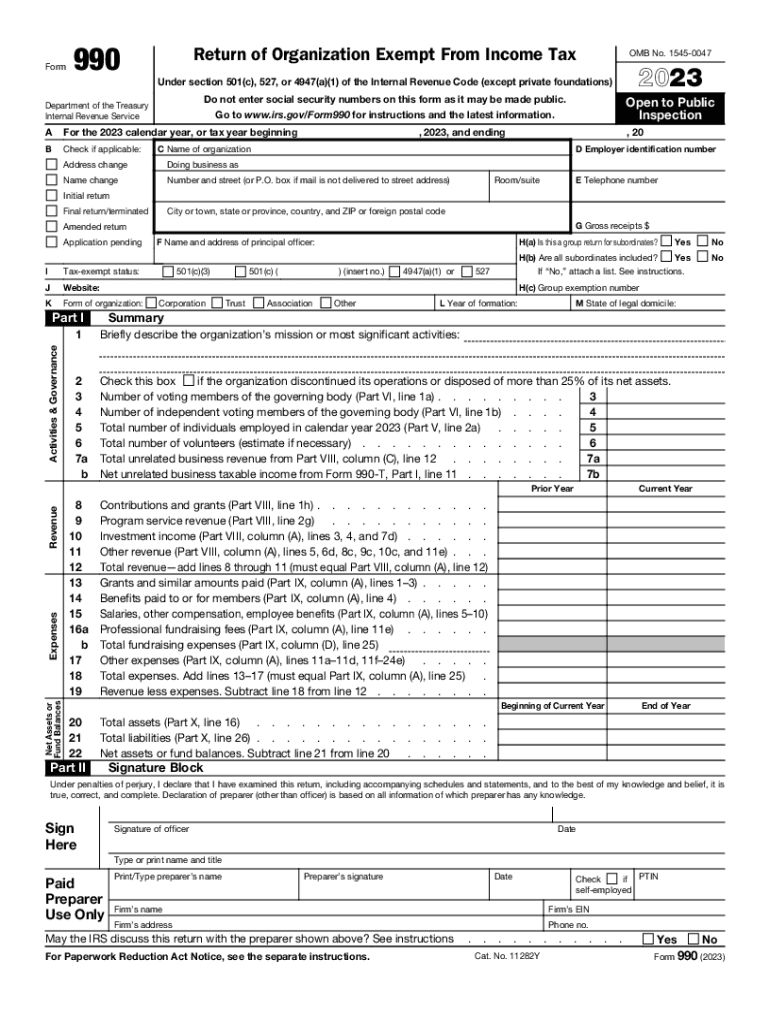

The form 990 is an essential tax document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides detailed information about the organization's financial activities, governance, and operational structure. Nonprofits use the IRS form 990 to report their income, expenses, and other financial information, ensuring transparency and accountability to the public and government.

Key elements of the 990

The form 990 consists of several key sections that capture vital information about the nonprofit. These include:

- Mission Statement: A brief description of the organization's purpose and goals.

- Financial Statements: Detailed reports of income, expenses, assets, and liabilities.

- Governance Information: Details about the board of directors and key staff members.

- Program Service Accomplishments: Information on the nonprofit's major programs and their impact.

These elements help stakeholders, including donors and grant-making organizations, assess the nonprofit's effectiveness and financial health.

Steps to complete the 990

Completing the form 990 involves several steps to ensure accuracy and compliance. Here are the essential steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and expense reports.

- Review IRS Guidelines: Familiarize yourself with the latest IRS requirements for the IRS form 990.

- Fill Out the Form: Complete each section of the form accurately, ensuring all information is up to date.

- Review and Revise: Check the completed form for errors or omissions, and make necessary corrections.

- Submit the Form: File the form 990 electronically or via mail by the designated deadline.

Filing Deadlines / Important Dates

Nonprofits must adhere to specific deadlines when filing the form 990. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, the due date is May 15. If additional time is needed, nonprofits can file for an extension, which typically grants an additional six months. However, it is crucial to ensure that the extension request is submitted on time to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The form 990 can be submitted through various methods, making it convenient for organizations. The primary submission methods include:

- Online Filing: Many nonprofits choose to file electronically through the IRS e-file system, which is efficient and reduces processing time.

- Mail Submission: Organizations can also print the completed form and mail it to the appropriate IRS address based on their location.

- In-Person Filing: While less common, some organizations may opt to deliver the form directly to an IRS office.

Choosing the right submission method can help ensure timely and accurate filing of the IRS form 990.

Penalties for Non-Compliance

Failure to file the form 990 on time can result in significant penalties for nonprofits. The IRS imposes fines based on the organization’s annual gross receipts and the length of the delay. For instance, organizations that do not file for three consecutive years may lose their tax-exempt status. It is essential for nonprofits to understand these penalties and ensure compliance to maintain their operational status and public trust.

Quick guide on how to complete 990

Manage 990 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed files, allowing you to locate the right template and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Handle 990 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign 990 with ease

- Obtain 990 and click Get Form to commence.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Edit and eSign 990 to guarantee excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990

Create this form in 5 minutes!

How to create an eSignature for the 990

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 990 and why is it important?

Form 990 is an annual reporting return that provides essential information about a nonprofit's financial activities. It is vital for transparency and allows the IRS to maintain oversight on tax-exempt organizations. Organizations must properly fill out and submit form 990 to ensure compliance and maintain their tax-exempt status.

-

How does airSlate SignNow facilitate the completion of form 990?

airSlate SignNow simplifies the process of completing form 990 by providing intuitive templates and eSignature capabilities. Our platform allows nonprofits to easily fill out the form electronically, ensuring accuracy and efficiency in submission. This helps organizations save time and resources while maintaining compliance.

-

Is airSlate SignNow a cost-effective solution for managing form 990 submissions?

Yes, airSlate SignNow is designed to be an affordable option for nonprofits handling their form 990 submissions. With flexible pricing plans and a range of features that streamline the process, organizations can save money on document management. Our solution provides great value without compromising on quality or functionality.

-

What features does airSlate SignNow offer for form 990 preparation?

airSlate SignNow offers various features tailored for form 990 preparation, including customizable templates, collaboration tools, and secure eSigning capabilities. Users can easily gather necessary signatures and collaborate with team members to complete the form efficiently. These features ensure that form 990 is submitted accurately and on time.

-

Can I integrate airSlate SignNow with other tools to manage form 990?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and nonprofit management software to help streamline form 990 management. This connectivity allows organizations to pull in relevant data, which makes filling out form 990 more accurate and less time-consuming. Our integrations facilitate a smoother workflow for your nonprofit.

-

What are the benefits of using airSlate SignNow for our nonprofit?

Using airSlate SignNow for your nonprofit can greatly enhance your operational efficiency, especially when it comes to managing form 990. The platform provides a user-friendly interface, reducing the time spent on paperwork while ensuring compliance with IRS regulations. Enhanced collaboration capabilities also improve teamwork in preparing and submitting your form 990.

-

Is airSlate SignNow compliant with IRS regulations for form 990?

Yes, airSlate SignNow is fully compliant with IRS regulations regarding electronic submissions and signatures, ensuring that your form 990 meets necessary legal standards. Our platform is designed with security and compliance in mind, allowing nonprofits to submit their forms confidently. You can trust us to help maintain your organization's compliance with IRS requirements.

Get more for 990

- How to fill form of sea lanes

- Florida bar initial interview form

- Frontier club san antonio form

- Ob intake form drleeobgyn net

- Haracter form 800 doc national university of health sciences nuhs

- Cd 418cooperative or mutual association w form

- Employer quarterly return earned income tax withholding form

- Pennsylvania form dex 93 personal income tax

Find out other 990

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now