California Form 100 ES Corporation Estimated Tax 2023

What is the California Form 100 ES Corporation Estimated Tax

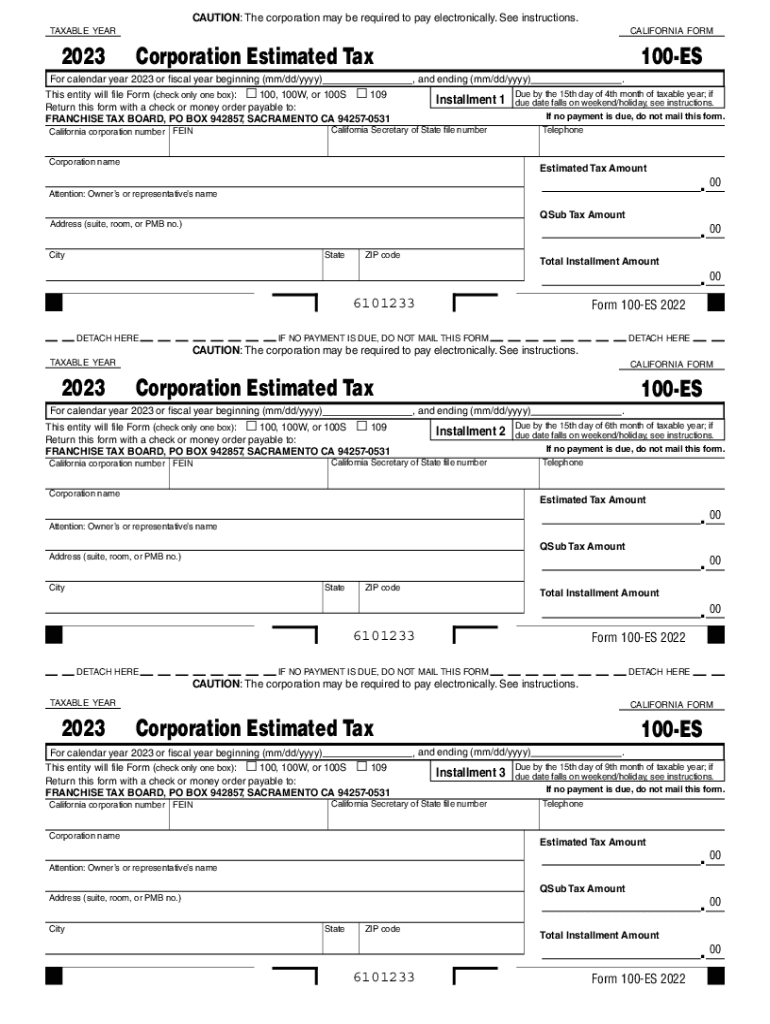

The California Form 100 ES is used by corporations to calculate and pay estimated taxes owed to the state. This form is essential for corporations that expect to owe tax of five hundred dollars or more during the year. It helps ensure that businesses stay compliant with California tax laws by allowing them to make timely payments throughout the year rather than a lump sum at tax time. Understanding this form is crucial for effective tax planning and avoiding penalties.

Steps to complete the California Form 100 ES Corporation Estimated Tax

Completing the California Form 100 ES involves several key steps:

- Determine your estimated taxable income: This is the first step in calculating your estimated tax liability. Review your financial records to project your income for the year.

- Calculate your estimated tax: Use the California corporate tax rate to compute your estimated tax based on your projected income.

- Fill out the form: Enter the calculated amounts in the appropriate sections of the form. Ensure all information is accurate to avoid delays.

- Submit your payment: Include your payment with the form, ensuring it is sent to the correct address to avoid penalties.

Legal use of the California Form 100 ES Corporation Estimated Tax

The California Form 100 ES is legally binding when filled out correctly and submitted on time. It complies with state tax regulations, which require corporations to pay estimated taxes based on their income. Failing to use this form appropriately can result in penalties and interest on unpaid taxes. It's essential to keep a record of submitted forms and payments for your records and potential audits.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when submitting the California Form 100 ES. Generally, estimated tax payments are due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. For example, if your tax year aligns with the calendar year, the due dates would be April 15, June 15, September 15, and December 15. Missing these deadlines can lead to penalties, so it's vital to mark your calendar and plan accordingly.

Form Submission Methods (Online / Mail / In-Person)

The California Form 100 ES can be submitted through various methods. Corporations can file online through the California Franchise Tax Board's website, which offers a convenient and secure way to submit forms and payments. Alternatively, businesses can mail the completed form along with their payment to the designated address provided in the form instructions. In-person submissions are also accepted at local Franchise Tax Board offices, although this may not be the most efficient option.

Who Issues the Form

The California Form 100 ES is issued by the California Franchise Tax Board (FTB). This agency is responsible for administering California's income tax laws and ensuring compliance among corporations operating within the state. The FTB provides resources and guidance on how to complete the form correctly, making it easier for businesses to fulfill their tax obligations.

Quick guide on how to complete california form 100 es corporation estimated tax

Effortlessly Prepare California Form 100 ES Corporation Estimated Tax on Any Device

Managing documents online has gained signNow traction among both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle California Form 100 ES Corporation Estimated Tax on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign California Form 100 ES Corporation Estimated Tax with Ease

- Locate California Form 100 ES Corporation Estimated Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and eSign California Form 100 ES Corporation Estimated Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 100 es corporation estimated tax

Create this form in 5 minutes!

How to create an eSignature for the california form 100 es corporation estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 100 es 2024?

The form 100 es 2024 is a tax form used in California for reporting income for S corporations. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for businesses operating in California, especially for tax season.

-

How can airSlate SignNow help with the form 100 es 2024?

airSlate SignNow simplifies the process of signing and sending the form 100 es 2024. Our eSignature solution enables users to quickly get approvals and signatures without the hassle of physical paperwork. This streamlines your tax reporting process signNowly.

-

Is there a cost associated with using airSlate SignNow for the form 100 es 2024?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is generally competitive and offers value for the efficiency gained in managing documents like the form 100 es 2024. We recommend checking our pricing page for detailed information.

-

What features does airSlate SignNow provide for completing the form 100 es 2024?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders, making it easier to complete the form 100 es 2024. These tools allow you to manage your documents efficiently and keep everyone involved updated on status changes.

-

How secure is airSlate SignNow for handling sensitive documents like the form 100 es 2024?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance protocols to ensure that all documents, including the form 100 es 2024, are protected. This gives users peace of mind when handling sensitive tax-related information.

-

Can I integrate airSlate SignNow with other software for managing the form 100 es 2024?

Absolutely! airSlate SignNow offers integrations with various business tools such as CRM and accounting software. This allows for a seamless workflow when preparing and submitting the form 100 es 2024, enhancing operational efficiency.

-

Does airSlate SignNow provide support for users filling out the form 100 es 2024?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions regarding the form 100 es 2024. Our team is available through various channels to ensure you have the guidance you need to complete your documents correctly.

Get more for California Form 100 ES Corporation Estimated Tax

Find out other California Form 100 ES Corporation Estimated Tax

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement